Investor says ‘you will make a lot of money very quickly,’ urges to ‘take profit frequently’

![]() Cryptocurrency Nov 10, 2024 Share

Cryptocurrency Nov 10, 2024 Share

Cryptocurrencies have added over $800 billion in capitalization since September, with $465 billion inflowing in the last five days alone. As a bull market starts and greed dominates the crowd’s sentiment, trading experts share their experience with excited beginner investors.

In particular, the expert long-term crypto and stock investor Jelle went to X on November 10 to share his insights. According to him, we have entered the “genius season,” when most investors will feel like geniuses while making significant money.

Another analyst had previously described this as a market that rewards “dumb bulls” more than “smart bears,” as Finbold reported.

Picks for you

AI predicts Cardano price for 2025 amid Hoskinson-Trump rumors 2 hours ago We asked this AI to build a crypto portfolio for the altseason bull market 2 hours ago How much would $1,000 in Bitcoin from the 2020 COVID-19 crash be worth today 3 hours ago R. Kiyosaki explains how to not be a loser during ‘this giant crash’ 5 hours ago

However, the analyst urged investors to ensure they can keep their profits by realizing the gains frequently. In this case, it is crucial to have a planned strategy with clear price targets to start selling in parts.

“Genius season is here – which means a lot of you will make a lot of money – very quickly. The hard part? Keeping those profits. My #1 tip for the rest of this cycle: take profit frequently, straight into the bank. Have a good Sunday, lads.”

– Jelle

What can investors do with their crypto profits?

Interestingly, the comment section brought different ideas on what investors should and should not do with their cryptocurrency investment profits.

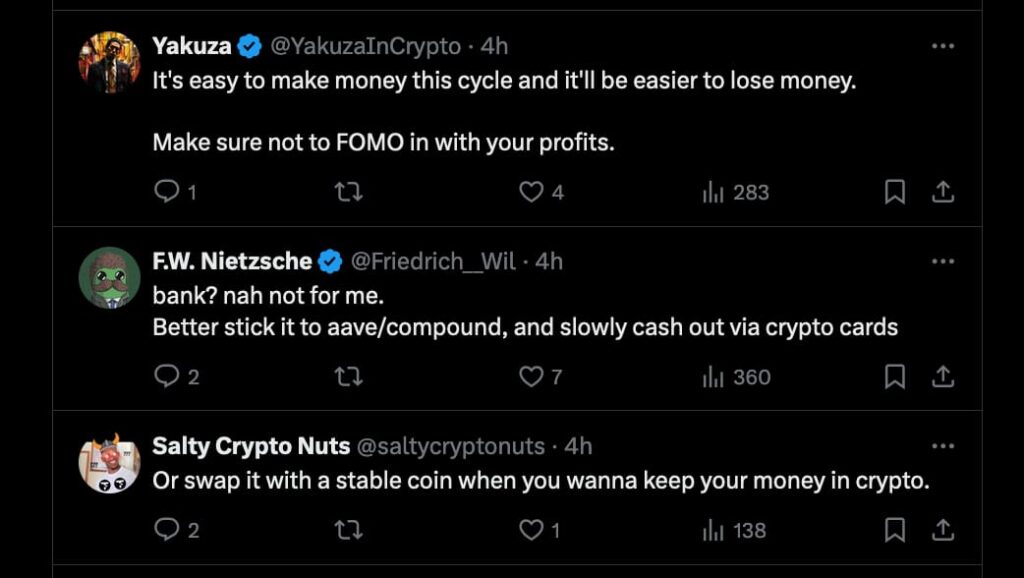

Commentators mentioned the possibility of keeping profits in stablecoins to avoid banks, which can be USDT, USDC, or even alternatives like DAI and USH.

Another comment suggested investors “stick” the profits into Aave or Compound to earn passive income through yield farming. Then, slowly cash out the acquired yield via crypto cards or look for merchants to spend the cryptocurrencies directly.

On the other hand, a more cautious investor warned others against not using the profit to “FOMO” into volatile assets. Essentially, investors should be careful with the “Fear of Missing Out” from other cryptocurrencies, risking losing all the gains.

“It’s easy to make money this cycle and it’ll be easier to lose money. Make sure not to FOMO in with your profits.”

– Yakuza (@YakuzaInCrypto)

Comments on Jelle’s post about taking profits from the “genius season.” Source: X / Finbold

Comments on Jelle’s post about taking profits from the “genius season.” Source: X / Finbold

During a bull market and, more specifically, an altseason, investors can easily see over 30x returns from their positions. Such expressive gains could turbid people’s perception, and greed is a strong motivator to abandon solid strategies for the “FOMO.”

Therefore, investors should plan their strategies beforehand and force themselves to follow the original plan despite the prevailing sentiment. Nevertheless, crypto goes beyond trading and investing, and market participants can be open to embracing the technology as they learn.

Featured image via Shutterstock