OpenAI’s ChatGPT names the two cryptocurrencies that will win in 2025

![]() Cryptocurrency Feb 11, 2025 Share

Cryptocurrency Feb 11, 2025 Share

The global cryptocurrency market cap has fallen to $3.3 trillion, down 1.9% in the past 24 hours, as digital assets struggle to regain footing despite broader market recoveries.

While stocks have rebounded from last week’s trade war concerns, cryptocurrencies remain under pressure, fueling uncertainty among investors. With investor sentiment shifting rapidly, traders are on the lookout for assets that can withstand volatility and deliver strong returns.

Against this backdrop, Finbold tasked OpenAI’s ChatGPT to identify cryptocurrencies expected to maintain dominance and thrive despite market uncertainty in 2025.

Picks for you

Gold price alert: Key levels to watch right now 7 hours ago We asked DeepSeek AI what will be XRP price end of 2025 7 hours ago Nexo Card now available in Switzerland and Andorra 9 hours ago ChatGPT says Cardano (ADA) will hit this target by Q1 2025 9 hours ago

ChatGPT names two cryptocurrencies that will win in 2025

When queried about the top cryptocurrencies for 2025, OpenAI’s ChatGPT projected Bitcoin (BTC), Ethereum (ETH), and Solana (SOL)—a prediction that interestingly mirrors projections from DeepSeek, further reinforcing the credibility of these picks in the long term.

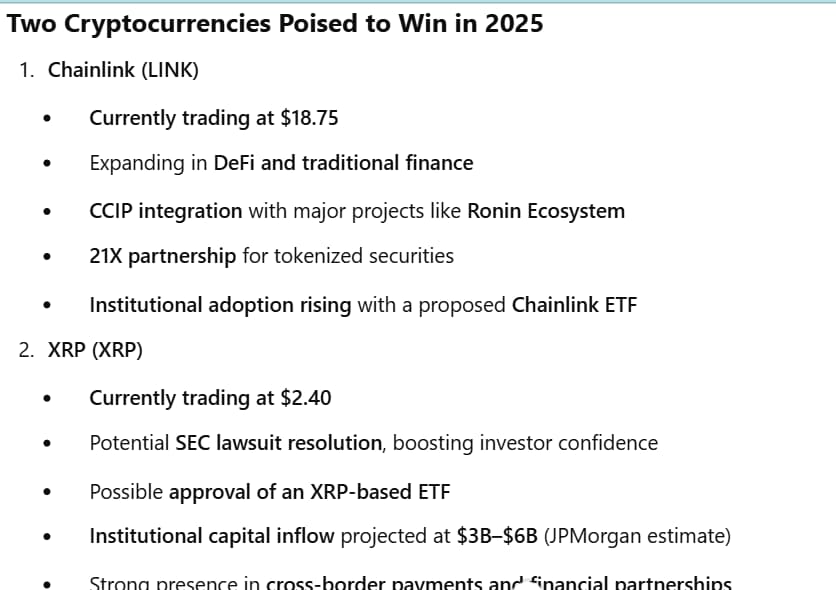

However, when prompted for alternative picks, the AI model highlighted Chainlink (LINK) and XRP as strong candidates. With Chainlink’s dominance in blockchain infrastructure and XRP’s continued relevance in cross-border payments, these two cryptocurrencies could emerge as key players in 2025.

ChatGPT picks two cryptocurrencies poised to win in 2025. Source: ChatGPT/Finbold

ChatGPT picks two cryptocurrencies poised to win in 2025. Source: ChatGPT/Finbold

Chainlink(LINK)

Currently trading at $18.37, Chainlink continues to expand its presence across DeFi and traditional finance, strengthening its long-term growth potential.

LINK one-day price chart. Source: Finbold

LINK one-day price chart. Source: Finbold

The network’s influence in DeFi continues to grow, with the Ronin Ecosystem, a major gaming blockchain, integrating Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable seamless cross-chain asset transfers.

Meanwhile, Chainlink is making inroads into traditional finance, with European fintech firm 21X integrating its infrastructure to support tokenized securities, strengthening its relevance in some of the world’s most tightly regulated financial markets.

At the same time, strategic partnerships continue to support Chainlink’s ecosystem. Usual, a decentralized stablecoin protocol, has adopted the Chainlink Standard to enhance liquidity and utility for its $USD0++ and $USD0 tokens.

Institutional interest in Chainlink is gaining momentum, with Tuttle Capital Management filing a proposal with the Securities and Exchange Commission (SEC) for the first ETF tied to the token.

If approved, this could drive broader adoption and attract substantial institutional capital.

As the altcoin market prepares for a potential rebound, LINK stands out as a key asset to watch, backed by growing real-world utility, expanding integrations, and increasing investor confidence.

XRP

Currently trading at $2.40, a key factor that could drive XRP’s rally is the ongoing SEC lawsuit, which has weighed heavily on the token’s price.

XRP one-day price chart. Source: Finbold

XRP one-day price chart. Source: Finbold

With a new administration now in office, optimism is growing for a favorable outcome, which could bring long-awaited regulatory clarity, potentially strengthening investor confidence and driving demand for the token.

Beyond legal developments, XRP could see a major boost from broader market catalysts. One of the most anticipated breakthroughs is the potential approval of an XRP-based exchange-traded fund (ETF), which could unlock substantial institutional capital.

With Grayscale Trust and Purpose Investments submitting applications and a pro-crypto stance from the current U.S. administration, speculation is mounting that an XRP ETF could gain regulatory approval within the next year.

According to JPMorgan analysts, such a fund could attract between $3 billion and $6 billion in net assets in its first year, potentially pushing XRP toward new highs as institutional interest accelerates.

That being said, given the cryptocurrency market’s inherent volatility, traders must remain vigilant, closely monitoring trends and developments to navigate risks and capitalize on opportunities.

While LINK and XRP demonstrate strong potential, market conditions can shift rapidly, making informed decision-making essential for investors looking to maximize gains in 2025.

Featured image via Shutterstock