Koji Higashi, a prominent entrepreneur in the Japanese BTC crypto arena, has said that while many people in Japan believe Bitcoin is not backed by anything of value, the Japanese yen (JPY) is backed by citizens held hostage to the economy. Higashi’s sentiment strikes the root of a bigger, more controversial issue for Bitcoin fans: the political co-opt of cryptocurrencies.

Japanese crypto entrepreneur and CEO of the Diamond Hands Lightning Network (LN) solution provider, Koji Higashi, has recently said that the Japanese people are being held as “hostages” to a faltering JPY.

Higashi has a rich record of crypto projects and involvement in Bitcoin in Japan reaching back to 2014.

‘The Japanese yen is backed by hostages’

In a recent post on X, Higashi proclaimed (translated from Japanese): “The argument that Bitcoin is not backed up is something the general public agrees with … but what about the backing of the Japanese yen?”

The crypto developer went on to say that the currently embattled JPY is “backed by hostages – Japanese people who, even when their lives are struggling, work diligently, pay taxes, and save money in yen without a word.”

Indeed, the plight Higashi references eroding the Japanese quality of life in the past decade has become noticeable for many.

Retirees who cannot live on their pensions, underpaid workers trying to keep up with a weak yen and inflation, and victims of the massive tax racket in Japan’s ever-expanding bureaucracy are all starting to speak out. This, coupled with an incentivized influx of USD- and euro-toting tourists is all taking an effect.

“That’s all you need to say,” the Diamond Hands co-founder and CEO ends his post.

But Higashi’s observation about folks demanded (under threat of police violence) to pay up taxes, and suffer in silence with a sub-par yen, opens another can of worms that’s been a hot topic lately: the idea that there may be a state and corporate co-opt of popular cryptos.

Blackrock Bitcoin and the Saylor Moon: The ‘fiat-ization’ of crypto

In a recent post on crypto pioneer Roger Ver, Cryptopolitan notes that the early Bitcoin evangelist maintains in his new book that the original Bitcoin — BTC — has been co-opted by powerful and vested interests.

He’s not alone. Some believe the recent orange coin price highs are pumps from market hype and the same fiat system (but this time in USD) that Higashi calls out in his post.

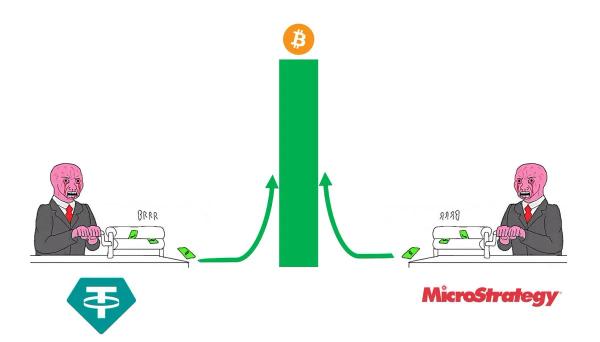

“I mean Tethers are unredeemable and MicroStrategy can always borrow more for more leverage, so this party can just continue forever, right?” software engineer and self-described “Bitcoin Evangelist” David Shattuck quipped on Nov. 21st via social media.

In response to retorts that the hugely popular USD stablecoin is indeed redeemable, another user of X noted: “If anything undermines the market’s trust in it, it loses its peg and the whole thing falls apart.”

Whatever one’s view, indeed, USDT’s reserves are overwhelmingly denominated in U.S. Treasury bills. With American president-elect Trump who says “You never have to default because you print the money,” one may wonder if a state and mega-corporate buy-up of Bitcoin is a good thing.

But according to MicroStrategy CEO, Michael Saylor, these concerns of vested, centralized capture by Blackrock and other state-embedded actors are just the delusions of “paranoid crypto-anarchists.”

Higashi, for his part, is a fan of hotly contested Layer 2, custodial entities like the Liquid and Lightning Networks, but has also said “It is not that difficult to predict the development in which MicroStrategy and Saylor will become ‘enemies of Bitcoin’ in October.