Shiba Inu flashes new buy signal; Is rebound imminent?

![]() Cryptocurrency Dec 25, 2024 Share

Cryptocurrency Dec 25, 2024 Share

Meme cryptocurrency Shiba Inu (SHIB) is witnessing a short-term price correction, but technical indicators suggest that the coin might target new highs.

Specifically, SHIB’s TD Sequential indicator flashed a fresh buy signal on its daily chart, raising the possibility of the token targeting new resistance levels in the short term, according to insights shared by prominent cryptocurrency analyst Ali Martinez in an X post on December 24.

The TD Sequential is used to identify trend exhaustion and potential reversals. It consists of a series of candlestick patterns, and in Shiba Inu’s case, the formation suggests that the current downtrend may be nearing its end.

Picks for you

Crypto developers can earn up to $1.5 million in 2025 with EGLD’s Growth Games grants 2 hours ago Ripple will unlock 1 billion XRP on January 1 2025 – What to expect? 4 hours ago AI picks 2 cryptocurrencies that will outperform others in Q1 2025 5 hours ago Top 3 REITs for 2025 6 hours ago  SHIB price analysis chart. Source: TradingView/Ali_charts

SHIB price analysis chart. Source: TradingView/Ali_charts

According to Martinez, with SHIB currently trading near $0.00002307, the buy signal hints at a possible rally toward the 0.618 Fibonacci retracement level, approximately $0.000026. If buying pressure intensifies, SHIB could aim for the next resistance at $0.000029, corresponding to the 0.236 Fibonacci level.

X trading expert Javon Marks also highlighted the bullish sentiment, stating that SHIB’s technical layout indicates the possibility of claiming the $0.000081 level. This would mark a 3.33-fold surge, reflecting a more than 234% climb from its current levels.

SHIB price analysis chart. Source: TradingView

SHIB price analysis chart. Source: TradingView

Indeed, SHIB has formed a descending wedge pattern, a bullish reversal formation. This pattern was followed by a breakout to the upside, indicating the possibility of further gains. After consolidating, SHIB has begun forming higher lows, showing strong resilience and buyer confidence.

Possible reprieve for SHIB after sell-off

The bullish outlook may relieve Shiba Inu investors, considering that the meme coin has witnessed sustained trading sessions of losses that have largely mirrored the general cryptocurrency market.

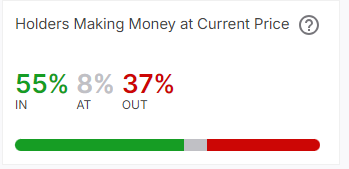

At the same time, the current SHIB investors’ profits and losses might offer insights into what to expect from the coin. In this case, data retrieved by Finbold from crypto onchain analysis platform IntoTheBlock on December 25 indicates that 55% of Shiba Inu holders are in profit, 8% are at breakeven, and 37% are at a loss.

SHIB holders making moneyt at the current price. Source: IntoTheBlock

SHIB holders making moneyt at the current price. Source: IntoTheBlock

Profit-taking by the majority could create selling pressure, capping price growth, while losses for 37% of holders may reduce selling activity, providing price stability. Meanwhile, the investors at breakeven might add short-term resistance if they sell as prices rise.

Besides the technical outlook, SHIB will be banking on network-specific elements that are likely to spur possible price growth. For instance, the network’s layer-two scaling solution, Shibarium, is taking center stage with notable milestones.

On December 25, the platform surpassed 700 million total transactions since its launch last summer, pointing to the rapid adoption of the protocol.

The milestone has come with several additional developments, such as a revamped user interface to enhance compatibility with wallets like MetaMask, Coinbase Wallet, and Trust Wallet. Additionally, a hard fork introduced faster block processing and empowered developers, while a refined burning mechanism aims to reduce token supply.

SHIB price analysis

By press time, SHIB was trading at $0.000022, down 2% in the last 24 hours. The meme coin has plunged almost 10% on the weekly time frame.

SHIB seven-day price chart. Source: Finbold

SHIB seven-day price chart. Source: Finbold

Shiba Inu’s technical setup suggests that the coin will likely witness more bearish sentiments in the short term since the current price is below its 50-day simple moving average (SMA) but remains above its 200-day SMA, signaling a positive long-term trend.

The relative strength index (RSI) at 47.31 is neutral, suggesting no overbought or oversold conditions, while moderate volatility (11.38%) hints at stable fluctuations.

Featured image via Shutterstock