Today, Bitcoin reached a fresh record, successfully recapturing the much-anticipated $70,000 level—a threshold it had struggled to regain over the last four months.

Bitcoin has not only re-entered the $70,000 range but is also progressing swiftly toward its all-time high. Specifically, it has hit an intraday high of $71,475 and continues to maintain its gains. Now, Bitcoin is just 3.5% shy of its peak of $73,750.

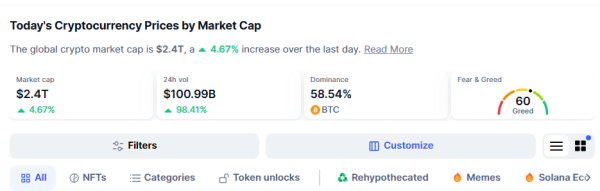

Bitcoin’s rally has been felt throughout the crypto market. The global market experienced a 4.56% increase over the past day, bringing it to $2.4 trillion. This reflects a fresh influx of approximately $112.08 billion entering the market in the last 24 hours. Moreover, market volume has surged by 89.41%, now standing at $100.99 billion.

Robust crypto market amid Bitcoin rally

Robust crypto market amid Bitcoin rally

This unexpected development has prompted market participants to consider the factors behind the turnaround. Analytics platform CryptoQuant attributes the Bitcoin uptrend to massive trading activity, particularly from Binance whales—large traders on the Binance exchange.

How Binance Whales Are Driving Bitcoin Price

In an analysis today, CryptoQuant market watcher Mignolet highlighted that Binance whales have been engaging in the market during Asian trading hours, beginning around October 14.

This activity has impacted the Coinbase Premium Gap (CPG) data, which tracks price differences between Coinbase and Binance—prominent exchanges for U.S. and international traders. As of today, the CPG is declining even as Bitcoin’s price rises, showing a “negative premium.”

Mignolet cautions against interpreting this as a drop in U.S. demand. In fact, since October 14, U.S. Bitcoin spot ETFs have seen heightened inflow, with net influxes of about 47,000 Bitcoin—roughly $3.34 billion, given Bitcoin’s current market value above $71,000.

Additionally, recent inflows into U.S. Bitcoin ETFs reached a six-month high, as reported by The Crypto Basic last week.

Mignolet further noted that CPG data closely tracks ETF demand, as most ETF products use Coinbase. Normally, high U.S. demand would drive the CPG positive, but the negative premium instead suggests that Binance whales are playing a central role in driving Bitcoin’s price. In contrast, U.S. demand remains robust but isn’t fully reflected in Coinbase prices.

Essentially, the current Bitcoin price is being influenced primarily by Binance whales, with strong support from steady U.S. capital inflows.