R. Kiyosaki reveals what to do ‘when the stock market bursts’

![]() Cryptocurrency Dec 10, 2024 Share

Cryptocurrency Dec 10, 2024 Share

Robert Kiyosaki, the prominent investor and author of the best-selling personal finance book Rich Dad Poor Dad, has long warned of the fragility of the U.S. economy, frequently raising the alarm of a massive looming crisis.

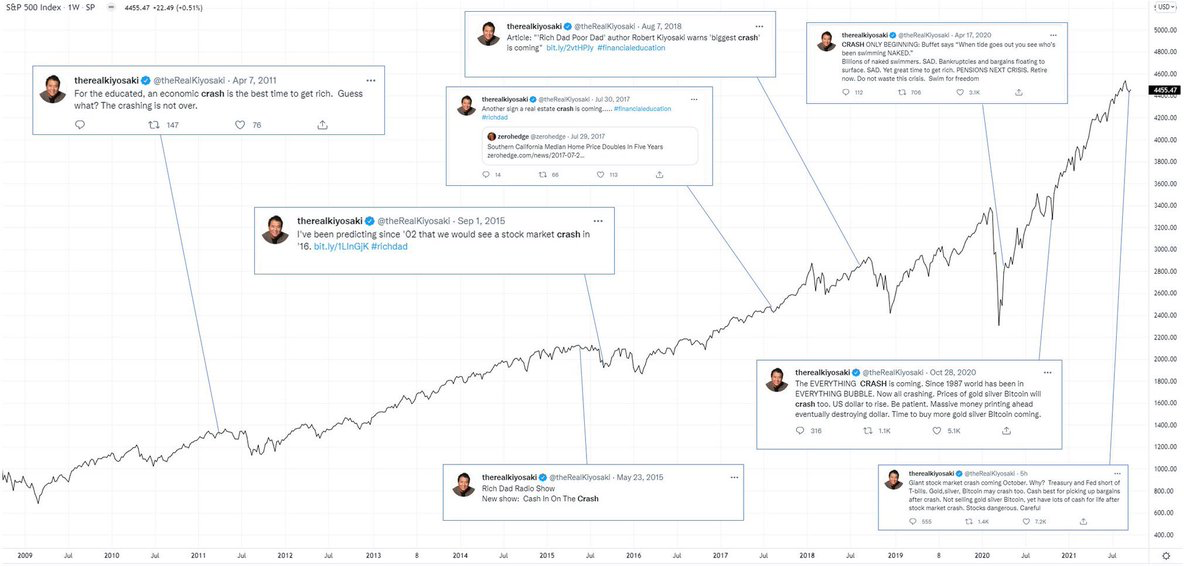

The S&P 500 price chart with Rober Kiyosaki’s crash predictions up to 2021. Source: @fintwit_news

The S&P 500 price chart with Rober Kiyosaki’s crash predictions up to 2021. Source: @fintwit_news

Still, it is worth pointing out that the writer’s specific predictions – particularly those cautioning that an economic crisis is imminent – haven’t always been well-timed and the stock market has been on a near-constant rise despite the dire forecasts.

Additionally and, again, despite being a supporter of Donald Trump and elated by the election results, as evidenced by his X posts, Kiyosaki appears to indicate that America is not out of the woods. Indeed, on December 9, the finance guru once again took to social media to advise his followers on how to survive ‘the CRASH that is coming.’

Picks for you

Trading expert charts Bitcoin’s path to $400,000 by 2026 17 mins ago ChatGPT says Shiba Inu price will hit this target by December 31, 2024 1 hour ago Legendary crypto trader turns $3k into $73 million 2 hours ago Bitcoin price set for a massive crash if this crucial level is lost 4 hours ago

Specifically, the author and investor identified the members of the Boomer generation – his own – as the ones who will suffer the most once the economy, as it is known at press time, presumably collapses.

BOOMERS are SOL:

When stock market bursts…BOOMERS will be BIGGEST LOSERS.

BOOMERS have been lucky.

In 1970’s BOOMER’s caused real estate market to BOOM.

In 1970’s BOOMER’s 401k’s caused stock and bond market to BOOM.

In 2020’s BOOMER’s old age will cause real estate and…

— Robert Kiyosaki (@theRealKiyosaki) December 9, 2024

Robert Kiyosaki’s panacea against ‘the CRASH that is coming’

Simultaneously, Kiyosaki urged his younger followers to advocate with their parents that they take advantage of the luck they had growing up – baby boomers are among the richest generations as they both benefited from the final phase of the New Deal economy and the initial headwinds of the pivot to neoliberalism – by selling their real estate.

The author implied that the housing market would eventually crash and that the right decision would be to cash in now while prices are still at record highs.

While the ‘Rich Dad Poor Dad’ writer did not advise where the parents and children should live once they sell their real estate, he did say what they should do with the money they raise: buy gold, silver, and Bitcoin (BTC).

Kiyosaki himself explained he isn’t relying on his ‘home to be an asset, or a 401k or IRA to keep me alive in retirement,’ and has been a known BTC and commodity investor for years.

Still, it is interesting that despite saying he isn’t counting on his house to be an asset and recommending his followers sell their real estate to buy cryptocurrency, gold, and silver, he also claims to own 15,000 houses.

Would following the ‘Rich Dad’ portfolio be a profitable strategy?

Whatever the actual potential of the Kiyosaki strategy to help people survive ‘the biggest CRASH in history’ that he says is ‘coming,’ it is hard to argue that the author’s portfolio – known to consist of real estate, Bitcoin, Ethereum (ETH), Solana (SOL), gold, silver, and wagyu cattle – has performed remarkably well in 2024.

Though his non-cryptocurrency investments have also been doing well this year – gold, for example, surged above $2,700 by early November and is, at press time, just some $100 away from all-time highs (ATH) – Bitcoin has, without a doubt, been the star of 2024.

Indeed, despite the slight retracing and BTC’s inability to find a stable footing above $100,000, the coin is a remarkable 132.44% in the green since January 1, with a press time price of $97,325.

BTC YTD price chart. Source: Finbold

BTC YTD price chart. Source: Finbold

The situation in the stock, commodity, and cryptocurrency market in 2024 has, by extension, also ensured that investors who followed Kiyosaki’s strategy so far have recorded massive profits throughout the year.

Featured image via Cavaleria Com YouTube