Google Search for “Bitcoin” at a yearly low

![]() Cryptocurrency Oct 18, 2024 Share

Cryptocurrency Oct 18, 2024 Share

Despite Bitcoin (BTC) trading at an impressive $68,000, up 1% on the day and 11.30% over the past week, adding a hefty $130 billion to its market cap—Google Search trends tell a different story.

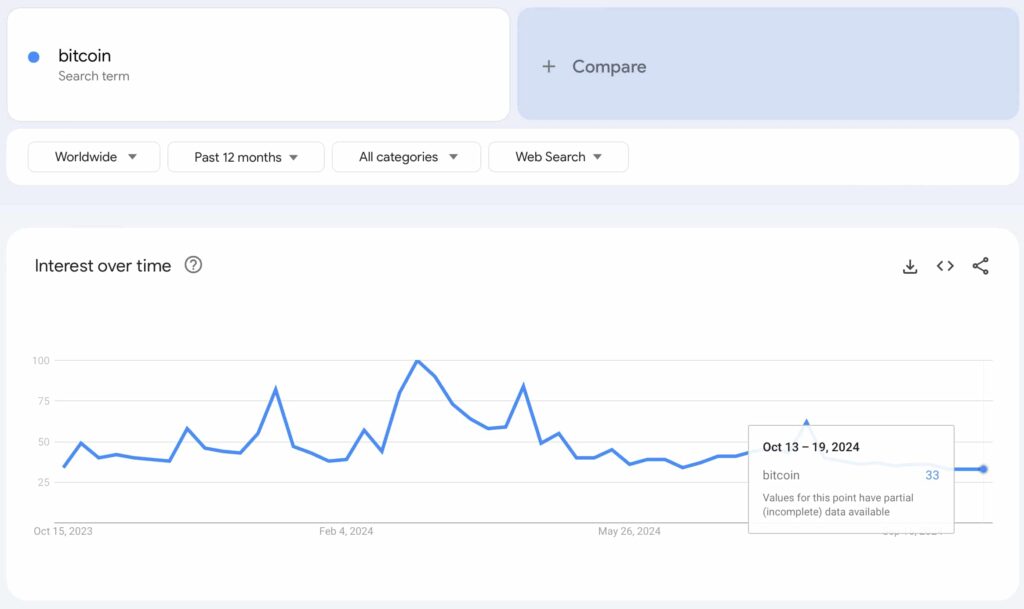

Finbold Research discovered via Google Trends that search interest for “Bitcoin” has fallen to a yearly low of 33. For comparison, during the same period last year, when BTC was trading at just $28,700, search interest was at 34.

Google Trends Bitcoin search. Source: Google Trends

Google Trends Bitcoin search. Source: Google Trends

Interestingly, this low level of search interest has been consistent, remaining at 33 for the periods spanning from September 29 to October 19. This stands in stark contrast to March 2024, when Bitcoin hit a search interest high of 100, while the price hovered between $62,000 and $68,000.

Picks for you

Here’s how much Trump's crypto portfolio is up in 2024 2 hours ago Truflation and Scannit partner up to create more comprehensive data sets 3 hours ago Crypto trader turns $96 into $3 million with TRUMP token 3 hours ago 2 promising yield farming crypto to buy in Q4 2024 3 hours ago

The question is, why is search interest so low despite the dramatic rise in BTC’s price?

The “Uptober” paradox

October, often referred to as “Uptober” by crypto enthusiasts due to its typically bullish trends, has seen Bitcoin make significant gains, but the drop in search interest is puzzling.

Market expert Andreja Stojanovic noted on October 18 that after a rocky start to the month, BTC swiftly rebounded to levels between $65,000 and $67,000, giving investors hope that the cryptocurrency could soon reach new all-time highs. Yet despite this rally, public interest—as reflected in Google searches has fallen to its lowest point in a year.

One possible explanation is that this rally is being driven more by institutional players such as BlackRock who bought even more Bitcoin this week than retail traders. Retail traders, who typically drive spikes in search volume, may be less engaged this time around, perhaps waiting for clearer signals before jumping back into the market.

Stojanovic suggests that institutional investors, less swayed by the social hype, are likely focusing on BTC’s long-term potential rather than short-term speculation, quietly accumulating positions in anticipation of future gains.

The decline in Google search interest may signal a shift in the dynamics of Bitcoin’s price movement. The lack of retail FOMO (fear of missing out) could indicate that the retail segment is either sidelined or cautiously observing the market before jumping back in.

Crypto traders growing cautious

Even though BTC’s price continues to climb, sentiment among traders remains mixed. Data from Binance reveals that 58.23% of accounts with open Bitcoin positions have shifted to shorting the cryptocurrency, signaling a growing belief that the rally could be nearing its peak.

This increased short interest suggests that some traders are preparing for a potential pullback after the recent price surge. The broader macroeconomic environment regulatory uncertainties and concerns over a possible recession—might also be fueling this cautious approach.

Still, Bitcoin has historically thrived in contrarian environments. The combination of technical strength and underlying institutional demand suggests that Bitcoin could still have room to grow, even as short-term traders prepare for a correction.