Solana spot ETF approval odds spike to over 80%

![]() Cryptocurrency Jun 1, 2025 Share

Cryptocurrency Jun 1, 2025 Share

The chances of the Securities and Exchange Commission (SEC) approving a spot Solana (SOL) exchange-traded fund (ETF) in 2025 have soared to over 80%.

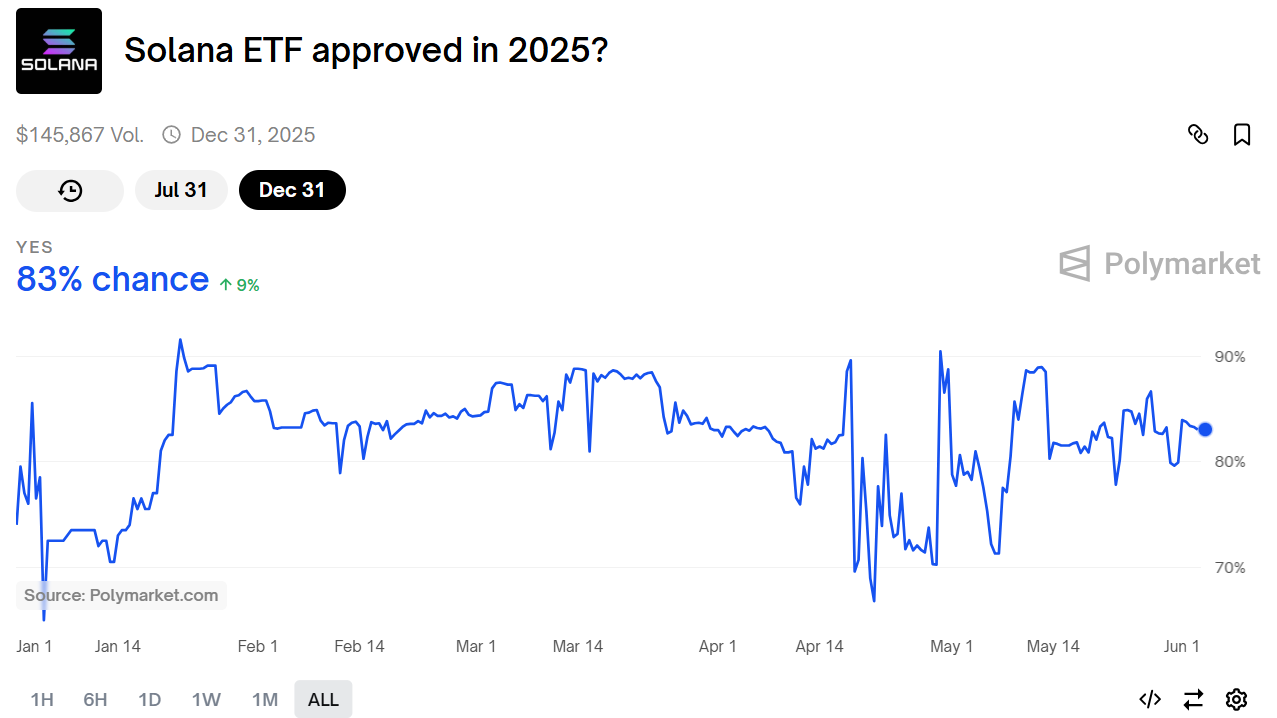

As of June 1, the odds stood at 83%, reflecting a 9% increase in market confidence, according to data retrieved by Finbold from the prediction platform Polymarket.

Polymarket’s chart tracking the question “Solana ETF approved in 2025?” revealed a volatile yet steadily rising trend in approval odds throughout the year.

SOL spot ETF approval odds. Source: Polymarket

SOL spot ETF approval odds. Source: Polymarket

Since early January 2025, the probability has fluctuated, dropping below 70% in April before spiking sharply in May to as high as 90%. Despite minor pullbacks, the odds have stabilized above 80% as the year progresses.

SOL spot ETF progress

This growing optimism aligns with ongoing developments in Solana-related ETF proposals. Notably, the SEC is reviewing a proposed rule change by NYSE Arca to list the Bitwise 10 Crypto Index Fund, which includes Solana, alongside other major cryptocurrencies such as Bitcoin and Ethereum.

Recently, the SEC extended its decision timeline by 60 days, pushing the original June 1, 2025, deadline to July 31, 2025.

Adding to the regulatory landscape, REX Shares and Osprey Funds have submitted a proposal for a novel “staking ETF.” This fund would invest in Solana and Ethereum, staking at least half of its assets to generate additional yield.

However, the SEC has expressed concerns about whether this structure qualifies as an investment company under the Investment Company Act.

In a letter, SEC Associate Director Brent J. Fields outlined unresolved questions regarding the proposal’s compliance, signaling potential hurdles for Solana’s ETF ambitions.

SOL price analysis

SOL was trading at $151 at press time, dropping approximately 1.5% over the past 24 hours. However, on the weekly chart, the asset has dropped more than 10%.

SOL price analysis chart. Source: Finbold

SOL price analysis chart. Source: Finbold

Overall, Solana’s market sentiment remains bearish. The Fear & Greed Index indicates extreme fear.

Additionally, the 50-day simple moving average (SMA) at $157.44 and the 200-day SMA at $166.02 sit above the current price, suggesting a potential downtrend.

Featured image via Shutterstock