Small-cap crypto dominates payments in this AI pay-per-use hub

![]() Cryptocurrency Dec 1, 2024 Share

Cryptocurrency Dec 1, 2024 Share

NanoGPT is an artificial intelligence (AI) hub that exclusively takes crypto for payments to pay-per-use dozens of premium AI models. Finbold covered NanoGPT’s launch and growth while also reporting on its competitors like PayPerQ, a Bitcoin (BTC)-first platform.

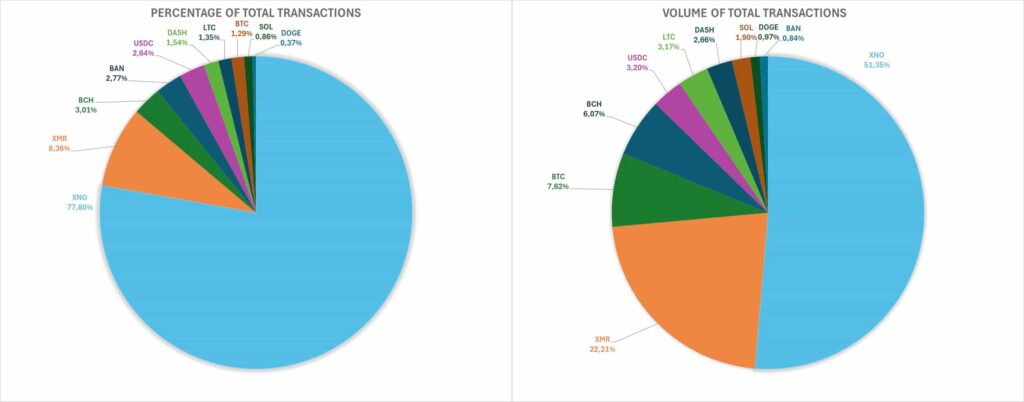

On December 1, NanoGPT published a data breakdown of all its crypto payments from November in the different accepted cryptocurrencies. The AI hub looked at the transaction count and volume of each coin, revealing its users’ preferences and customers’ behavior.

As promised in October we're releasing the payment stats for the different coins used on our website!

We hope this can help other merchants decide what to prioritise in integrating, and we were quite interested ourselves to see what the stats would show.

🧵 pic.twitter.com/4iXBNTqwZA

— Nano-GPT (@NanoGPTcom) December 1, 2024

What is NanoGPT’s AI hub and pay-per-use model

Essentially, people can top up their NanoGPT accounts with 15 cryptocurrencies to pay-per-use more than 30 AI models (chat and image). Each prompt or query generates a payment, which is deduced from the pre-funded wallet.

Picks for you

Analyst sets XRP price roadmap to $6 51 mins ago Legendary trader warns Bitcoin ‘expectations way too high’ – Here’s why 2 hours ago Here’s how bad the U.S. debt crisis has become 20 hours ago Analyst traces Bitcoin roadmap as BTC price edges closer to $100,000 20 hours ago

Among the AI models, customers can query OpenAI’s o1, ChatGPT-4o, and Dall-E 3, Antrhopic’s Claude 3.5 Sonnet, Google’s Gemini 1.5 Pro, Meta’s Llama 3.1 Large, xAI’s Grok 2, Flux Pro, and others.

The accepted crypto and blockchains for payments are Nano (XNO), Monero (XMR), Base, Polygon (POL), Optimism (OP), Arbitrum (ARB), Litecoin (LTC), Bitcoin Cash (BCH), Solana (SOL), Circle USD (USDC), Dash (DASH), Dogecoin (DOGE), Banano (BAN), Bitcoin (BTC), Ethereum (ETH), and Tether USD (USDT).

NanoGPT’s AI crypto payments breakdown

Notably, Nano leads with a 77.8% and 51.35% dominance for crypto payments count and volume, respectively. The “OG” cryptocurrency is the AI hub’s favorite and has a 5% discount if chosen as the deposit method.

“With many other coins, there are always fees and often waiting times,” Milan de Reede, NanoGPT’s creator, exclusively told Finbold. “Whereas with Nano, it just feels really good to send it and see it instantly confirmed without paying any fees.”

Monero comes as the second most used crypto for payments in the AI platform despite being the most-recent addition. XMR has seen remarkable growth, which NanoGPT believes is due to its privacy-experience, aligned with the platform’s values and mission.

Then, BTC is the third by volume, while BCH has this position by payment count and the fourth by volume. Interestingly, this reflects a user’s behavior depending on the crypto used, favoring higher or lower value per each payment made.

NanoGPT’s percentage (left) and volume (right) of total transactions. Source: NanoGPT / Finbold

NanoGPT’s percentage (left) and volume (right) of total transactions. Source: NanoGPT / Finbold

Why is Nano (XNO) leading AI pay-per-use crypto payments?

It is notable that, despite having a far lower market capitalization and overall penetration than the other cryptocurrencies, XNO dominates the users’ spending preferences in the AI pay-per-use platform.

Talking to Finbold, de Reede explained that, besides Nano’s efficiency for payments, the small-cap crypto also has other notable qualities. “It’s probably a combination of [XNO] being the first coin that we supported, so it having spread widely in the Nano community,” he added.

“The reason we like Nano so much despite its low market cap is that it’s quite unrivaled as a medium of exchange with zero fees and instant confirmations, but also that we think it fundamentally might be the strongest possible store of value. That is not recognized in the market cap at all right now, but Nano is fixed supply and has a game theory that actively incentivizes decentralization. We feel more confident about it than any other crypto.”

– Milan de Reede, to Finbold

Right now, Nano trades at $1.45, up 33.5% year-to-date despite a local top of $1.85 in March. Moreover, XNO surged by 97% from a local bottom of $0.736 in August, still below a $200 million capitalization.

Nano (XNO) year-to-date price chart. Source: Finbold

Nano (XNO) year-to-date price chart. Source: Finbold

As things develop, Finbold will continue to monitor crypto payment data from NanoGPT, competing AI pay-per-use platforms, and other services. Analysts like Alex Becker believe “utility altcoins” are the “easiest and surest” investment play into what experts believe will be “the mother of all bull markets” or “the biggest crypto bull run ever.”

Featured image from Shutterstock.