Planning on shorting Bitcoin? Here’s the latest BTC short ratio

![]() Cryptocurrency Nov 12, 2024 Share

Cryptocurrency Nov 12, 2024 Share

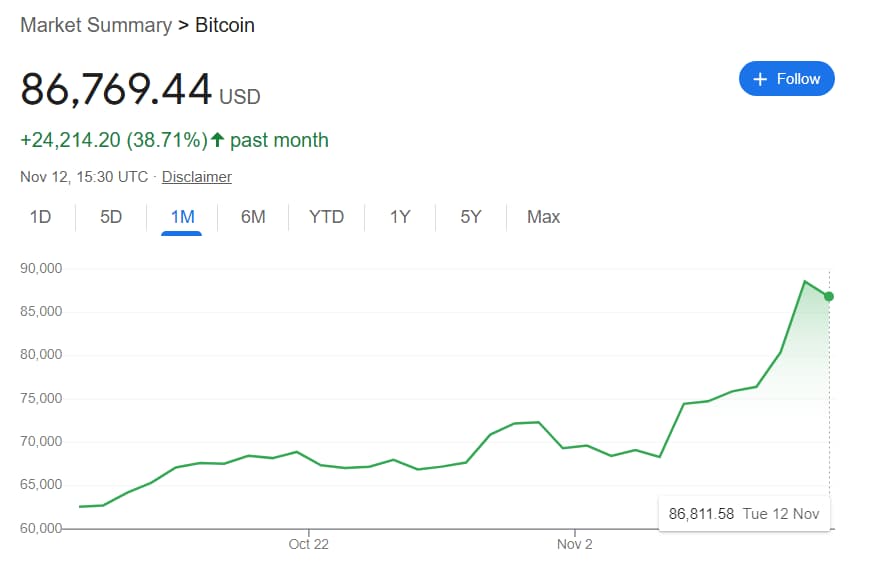

After the 2024 presidential election results became certain on November 6, Bitcoin (BTC) embarked on a remarkable rally, surpassing silver to become the world’s eighth-largest asset and soaring toward the $90,000 mark.

Such a staggering rally has simultaneously fueled investor interest as BTC appeared poised to hit the long-awaited $100,000 as the market experienced massive inflows and provided an opportunity to profit off a well-timed short position.

Still, as ever, betting against the world’s premier cryptocurrency is proving risky, as an estimated $222 million worth of Bitcoin shorts have been liquidated in the last 24 hours alone.

Picks for you

2 cryptocurrencies to reach $10 billion market cap by the year-end 7 hours ago Smart trader buys $34M in ETH as Ethereum Foundation sells $340k 9 hours ago This is the event that will force MicroStrategy to sell Bitcoin, warns expert 10 hours ago Is buyer confidence in Gold fading as bears loom on the horizon? 12 hours ago

Shorts dominate Bitcoin volume despite record rally

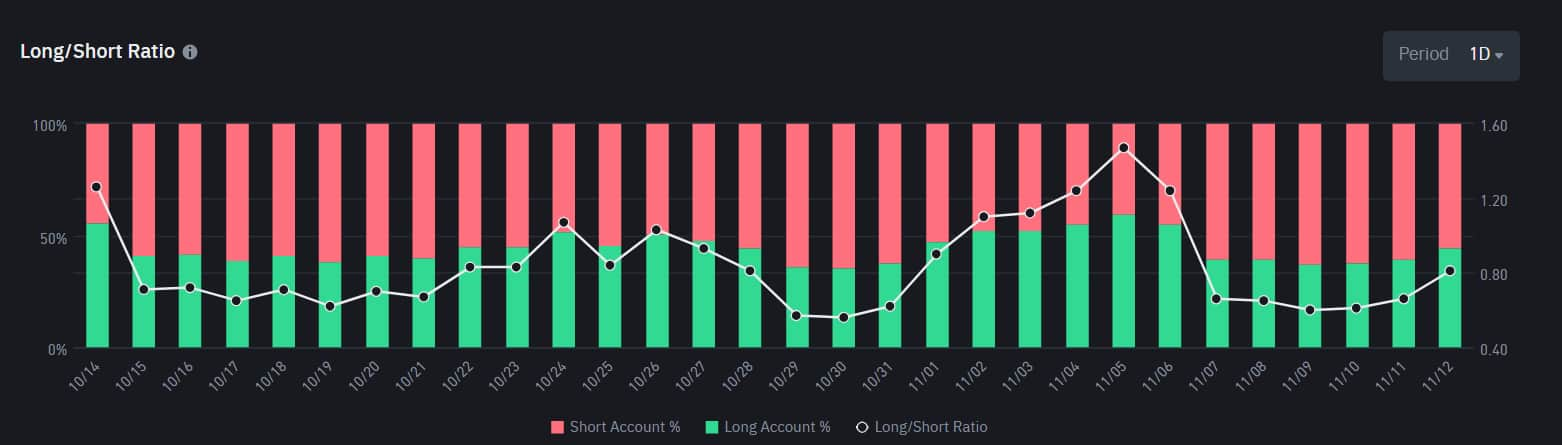

Still, it is interesting that comparatively few traders opted to short Bitcoin amidst the price surge as the actual peak of short positions came shortly before the election, per the data retrieved from Binance on November 12.

Data shows, there were two distinct periods of heightened short volume. The first occurred during the transition between October and November, and the ratio approached 65% in favor of shorts.

The second phase came as the post-election BTC rally temporarily slowed down as it struggled to climb within the rough range between $74,000 and $76,000.

Interestingly, recent trading shows a shift, with long positions regaining dominance as of November 12, signaling renewed optimism for Bitcoin’s continued rally. Specifically, bets favoring a continued rally exceeded 40% of the total volume for the first time since November 6.

Bitcoin long/short ratio. Source: Binance

Bitcoin long/short ratio. Source: Binance

Such a shift in the dynamic can be explained, on the one hand, by the rapid weekend and Monday rally erasing a vast amount of short positions and, on the other hand, by BTC finally entering a correction on Tuesday.

Bitcoin price analysis

Indeed, after experiencing what appeared like an unrelenting upsurge since November 5, Bitcoin rejected the final push to $90,000 and retraced to just above $85,000.

Such moves might indicate BTC is narrowing in on its new critical support and resistance levels, though it remains uncertain if the cryptocurrency will continue its record-breaking run on the next attempt or if it will trade sideways in the $5,000 channel before finding its next direction.

Still, as pointed out by the cryptocurrency expert Seth on X, the current volatility will have little bearing on long-term investors, though it is likely to harm traders seeking to time their positions as BTC is, as of press time, fully in untested waters.

Whatever future trading may bring, Bitcoin is, at press time on November 12, standing at $86,769 following a remarkable 38.71% surge in the last 30 days and a 14.30% rise in the last 5.

Bitcoin 30-day price chart. Source: Google

Bitcoin 30-day price chart. Source: Google

This latest performance came at the top of BTC’s already strong growth in 2024, which ensured it is up 96.29% in the year-to-date (YTD) chart.

Featured image via Shutterstock