Monster $15 billion Bitcoin short squeeze alert

![]() Cryptocurrency Jul 25, 2025 Share

Cryptocurrency Jul 25, 2025 Share

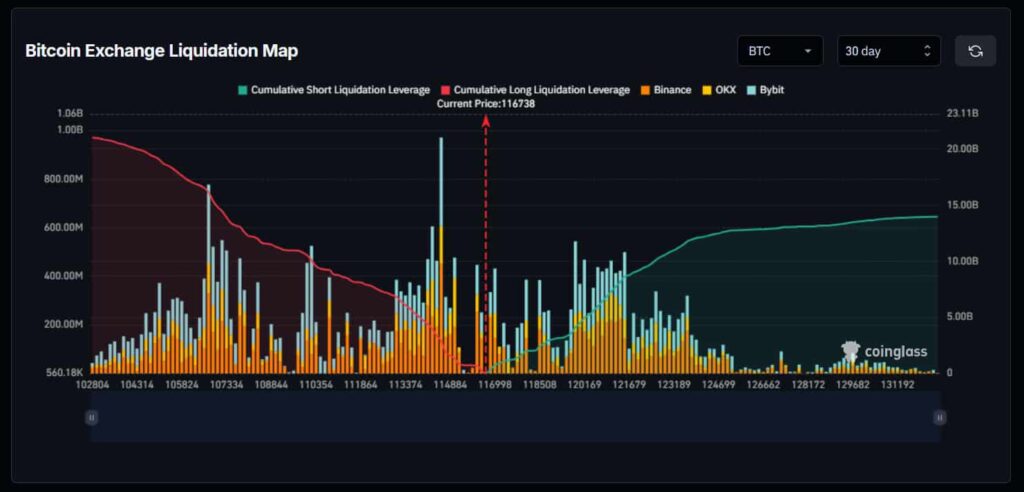

It appears that a surge in upside liquidity suggests that Bitcoin (BTC) could be gearing up for another short squeeze.

While the cryptocurrency is trading at over $116,738, nearly $15 billion in leveraged short positions on exchanges like Binance, Bybit, and OKX is now exposed heading into the weekend, according to the latest data from CoinGlass retrieved on July 25.

The liquidation heatmap also reveals a dense buildup of potential buybacks that could propel the asset higher if it breaches the $120,000 resistance zone.

For the sake of clarification, the chart below highlights the areas with the highest concentration of leveraged positions, as well as the areas where those positions are most at risk. The rising green curve on the right side indicates the level of short liquidation leverage, showing where traders are most likely to be wiped out.

BTC exchange liquidation map. Source: CoinGlass

BTC exchange liquidation map. Source: CoinGlass

Observing the data, we see the curve rising more rapidly past the $120,000 mark, where a large cluster of leveraged liquidity is concentrated. As soon as BTC begins approaching those levels, it could set off a chain reaction, trapping late short sellers and launching the cryptocurrency even higher.

Put simply, the chart reveals just how much capital is currently betting against Bitcoin rising. If BTC moves higher, these short positions will start losing money, and if it climbs fast enough, exchanges will begin automatically liquidating them.

Usually, when shorts are forced to close, the event triggers buy orders as traders have to purchase more Bitcoin to cover their positions. That sudden wave of buying pressure typically drives the price even higher, causing a cascade of additional liquidations, as we have observed during the 2020 and 2021 short squeezes.

Bitcoin short liquidation leverage summary

At first glance, the chart might look overwhelming, but it simply pinpoints where leveraged traders are most vulnerable. Right now, the traders in the danger zone are those betting against Bitcoin going up past more or less $120,000.

Of course, there is no guarantee that BTC will really rise, but the $14.69 billion in short exposure is still a bullish indicator because it shows how volatile the current price is. That is, if a strong enough growth catalyst appears, the price changes that follow could potentially be sudden and explosive instead of gradual.

Featured image via Shutterstock