Here’s how much Bitcoin BlackRock has bought in 2025

![]() Cryptocurrency Jan 23, 2025 Share

Cryptocurrency Jan 23, 2025 Share

With the approval of a series of spot Bitcoin (BTC) exchange-traded funds (ETFs) at the start of 2024, the biggest manager by assets under management (AUM), BlackRock (NYSE: BLK), joined the cryptocurrency fray and became one of the largest digital assets owners in the world.

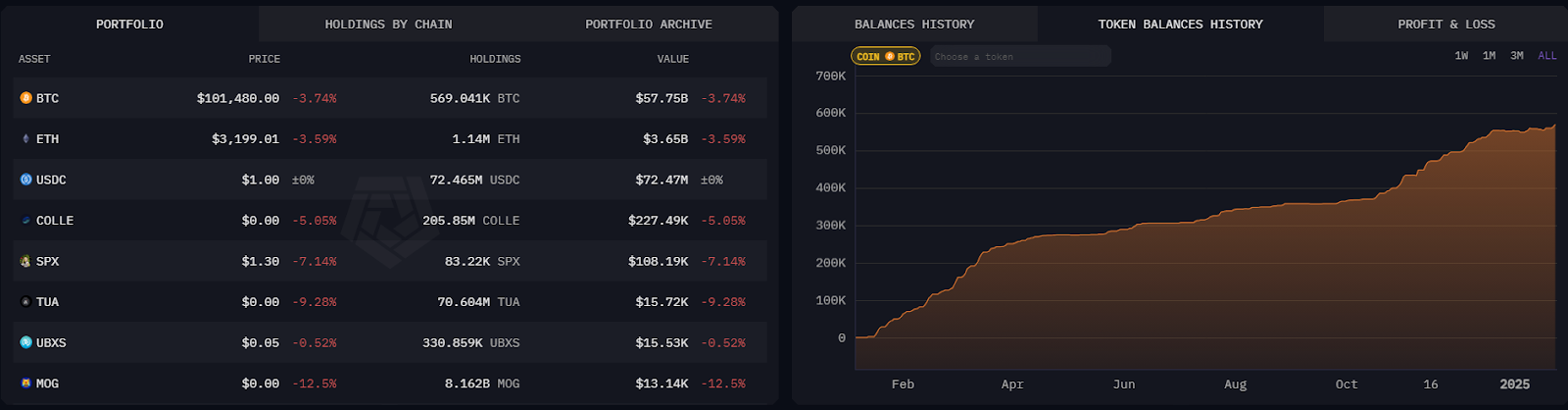

The finance giant’s cryptocurrency portfolio, by press time on January 23, 2025, grew to a staggering total value of $61.46 billion, with its biggest holdings made up of BTC, Ethereum (ETH), and the stablecoin USDC.

At press time, BlackRock owns about 569,000 Bitcoins, worth a total of $57,75 billion, per the data retrieved by Finbold from Arkham Intelligence.

Picks for you

Trump meme coin sees $38 billion in trading since launch 15 mins ago This bullish setup maps Ethereum’s price roadmap to $7,400 in 2025 1 hour ago Crypto trader goes from a $270K loss up to a $6M profit in less than a day 3 hours ago RFK Jr.'s stocks and crypto portfolio revealed 6 hours ago

BlackRock’s Bitcoin crypto balance

Since the inception of its ETF, the iShares Bitcoin Trust (IBIT), the asset-managing giant has been steadily buying up the world’s premier cryptocurrency, building its balance from 220 on January 6, 2024, to 552,000 on the last day of the same year.

Since the start of 2025, BlackRock purchased an additional 17,000 BTC, worth $1.7 billion, given the coin’s press time price of $102,484.

BlackRock’s Bitcoin and cryptocurrency balance as of January 23, 2025. Source: Arkham

BlackRock’s Bitcoin and cryptocurrency balance as of January 23, 2025. Source: Arkham

Despite some balance volatility – BlackRock held 559,000 on January 9 and 554,000 just days later on January 16 – the overall trajectory of cryptocurrency under management has been one of mostly steady growth.

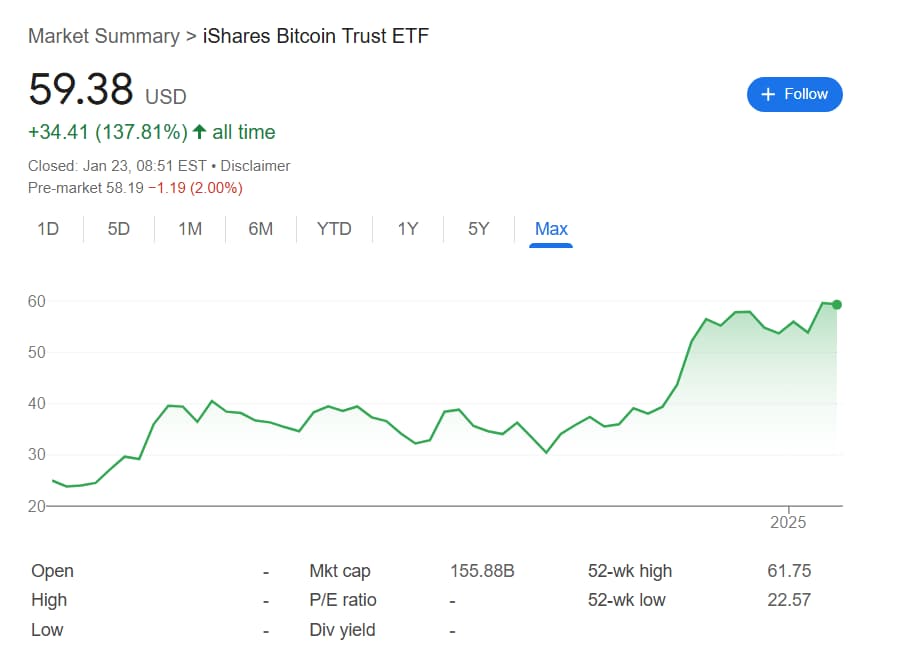

BlackRock Bitcoin ETF price performance

The same cannot be said about the IBIT ETF, which has been rising in waves despite being 137.81% in the green in the all-time chart. For example, the fund surged with some speed between January and March 2024 but then effectively traded sideways until Donald Trump’s re-election.

IBIT ETF all-time price chart. Source: Google

IBIT ETF all-time price chart. Source: Google

This year has been no different for IBIT as the ETF was on the rise until January 6 and was collapsing by January 13, only to regain it once more. Subsequently, it reentered a correction on the 22nd day of the month. At press time, the fund is changing hands at $59.38.

Still, it would appear that BlackRock is expecting an unprecedented surge later in 2025 as its CEO, Larry Fink, recently opined BTC might hit $700,000.

BTC price chart

The performance of the derivative asset isn’t surprising, given it has, so far, mimicked Bitcoin’s trajectory relatively faithfully. BTC itself experienced a staggering rise by March 2024 before undergoing months of sideways trading and decline.

Furthermore, like IBIT, Bitcoin was awakened from its slumber by the election results and found its new highs almost $10,000 above the important psychological $100,000 level.

BTC 1-year price chart. Source: Finbold

BTC 1-year price chart. Source: Finbold

Again, the situation in 2025 is similar as BTC found new and higher highs as recently as January 20 but then corrected to its press time price of $102,484.