Stablecoins make up one-third of all crypto payments in 2024 – CoinGate report

![]() Cryptocurrency Jan 14, 2025 Share

Cryptocurrency Jan 14, 2025 Share

The cryptocurrency market reached significant milestones in 2024. With mainstream appeal steadily rising on account of increased accessibility through Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) and a favorable political climate, the wider market went into a bull run in the last quarter of the year.

However, in the midst of an uptrend, it’s easy to forget the utility side of things. Crypto payments have likewise experienced a noted surge. Per CoinGate‘s crypto payments report 2024 published on January 14, stablecoins have seen the lion’s share of the gains — surpassing even Bitcoin as a method of payment, with Tether (USDT) leading the charge.

In addition, the report showcased that BTC was dethroned as the most popular blockchain by the Tron (TRX) network and that 2024 saw a marked increase in the popularity of layer 2 solutions like the Lightning Network. Meanwhile, ETH seems to be losing influence, while Solana (SOL) is on the rise.

Picks for you

Pete Sessions net worth revealed: How rich is the Texas representative? 55 seconds ago ‘No need to be surprised’ when Solana hits $300 in ‘a matter of months 23 mins ago Sony’s blockchain Soneium launches amid controversy, ‘blacklisting memecoins they don’t like’ 1 hour ago XRP eyes $100 this cycle if historical pattern plays out, according to technical analyst 2 hours ago

The findings, based on the 1,677,288 transactions processed through the Lithuanian headquartered firm, reveal several interesting takeaways. Let’s take a closer look at the data.

USDT dominates payments — but other assets are growing faster

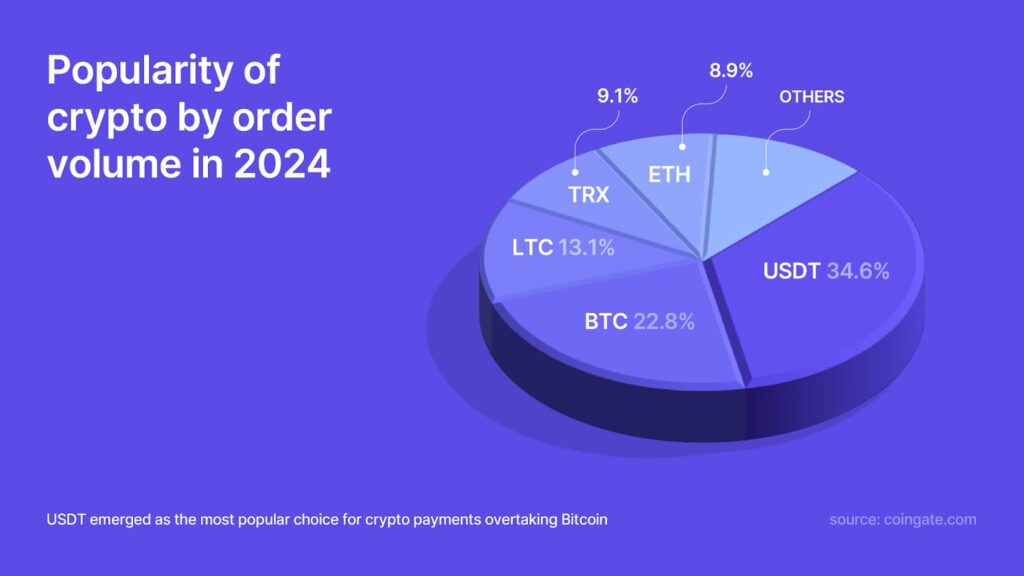

On the whole, transaction volume has increased by 29.6% over the course of the year. The most significant shift seen in 2024 is the fact that Tether has overtaken BTC to become the most popular cryptocurrency used for payments.

Notably, USDT accounted for 34.6% of payments, while BTC was the preferred method for 22.8% of transactions.

Popularity of cryptocurrency assets by volume. Source: CoinGate

Popularity of cryptocurrency assets by volume. Source: CoinGate

And that’s just Tether — once other stablecoins are factored in, the figure increases to 35.5% of all transactions.

Taking a look solely at stablecoins, USDT dominates — accounting for 97.2% of transactions, with USD Coin (USDC) at a distant second at 2.5% and Dai (DAI) coming in at third place with just 0.3% of payments.

However, USDC experienced the greatest growth — since the start of the year, usage has surged by 86.9%, driven primarily by its integration into the Solana network in May.

