While weak hands are dumping Bitcoin, forcing a retest of the $65,000 threshold, data shows investors with longer-term perspectives are accumulating BTC.

Bitcoin has dropped by over 4% today, triggering a market-wide dump. Specifically, the premier crypto dropped from the daily high of $68,284 to $65,894, with altcoins bearing the brunt. At press time, Bitcoin has settled at around $66,150, invalidating all gains accrued in the past week.

Bitcoin Selling Pressure Examined

Notably, this latest round of bearish sentiment emerged as the U.S. Government moved $2 billion Bitcoin to a new wallet on Monday evening. The movement coincided with Bitcoin briefly recapturing the $70K.

Following the massive Bitcoin movement announcement, the asset quickly tanked to around $66K. While it briefly recovered, it has since hit a lower target today.

The U.S. Government’s decision to move $2 billion Bitcoin stirred fears of a dump, with many criticizing the potential sales. The move comes hot on the heels of the German Government dumping close to $3 billion in Bitcoin this month.

Bitcoin has shown resilience and recovered all losses that the German sales caused, but it is now amid another significant bearish factor.

Long-term Holders Buy BTC with $7.4B

On the other hand, investors with longer-term perspectives are adding more BTC tokens to their portfolios. Prominent market observer Ali Martinez noticed the trend and called attention to it in a recent post on X.

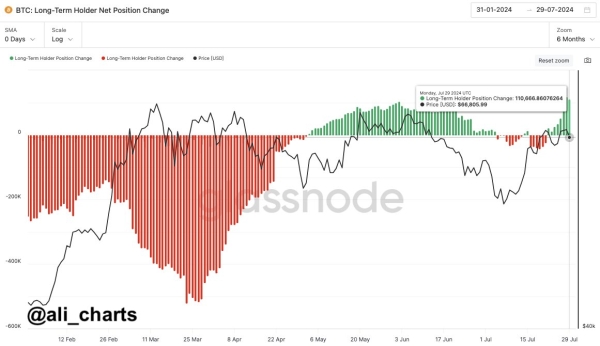

Citing statistics from the analytic platform Glassnode, Martinez disclosed that long-term holders are on an accumulation spree as they have added more than 100,000 BTC to their wallets this month.

In particular, the report noted that as of Monday, the positions of long-term holders positively changed by 110,666 BTC. At the price of $66,805 per Bitcoin yesterday, this change amounts to an astonishing $7,393,042,130 (approx $7.4 billion) accumulated.

This mirrors a similar occurrence in May when Bitcoin whales amassed over 47K BTC valued at $2.8 billion in one day.

Notably, Martinez’s chart indicated that long-term Bitcoin holders have continued to top up their wallets since May, though a slight negative trend surfaced earlier this month.

Bitcoin long term holders buying BTC | Glassnode

Bitcoin long term holders buying BTC | Glassnode

Before the sustained uptrend in Bitcoin buying, this tier of investors saw their holdings depreciate for an extended period between February and April, as they capitalized on Bitcoin’s price surge during the period. Now, they are reversing the trend amid Bitcoin’s price dip.