As Bitcoin (BTC) moves through its current bull market cycle, it is nearing an unusual milestone.

According to veteran trader Peter Brandt, this cycle may soon mark the longest stretch in Bitcoin’s history without hitting a new all-time high (ATH) following a halving. While Bitcoin remains locked in a sideways trend, the market is left to wonder: Will it soar to new heights, or is a new ATH slipping further out of reach?

Cycles of Boom and Decline

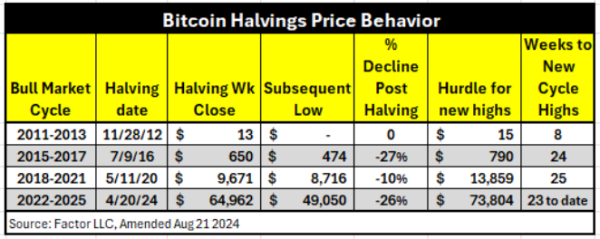

Per Brandt’s assessment, in the 2011-2013 cycle, Bitcoin barely stumbled after its first halving, quickly surging past the $15 hurdle in just eight weeks. This cycle was defined by rapid recovery and explosive growth.

But the terrain became rougher as time passed. In the 2015-2017 cycle, Bitcoin took a steep 27% plunge after halving, falling to $474 before slowly regaining momentum. It would be 24 weeks before Bitcoin broke through the $790 barrier and charted a new course to higher peaks.

The 2018-2021 cycle brought its own twists. Though the 10% decline post-halving seemed mild, Bitcoin still took 25 weeks to reach a new high of $13,859. The journey through this cycle demonstrated that while Bitcoin had matured, its path to recovery was slower, though steady.

Fast forward to the ongoing 2022-2025 cycle, and Bitcoin’s trajectory is even more uncertain. A 26% drop after the halving mirrors the 2015-2017 cycle, yet the market has stalled 23 weeks in, with no new ATH in sight. The $73,804 hurdle looms large, but will Bitcoin make the leap?

The Threat of Exponential Decay: $30K Drop Projected

As traders watch Bitcoin’s current cycle unfold, Brandt introduces a more unsettling concept: Exponential Decay, citing his April 26 blog. According to Brandt, each cycle since 2011 has lost roughly 80% of the force of the previous one. The 3,191X advance of the 2009-2011 cycle shrank dramatically in the following years. By 2018-2021, the advance had dwindled to just 22X. And now, Brandt projects the current cycle could rise by just 4.5X.

With Bitcoin’s high already touching $73,835 in March 2024, Brandt suggests there’s a 25% chance that the cycle has peaked. If that’s the case, the market could slide back into the mid-$30,000 range—a sobering possibility for those who have been holding out for a repeat of the explosive gains of earlier cycles.

The Waiting Game

Despite these concerns, the future remains unclear. Per The Crypto Basic report this month, Brandt points to an expanding triangle pattern forming on Bitcoin’s charts. The pattern, however, is incomplete.

Without a breakout in either direction, the market remains in a holding pattern, leaving traders guessing whether the next major move will take Bitcoin higher or lower.

Bitcoin inverted triangle Peter Brandt

Bitcoin inverted triangle Peter Brandt

Brandt’s cautious approach, rooted in classical charting principles, contrasts with the optimism of some who believe Bitcoin is poised for a rally toward $70,000. He refrains from jumping into trades until a breakout confirms the trend.

For now, the market is left to wait, watching closely for signs of that decisive moment that will dictate Bitcoin’s next direction.