A report from August highlights oversold conditions for Bitcoin and potential upside as it trades near cycle bottom.

The report outlined key factors influencing Bitcoin’s current market position and future price trajectory. The report resurfaced as Bitcoin recently surged to $62,000, spurred by yesterday’s rate cut. This latest movement has generated renewed discussions about Bitcoin’s long-term price potential, particularly the possibility of reaching $1 million within the next decade.

Current Market Position

Per the report, Bitcoin trades near the lower end of the Power Law’s logarithmic band, a historical indicator of consolidation or a potential market bottom. This position signals limited downside risk, suggesting the possibility of an upward movement.

Interestingly, the Long-Term Power Law model indicates that Bitcoin’s price should be around $89,000, significantly above its current value.

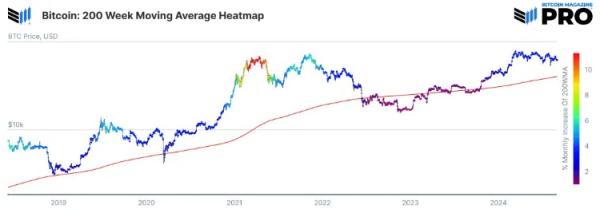

The 200-Week Moving Average (200W MA) Heatmap also highlights Bitcoin as oversold, often a precursor to significant price rebounds. Historically, when Bitcoin has traded near this level, it has led to substantial price increases as market sentiment improves and long-term investors re-enter.

BTC 200 Week MA

BTC 200 Week MA

The 200W MA Heatmap further supports this, with current deviations below the average indicating that Bitcoin is undervalued. This positioning has been rare historically and has typically preceded price recoveries within a few months.

Long-Term Projections and Industry Insights

The analysis extends beyond the short term, forecasting a possible price of $100,000 between 2021 and 2028, with expectations to maintain this level beyond 2028. In a broader timeframe, the report projects Bitcoin could reach $1,000,000 between 2028 and 2037, maintaining above this price thereafter.

This view aligns with investment strategist Lyn Alden’s recent prediction, which tips Bitcoin to trade at $1 million per coin by 2035. Alden emphasized Bitcoin’s continued dominance as a digital asset and portable store of value as key drivers for this ambitious forecast.