How Dogecoin could trigger next market crash, according to commodity strategist

![]() Cryptocurrency Mar 18, 2025 Share

Cryptocurrency Mar 18, 2025 Share

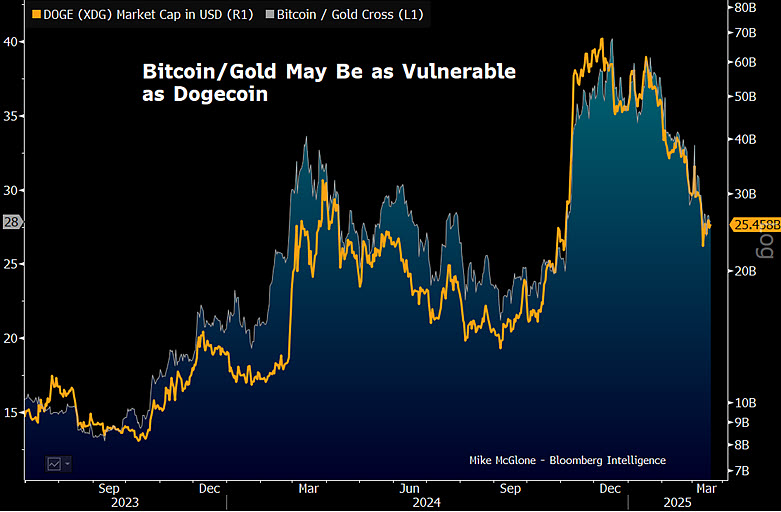

Bloomberg Senior Commodity strategist Mike McGlone has cautioned that meme cryptocurrency Dogecoin (DOGE) could play a surprising role in destabilizing financial markets.

According to McGlone, this potential destabilization could echo past downturns such as the Great Depression in 1929 and the Dot-com bubble of 1999, he said in an X post on March 17.

His analysis was based on Dogecoin’s market cap trajectory alongside Bitcoin (BTC) and gold, hinting at vulnerabilities in these assets. The expert drew a parallel between Dogecoin’s past rise and the speculative bubbles that preceded major market downturns.

Picks for you

Economist says the real Trump trade is ditching U.S. stocks for foreign markets 56 mins ago Legal expert warns Ripple v. SEC delay could crush XRP 4 hours ago XRP whales load up on 150 million tokens — should you buy the dip? 23 hours ago Top 3 commodities to invest in 2025 24 hours ago

McGlone argued that even if Dogecoin’s market cap were to lose three zeros, effectively slashing it by 99.9%, it would remain “silly expensive,” possibly highlighting its lack of utility.

“Silliness of 1929, 1999? Dogecoin, the joke coin, could lop off three zeroes from market cap and still be silly expensive. The chart may show what it might mean for Bitcoin/gold,” he said.

Dogecoin market cap trajectory. Source: Bloomberg Intelligence

Dogecoin market cap trajectory. Source: Bloomberg Intelligence

Dogecoin’s evolution

It’s worth noting that Dogecoin has evolved over the years, emerging as a key player in the cryptocurrency space. The community has moved to increase its utility, with the asset receiving different use cases, such as payments.

Notably, input from influential individuals such as Tesla (NASDAQ: TSLA) CEO Elon Musk has been central to DOGE’s rise.

Generally, McGlone’s concern is Dogecoin’s potential to influence Bitcoin and gold, which are viewed as safe havens or stores of value.

McGlone’s warning taps into broader anxieties about the crypto market’s susceptibility to crashes, especially given the changing regulatory environment and uncertain macroeconomic conditions.

Moreover, the strategist’s reference to the 1929 stock market crash and the dot-com bubble suggests the impact of unchecked speculation leading to collapses. This raises questions about whether Dogecoin’s valuation could be the tipping point for a new financial crisis.

Contrasting crypto and gold performance

Indeed, his warning comes as cryptocurrencies and gold markets depict contrasting performances. As of press time, Bitcoin was trading at $82,812, showing consolidation over the past week, with the asset up a modest 1.4%.

Meanwhile, Dogecoin is also facing bearish sentiment, aligning with the general market trend. At the time of reporting, DOGE was valued at $0.16, up over 3% in the past seven days.

Bitcoin and Dogecoin seven-day price chart. Source: Finbold

Bitcoin and Dogecoin seven-day price chart. Source: Finbold

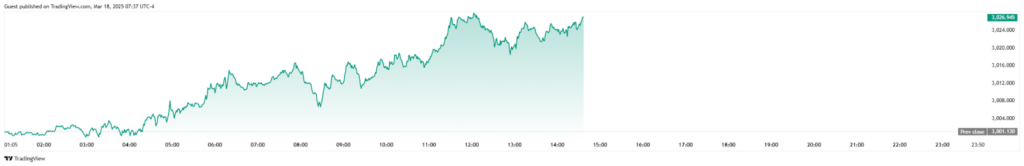

On the other hand, gold is trading at a new all-time high above $3,000 as its safe-haven attributes come into play. The precious metal is valued at $3,023, rallying almost 4% in the past week.

Gold one-day price chart. Source: TradingView

Gold one-day price chart. Source: TradingView

The yellow metal’s surge has been driven by emerging geopolitical uncertainties, with investors seeking it as a hedge against risk amid renewed conflicts in the Middle East and concerns over President Donald Trump’s tariffs.

Interestingly, as reported by Finbold, McGlone had warned that rising gold prices could trigger a possible Bitcoin price crash, with $10,000 as the next potential target. To this end, with gold up 15% in 2025 while Bitcoin has dropped by the same amount, the expert sees this inverse trend as a shift in demand from risk assets to safe havens.

Featured image via Shutterstock