History: S&P 500 down 100% v. Bitcoin

![]() Cryptocurrency Jul 11, 2025 Share

Cryptocurrency Jul 11, 2025 Share

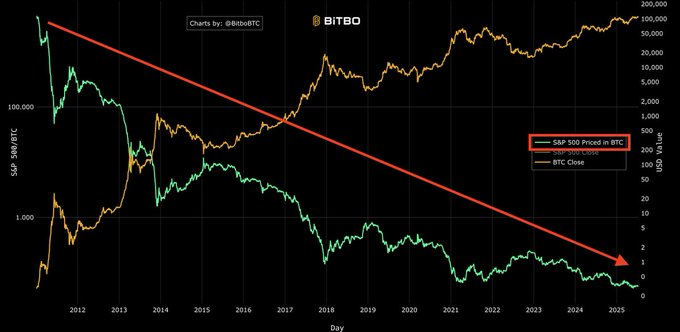

New data indicates that Bitcoin’s (BTC) long-term performance shows the S&P 500 has lost nearly all its value when measured in BTC terms.

These insights emerge at a time when both asset classes are trading at new record highs. For instance, Bitcoin has reached an all-time peak of $118,000, while the S&P 500 is edging close to the 6,300 mark.

By press time, the maiden cryptocurrency was trading at $117,624, having rallied over 6% in the last 24 days, while in the past week, BTC is up 8%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Regarding their relative long-term performance, the S&P 500 priced in Bitcoin is now down 99.98% since 2012, one of the most dramatic asset revaluations in modern financial history, according to data shared by market commentary platform The Kobeissi Letter on July 11.

Year-to-date, the S&P 500 measured in Bitcoin is down another 15%.

Bitcoin v. S&P 500 performance. Source: Bitbo

Bitcoin v. S&P 500 performance. Source: Bitbo

Overall, the data suggests that Bitcoin’s appreciation has been so extreme over the last decade that traditional equity benchmarks appear to have effectively gone to zero when denominated in BTC.

Implications of Bitcoin’s performance against S&P 500

Critics might argue this comparison is more symbolic than practical, considering that few institutions price their portfolios in Bitcoin.

However, for Bitcoin advocates, the data highlights the cryptocurrency’s feature as a scarce, decentralized asset capable of outperforming traditional financial systems over time.

It is essential to note that these two assets belong to distinctly different asset classes. The S&P 500 is a diversified index of large U.S. companies, representing traditional equity ownership in the global economy.

At the same time, Bitcoin is a decentralized, digital asset designed to serve as a store of value and an alternative to fiat currencies.

Featured image via Shutterstock