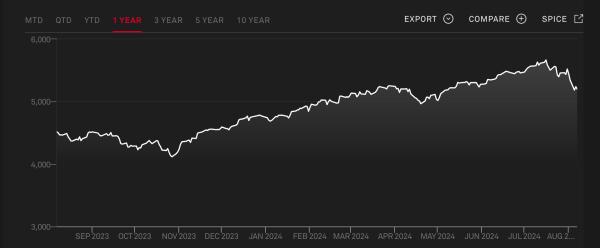

U.S. stocks are in the red again. The market is clearly struggling to recover after recent tumbles.

On Wednesday afternoon, the S&P 500 dropped 0.5%, while the Nasdaq Composite fell 0.7%. Earlier in the day, both indices were up, with the S&P 500 climbing as much as 1.7% and the Nasdaq jumping 2.1%.

Tech and consumer stocks hit hard

The reversal shows that stocks are finding it tough to maintain gains from Tuesday, when both the S&P 500 and Nasdaq managed a 1% recovery.

This came after a rough period where they each fell 6% and 8%, respectively, over the previous three sessions. Adding to the gloomy outlook were so many disappointing earnings reports.

Super Micro Computer took a massive hit, plunging nearly 20% as investors reassessed the future of the artificial intelligence boom.

Airbnb also had a rough day, dropping 14.7%, while Walt Disney fell 3.2%. These drops stoked fears of a broad consumer slowdown, adding to the market’s woes.

And Bitcoin?

Bitcoin, meanwhile, is showing some interesting trends of its own. The number of Bitcoin addresses with a balance of over 0.1 BTC is nearing an all-time high.

Right now, there are 4,580,424 such addresses, just shy of the record 4,586,540. This represents a month-over-month increase of 27,939 addresses.

Bitcoin’s price recently dropped from around $67,500 to $49,000, giving investors a prime buying opportunity. This allowed many to accumulate Bitcoin at prices below $50,000.

Even though Bitcoin is now trading in the $50,000-$60,000 range, down 24% from its all-time high, buyers are still keen. This could push the number of addresses with over 0.1 BTC to a new record soon.

Bitcoin’s total supply is capped at 21 million, with around 19 million mined to date. Estimates suggest about 3 million of these may already be lost.

As Bitcoin gains more traction, the number of addresses holding at least 0.1 BTC is expected to rise, reflecting broader adoption and increased usage.

At the time of writing, Bitcoin was worth over $57,000. It briefly tumbled below $50,000 on Monday, a massive drop but one that has seemingly reignited interest among investors.

Crypto saves Robinhood

Robinhood, the brokerage known for disrupting Wall Street with free stock, crypto, and options trading, saw a huge lift from the recent bounceback in cryptocurrency trading.

Their net revenue last quarter rose to $682 million, a 40% increase from the same period last year. Nearly half of this revenue came from customer transactions on the platform.

As cryptocurrency prices recovered this year, trading activity on Robinhood surged. Revenue from crypto trading shot up 161% from the previous year to $81 million.

Both sales and profits exceeded Wall Street expectations, showing strong performance despite the overall market struggles. Options trading on Robinhood also saw a boost, increasing 43% from the previous year to $182 million.