Legendary trader warns Bitcoin ‘expectations way too high’ – Here’s why

![]() Cryptocurrency Dec 1, 2024 Share

Cryptocurrency Dec 1, 2024 Share

A legendary trading expert has warned young people banking on Bitcoin (BTC) as their ticket to financial freedom, even as proponents maintain the asset is poised for record highs.

According to Peter Brandt, Bitcoin bull cycles have significantly ‘degenerated in magnitude’ over time, noting that Gen Z and millennials may have set their expectations regarding digital currency too high, he said in an X post on December 1.

“Bitcoin bull cycles have exponentially degenerated in magnitude. BTC is likely to remain a great hedge vs. fiat busts. But, the bloom is off the rose. Gen M & Zers who view BTC as the road to financial glory are likely to be very disappointed,” he said.

Picks for you

Here’s how bad the U.S. debt crisis has become 18 hours ago Analyst traces Bitcoin roadmap as BTC price edges closer to $100,000 18 hours ago Brazil Central Bank to ban self-custody stablecoins as BRL collapses against the USD 19 hours ago Why Bitcoin could trade at $140,000 in December 19 hours ago

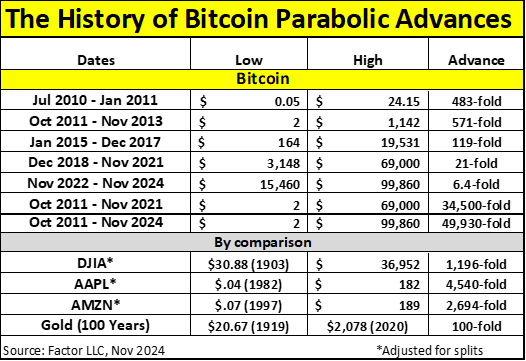

To back this assessment, Brandt shared data mapping Bitcoin’s historical price surges, from a 483-fold rise in 2010-2011 to a much more subdued 6.4-fold advance between November 2022 and November 2024.

History of Bitcoin parabolic advances. Source: Factor LLC

History of Bitcoin parabolic advances. Source: Factor LLC

While Bitcoin has far outpaced traditional investments like the Dow Jones, gold, and even technology giants like Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN) over decades, Brandt suggested the cryptocurrency’s days of explosive growth are fading.

Despite this, he remains optimistic about Bitcoin’s properties, saying it remains an ideal hedge against fiat currency devaluation.

What next for Bitcoin

His warning comes as the market anticipates Bitcoin reaching the $100,000 mark, with some proponents maintaining that the asset has the potential to rally to $1 million. To this end, MicroStrategy’s (NASDAQ: MSTR) executive chairman, Michael Saylor, has projected that Bitcoin might trade as high as $13 million by 2045—a prediction author and investor Robert Kiyosaki endorsed.

In the same vein, Kiyosaki warned that once Bitcoin hits the $100,000 mark, investors should expect a shift in ownership. As reported by Finbold, Kiyosaki believes ownership will be dominated by the ultra-rich, potentially locking young investors out.

Indeed, some key drivers are seen as favorable for Bitcoin, including the possibility of the United States incorporating the cryptocurrency into its strategic reserves and implementing crypto-friendly regulations.

Bitcoin price analysis

At press time, Bitcoin was trading at $96,830, having failed to push past the $100,000 mark. On the weekly chart, BTC is down almost 1%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

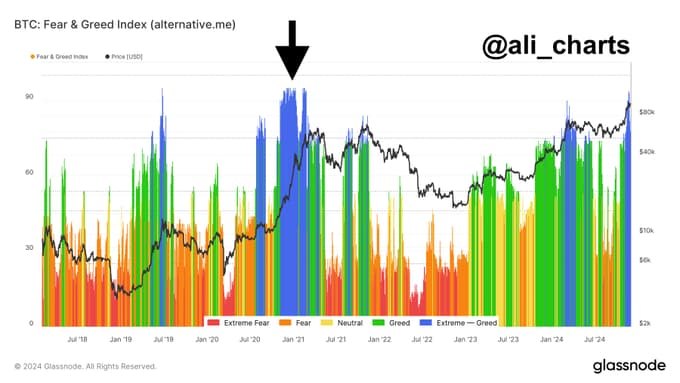

As things stand, on-chain metrics hint at a more explosive rally for the maiden cryptocurrency. Cryptocurrency analyst Ali Martinez shared data indicating that the Bitcoin Fear & Greed Index has hit “extreme greed” territory. Historically, such sentiment has coincided with explosive rallies.

Bitcoin Fear & Greed Index. Source: Glassnode/Ali_charts

Bitcoin Fear & Greed Index. Source: Glassnode/Ali_charts

For instance, Martinez noted that during the last Bitcoin bull run, the index’s extreme greed zone surged from $15,000 to a staggering $57,000. Martinez has already suggested that Bitcoin’s historical price movements indicate the asset might trade as high as $140,000 in December.

While Bitcoin’s growth is slowing, its possible role as a hedge against fiat and potential for future rallies keep it a key focus. However, investors need to monitor the tempered expectations by analysts.

Featured image via Shutterstock