A research-heavy French investment firm has published a quantitative paper explaining the reasons Strategy stock outperforms bitcoin.

French Asset Manager Tobam: Three Reasons Strategy Outperforms Bitcoin

Paris-based asset manager Tobam has researched exactly why Michael Saylor’s Strategy (MSTR) has continued to outperform bitcoin ( BTC), the very asset responsible for boosting its stock price. The firm published its findings on the research site SSRN in a March 2025 paper titled, “Accounting for the performance of Microstrategy.”

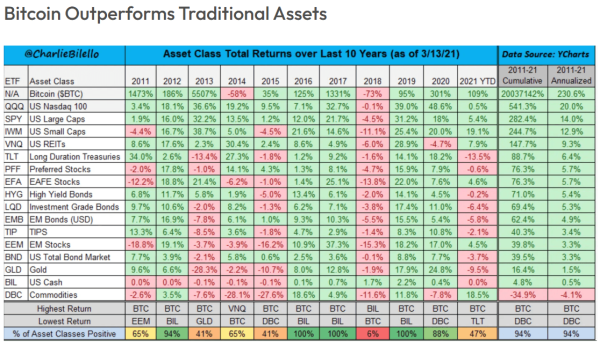

The dominant cryptocurrency is generally considered the best performing asset of all time. Bitcoin cumulative gains topped 20,000,000% between 2011 and 2021, but in August 2020, Strategy (formerly Microstrategy) initiated a radical pivot, transitioning from being a software business to a bitcoin treasury company.

(10-year cumulative returns for bitcoin vs. traditional assets / Charlie Bilello on X)

(10-year cumulative returns for bitcoin vs. traditional assets / Charlie Bilello on X)

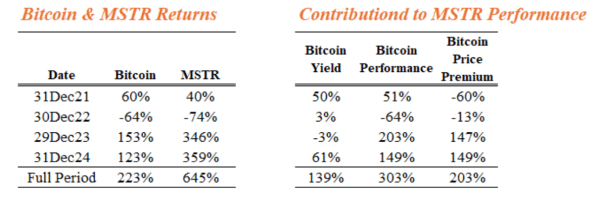

Investors who wanted bitcoin exposure without actually holding the cryptocurrency began purchasing Strategy stock at a premium, and according to Tobam, Strategy’s stock price skyrocketed by a factor of 7.5 while BTC only grew by a factor of 3.2, less than half of MSTR’s growth.

And now, after crunching the numbers, Tobam has distilled the meteoric success of Strategy’s bitcoin treasury approach down to three key reasons.

“We provide an exact decomposition of these rewards into three sources,” Tobam writes. “First, the monetization of a significant part of the pre-existing premium into book value. Second, taking advantage of the performance of bitcoin to which it has a growing exposure, and finally being subject to the variations in its bitcoin price premium.”

Three Key Reasons for Strategy’s Success

Tobam explains that first, Strategy takes advantage of the premium on its shares by selling them and using the proceeds to buy additional bitcoin. The goal is to increase the company’s bitcoin yield, or the percentage change of the number of bitcoins held for each fully diluted share.

Secondly, as the firm increases its bitcoin yield, its shares increasingly magnify the cryptocurrency’s price appreciation, what Tobam calls “bitcoin performance.”

Finally, MSTR’s bitcoin price premium, or the extra dollar value per bitcoin held, has fluctuated in a way that contributes to the stock’s outperformance relative to bitcoin itself.

( BTC vs MSTR performance and how each of Tobam’s 3 factors contributes to MSTR’s performance / Tobam: “Accounting for the performance of MicroStrategy”)

( BTC vs MSTR performance and how each of Tobam’s 3 factors contributes to MSTR’s performance / Tobam: “Accounting for the performance of MicroStrategy”)

In short, Tobam concluded that Strategy has become a leveraged bet on bitcoin, but its ability to outperform the digital asset is a combination of these three factors and not simply due to passively holding bitcoin.

“The performance of MSTR cannot be summarized solely by the variations in its bitcoin holdings and ratio premium,” the paper concludes.