Robert Kiyosaki’s Q1, 2025 portfolio performance

![]() Cryptocurrency Apr 1, 2025 Share

Cryptocurrency Apr 1, 2025 Share

While many of his X posts and other business activities have been controversial, the success of Robert Kiyosaki’s investment portfolio in 2024 is impossible to dispute as it appreciated 62.38% within the 12 months..

In 2025, however, some of the ‘Rich Dad Poor Dad’ author’s top picks have been trading either lower or mostly sideways, and Finbold decided to examine if the Kiyosaki cryptocurrency and commodity-focused strategy continued working through the just-ended first quarter (Q1).

Here’s how much investing in BTC, gold, and silver in Q1 would return

While his holdings extend beyond the big three – Bitcoin (BTC), gold, and silver – for most of his followers, these are the assets that first come to mind when Kiyosaki’s name is mentioned.

Picks for you

Mosaic Alpha launches the Basket Manager Combine contest 5 seconds ago AI predicts Bitcoin price for April 30, 2025 2 hours ago Ripple just unlocked 500 million XRP 3 hours ago Sui Network to unlock $150 million of SUI tomorrow – Sell time? 20 hours ago

Interestingly, BTC was the worst performer of the three in 2025, having dropped 10.23% year-to-date (YTD) to its press time price of $83,947.

BTC YTD price chart. Source: Finbold

BTC YTD price chart. Source: Finbold

Gold, on the other hand, has been recording a new high after a new high. The yellow metal soared 19.27% since 2025 started and is changing hands at $3,129. Though it is still far from Kiyosaki’s own ambitious target of $70, silver has also performed well and rallied 17.16% to its April 1 price of $33.85.

Gold and Silver YTD price chart. Source: TradingView

Gold and Silver YTD price chart. Source: TradingView

In total, this means that an equally divided $1,000 investment in the author’s top three assets would have appreciated to $1,087.32: Bitcoin to $299.23, gold to $397.56, and silver to $390.53.

The greater Robert Kiyosaki portfolio performance in Q1, 2025

Interestingly, a more detailed examination of the ‘Rich Dad’ portfolio is also possible – and would have different results – as he is known for trading Ethereum (ETH), Solana (SOL), cattle, and real estate.

Unfortunately, thanks to business operations, rent payments, illiquidity of certain markets, and the vast differences between regions, it is impossible to accurately assess the last two assets, though the WisdomTree Live Cattle ETF (CATL) can be used as a shorthand for cattle.

To begin with, Ethereum has become known for its comparatively abysmal performance. ETH price collapsed 44.22% in 2025 and the cryptocurrency is changing hands at $1,861 on April 1.

ETH YTD price chart. Source: Finbold

ETH YTD price chart. Source: Finbold

Solana hasn’t fared much better either, as SOL plunged 32.77% since the start of 2025 and is, at press time, changing hands at $127.37.

SOL YTD price chart. Source: Finbold

SOL YTD price chart. Source: Finbold

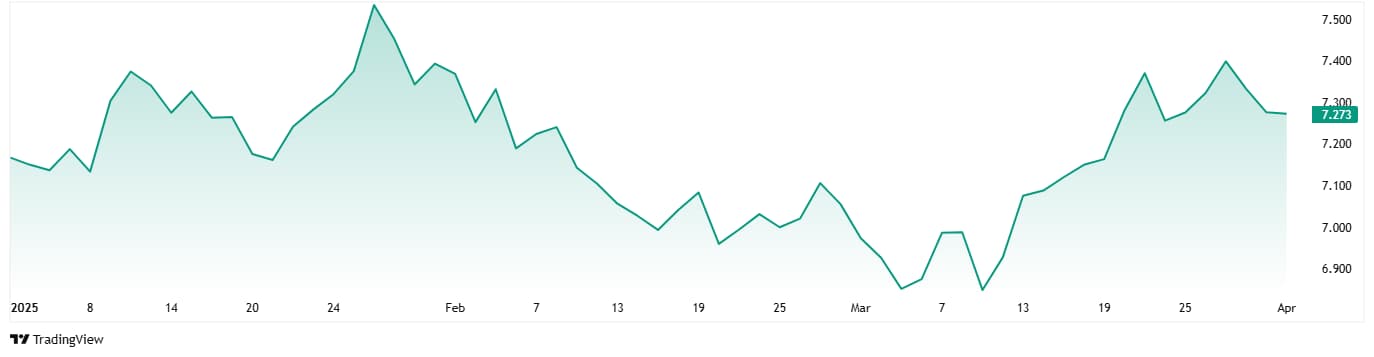

Lastly, the CATL exchange-traded fund (ETF) has been trading mostly sideways as it rallied 1.45% in Q1 and rose from €7.169 (~$7.73) to €7.273 (~$7.84).

CATL YTD price chart. Source: TradingView

CATL YTD price chart. Source: TradingView

Tracking the greater Kiyosaki portfolio in Q1 would have been a losing bet

Under the circumstances, it is evident that investing $1,000 in the greater Kiyosaki portfolio at the start of 2025 would not have yielded good results by the end of Q1. The portfolio’s value at press time, if the allocation was equal, would amount to $917.79.

Looking at the individual assets, the Bitcoin portion would have depreciated to $149.62, Ethereum to $92.97, and Solana to $112.05. The $166.67 put into gold would have risen to $198.79, silver to $195.27, and CATL would have remained mostly level at $169.09.

Featured image via Ben Shapiro’s YouTube