Smartest trader or insider? Anonymous prints $3 million in profits twice

![]() Cryptocurrency Oct 19, 2024 Share

Cryptocurrency Oct 19, 2024 Share

An anonymous smart trader printed over $3 million in profits twice, trading two different cryptocurrencies this month. While an analyst praised this address as the “smartest trader [he had] seen recently,” commentators speculate on being an insider.

Essentially, a smart trader is an entity capable of making good trading decisions and accumulating gains instead of losses. Its definition relates to “smart money,” currently used to indicate financial professionals but previously related to positive gambling track records.

The smart trader used the Solana (SOL) address ‘Aw1rq9VSY5SJisufnfmDJ6jAwJNx768EXypU15k8iVoW‘ and profitably traded two meme coins on Raydium. According to a Lookonchain post, it was “the smartest trader [they] have seen recently,” making over $6 million in profits.

Picks for you

Crypto trader misses out on $9 million windfall from $300 investment 18 hours ago Bitcoin 'Angle Theory' unlocks BTC’s next cycle top 19 hours ago 3 cryptocurrencies to avoid trading next week 19 hours ago Here’s how much Trump's crypto portfolio is up in 2024 22 hours ago

In summary, the address obtained a 117-fold return in a few days, trading $GOAT for a $3.45 million unrealized profit and an even higher 855-fold return in a few hours, trading $GNON for a $3.02 million unrealized gains.

The trades: $GOAT and $GNON meme coins

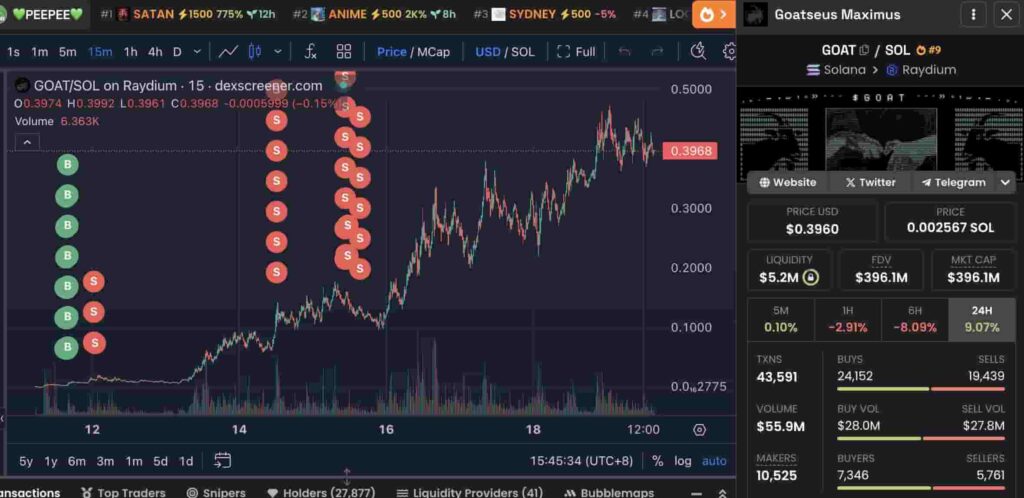

As reported, the “smartest trader” first purchased 11 million GOAT at a $2 million market cap, spending $30,000. He then made multiple sales totaling 3 million GOAT from October 12 to 16, amassing $279,000 of realized profits.

Notably, the meme coin had a $396.1 million market cap by reporting time. This results in a $3.2 million remaining balance of 8 million GOAT still available for selling.

GOAT/SOL on Raydium, 15-minute price chart. Source: dexscreener.com / Lookonchain

GOAT/SOL on Raydium, 15-minute price chart. Source: dexscreener.com / Lookonchain

Later on, the smart trader achieved a similar unrealized profit with an even more aggressive run, trading GNON. He purchased the memecoin at a $80,000 capitalization right after launch, paying $3,500 for 27.58 million GNON.

So far, the address has sold 579,000 GNON for $7,000, doubling the initial investment, still holding $3.02 million worth of 27 million GNON at a $116.1 million market cap.

GNON/SOL on Raydium, 15-minute price chart. Source: dexscreener.com / Lookonchain

GNON/SOL on Raydium, 15-minute price chart. Source: dexscreener.com / Lookonchain

Smartest trader or trading with insider information?

This last trade, however, raises an insider trading alert, considering how soon the trader jumped into the meme coin. An insider, in this case, could be a creator of GNON or related entities who helped promote it, like influencers.

Overall, smart traders always look for a clear edge against the market when opening their positions. This edge can come in the form of trading skills, rational thinking, insider information, or using one’s influence.

Buying recently launched meme coins at a low capitalization and shilling it to a large follower base has been a controversial topic in the crypto community on X. Figures like Ansem and Murad have made millions of dollars in profit following this strategy, which many experts consider immoral.

maybe they're just really lucky… every single time. totally not insider trading

— anushk (@anushkmittal) October 19, 2024

Meme coins and the greater fool theory

On Finbold, we have reported other cases of impressive profits acquired by trading meme coins in October. An anonymous trader turned $368 into $2 million in three days, for example, while another speculator achieved a remarkable 3,329-fold return.

Yet, meme coins have characteristics that resemble financial bubbles, which traders should be aware of. The “Greater Fool Theory” explains the dynamics seen on these speculative tokens, moved primarily by social hype and buzz without any organic demand.

Traders buy the token with the expectation that a “greater fool” will pay a higher price in the future. Nevertheless, the scheme fades away once there are no “greater fools” to continue fueling the price up, often facing liquidity issues and death spirals.

On the other hand, “smart traders” or insiders can take advantage of the “greater fools” by creating and promoting meme coins. They benefit from information asymmetry and the hype of a market that insists on gambling with poor fundamental digital assets.