Ethereum price approaching ‘trouble area’, crash below $3,000 imminent?

![]() Cryptocurrency Nov 28, 2024 Share

Cryptocurrency Nov 28, 2024 Share

Ethereum (ETH) has rallied past the $3,600 resistance for the first time in about five months, but technical indicators suggest a cautious approach for the second-ranked digital asset by market cap.

The latest Ethereum upside momentum was partly driven by increased capital flowing into the asset’s exchange-traded fund (ETF), alongside a surge in open interest and futures premium.

Now, the Ethereum rally is facing its first major test as the ETH/BTC pair approaches a critical resistance zone dubbed the ‘trouble area’ around 0.04615 BTC, which could act as a strong ceiling, potentially leading to a price rejection, according to an outlook shared by prominent pseudonymous crypto trading expert CrediBULL in an X post on November 28.

Picks for you

Is this time different? Expert explains why altcoins are underperforming 18 hours ago SUI prepares for its largest unlock to date this Sunday – Should you be worried? 20 hours ago Gold to $3,000 back in play, according to commodity strategist 21 hours ago Tonkeeper announces Black Friday offers and exclusive deals 21 hours ago  Ethereum price analysis chart. Source: TradingView/CrediBULL

Ethereum price analysis chart. Source: TradingView/CrediBULL

Ethereum will likely form a lower high if this rejection is confirmed, which could drive ETH into its weekly demand zone.

The expert noted that the price movement is closely tied to Bitcoin’s (BTC) performance, suggesting that a broader market pullback could amplify Ethereum’s downward move, pushing it toward the key $2,700–$2,800 buy zone.

Ethereum price analysis chart. Source: TradingView/CrediBULL

Ethereum price analysis chart. Source: TradingView/CrediBULL

This level, marked by strong demand, is seen as a prime re-entry opportunity for traders looking to capitalize on a potential recovery.

“Spot holders can hold till new highs and ignore this lower TF PA imo, but for traders the 2700-2800 zone is where I’m interested in doing business at this stage, if we get it,” the analyst noted.

Ethereum’s bullish outlook

Despite this caution, another projection by cryptocurrency trading analyst Ali Martinez offered a dissenting opinion, pointing out that the recent Ethereum breakout positions the decentralized finance asset for a target of $10,000.

In an X post on November 28, Martinez set ETH’s short-term target at $6,000, with the $10,000 projection as a long-term price forecast.

His projection is based on Ethereum’s technical structure, which shows the asset continues to trade within a strong ascending channel.

Ethereum price analysis chart. Source: TradingView/Ali_charts

Ethereum price analysis chart. Source: TradingView/Ali_charts

The outlook aligns with the $8,000 set by another trading expert, Alan Santana, who set a similar target.

Ethereum’s rally was backed by $40.6 million in net inflows into its ETF on November 26, marking three consecutive days of positive activity around the asset.

This inflow contrasts with Bitcoin ETFs, which have faltered recently, a shift attributed to possible changes in investor sentiment amid anticipation of the start of the altcoin season.

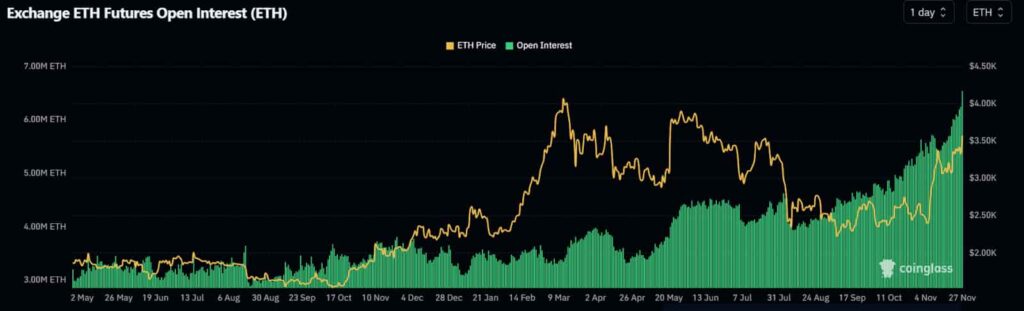

Further supporting the bullish narrative around the cryptocurrency, Ethereum open interest (OI) hit a record 6.55 million ETH, valued at $23.34 billion, on November 27, as more investors showed confidence in the asset.

Ethereum futures open interest chart. Source: Coinglass

Ethereum futures open interest chart. Source: Coinglass

Ethereum price analysis

Ethereum was trading at $3,608 by press time, reflecting a price growth of almost 6% in the last 24 hours. The weekly chart highlights the magnitude of ETH’s recent breakout, with the asset gaining over 15% during the timeframe.

Ethereum seven-day price chart. Source: CoinMarketCap

Ethereum seven-day price chart. Source: CoinMarketCap

As things stand, Ethereum is generally bullish. If this momentum is sustained, the asset will likely touch the $4,000 resistance zone. This target remains possible, considering ETH is trading above the 50-day and 200-day simple moving averages, confirming a strong upward trend.

However, Ethereum is in overbought territory with a 14-day relative strength index (RSI) of 70, signaling a possible price consolidation or pullback could be on the cards. Investors should remain cautious of a potential dip below $3,000.

Featured image via Shutterstock