Opportunity? This Solana (SOL) indicator ‘calling for $850’ target

![]() Cryptocurrency Sep 4, 2024 Share

Cryptocurrency Sep 4, 2024 Share

Solana (SOL) could be presenting a potential buying opportunity for investors, as chart patterns hint at a possible bullish momentum in the coming months.

Cryptocurrency trading expert Trading Shot has identified this opportunity in a TradingView analysis posted on September 4.

In presenting this opportunity, Trading Shot referenced an analysis shared three months ago, which cautioned against buying SOL until the decentralized finance (DeFi) token tested the 50-week moving average (1W MA50).

Picks for you

Here's when the U.S. Dollar could reach 154 Japanese Yen (USD/JPY) 5 hours ago Bitcoin is ready for a bullish reversal: ‘This time could be different’ 7 hours ago Why is Michael Saylor not buying Bitcoin lately? 9 hours ago Bitcoin's dip 'may keep dipping' if this trendline is not breached, says analyst 10 hours ago

Notably, this projection has been realized, with the token rebounding to hit the mark early this month. However, Solana’s recent price drop has put this thesis in a precarious position.

The expert pointed out that attention has now shifted to whether the token can sustain its price above the 1W MA50. Failure to do so could lead SOL to plunge to the 200-week moving average (1W MA200), a crucial level for the survival of the bull cycle.

SOL price analysis chart. Source: TradingView/Trading Shot

SOL price analysis chart. Source: TradingView/Trading Shot

Additionally, the analysis identified the one-week Relative Strength Index (RSI), which has been in a corrective phase since SOL’s March 2024 high. This correction is seen as a necessary adjustment following the massive rally in 2023.

Interestingly, the indicator is nearing the bull cycle’s buy zone, which enables buyers to initiate major moves during bullish cycles rather than at bear market bottoms. This pattern is reminiscent of a similar one observed in December 2020, potentially signaling a new phase of buying interest.

SOL’s next target

Regarding price movement, Trading Shot noted that a review of past performances indicated that Solana’s previous cycle saw an astronomical rise of 51,250% as it began forming its current long-term Fibonacci channel up.

If a similar growth rate is observed from the recent bear market bottom, Solana could potentially peak slightly above $4,000—an optimistic scenario. At the same time, the expert offered a more realistic and less risky target of $850, anticipated to be at the top of the Multi-Moving Bands (MMBs).

“A more realistic target for those who don’t want to hold for that long and assume higher risk, would be $850.00, which is expected to be at the top of the MMBs,” the expert said.

It’s worth noting that increased whale-selling activity could derail Solana’s potential price trajectory. For instance, data shared by Lookonchain in an X post on September 3 revealed that a whale sold 695,000 SOL, approximately $99.5 million, this year.

Since the beginning of the year, the same whale has been on a selling spree, offloading an average of 19,306 SOL weekly, totaling almost $100 million worth of the token.

Indeed, Solana has been among the best-performing digital assets in recent months, driven by elements such as increased interest in meme coins developed on the network.

Solana price analysis

As of the reporting time, Solana was trading at $134, reflecting daily gains of over 3%. However, over the past seven days, the token has plunged by over 7%.

SOL seven-day price chart. Source: Finbold

SOL seven-day price chart. Source: Finbold

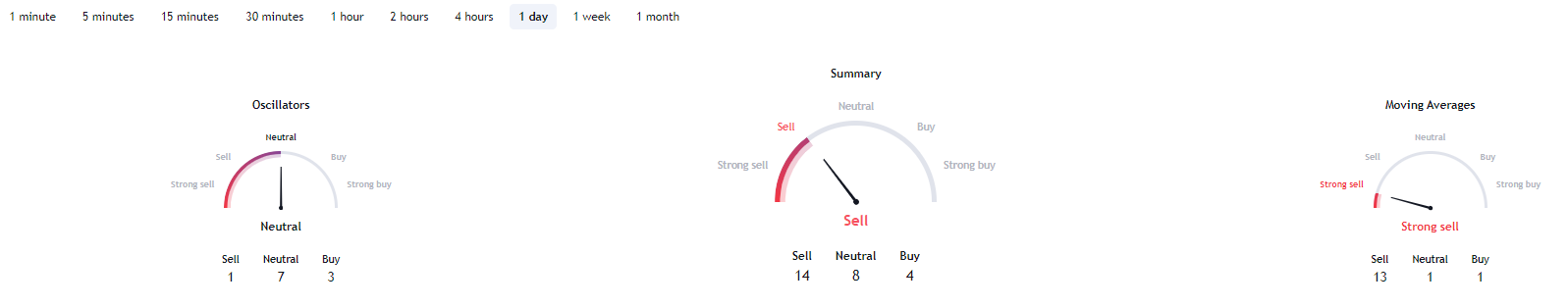

Although Solana demonstrates bullish sentiment in the short term, technical analysis from TradingView points to a more bearish outlook. According to a summary of the one-day indicators, the token is dominated by a ‘sell’ signal at 14, with moving averages indicating a ‘strong sell’ at 13. However, oscillators are ‘neutral’ at 7.

SOL one-day technical analysis. Source: TradingView

SOL one-day technical analysis. Source: TradingView

In conclusion, based on recent price movements, Solana’s price trajectory will likely depend on overall market sentiment, considering the token has minimal network-specific fundamentals to drive a price rally.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.