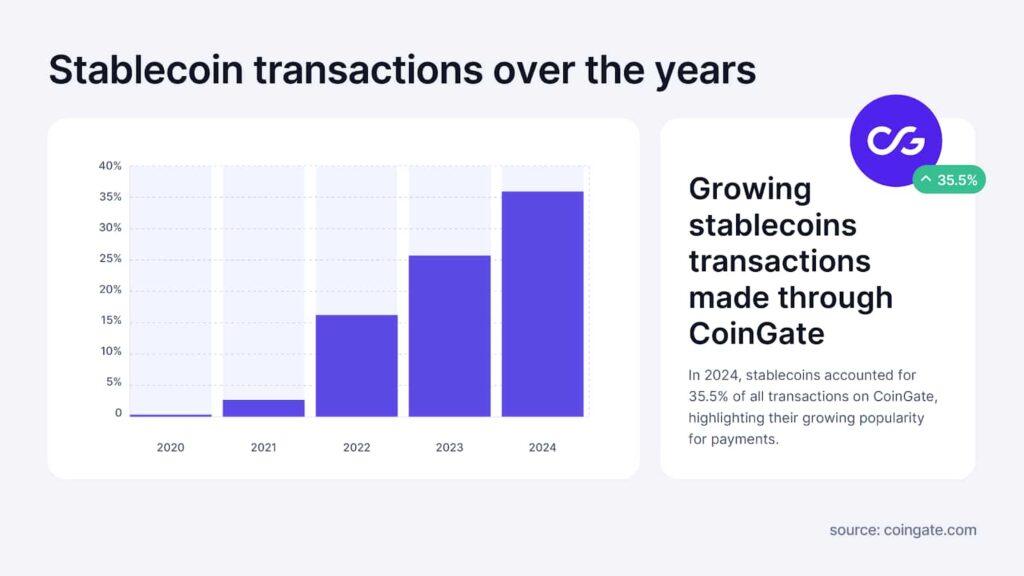

As impressive as that is, it’s only fair to note that the trajectory of stablecoins, in general, has been positive — with payment usage more than doubling from 2022 when assets like these accounted for only 16% of total transactions.

Chart depicting the growth of stablecoin transactions over the years. Source: CoinGate

Chart depicting the growth of stablecoin transactions over the years. Source: CoinGate

BTC and ETH lose ground while TRON and LN become more popular

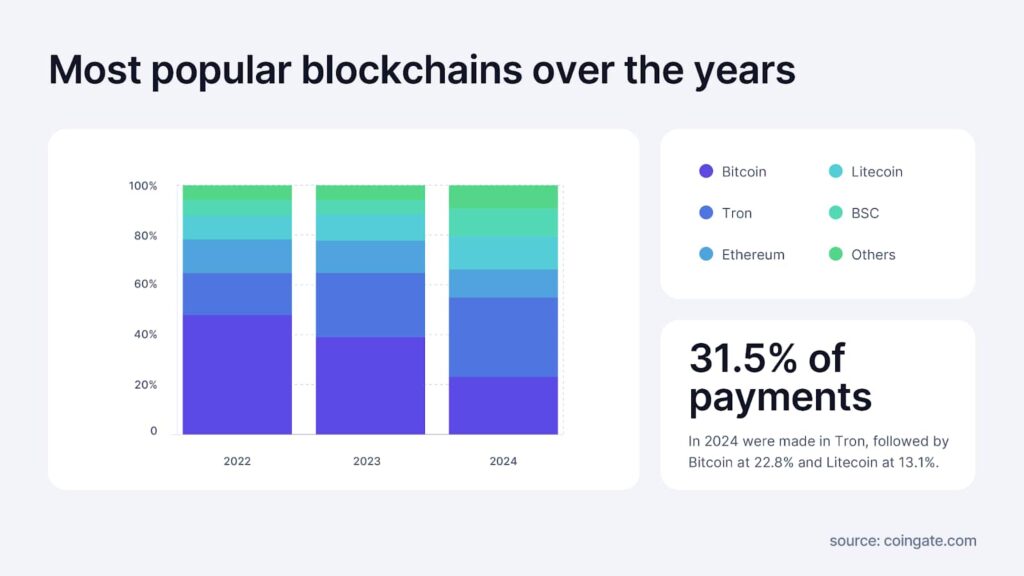

In contrast to the growth trajectory of stablecoins, mainline assets have become less popular as methods of payment. In 2023, Bitcoin accounted for 35.6% of payments — in 2024, its share experienced a sharp drop to 22.8%.

Blockchain preferences seem to be changing as well. Last year, Ethereum’s share of total payments decreased by 1.7% — meanwhile, Solana, which saw a 56.4% increase in order volume between October and November, was propelled to become the 6th most preferred blockchain.

However, the largest beneficiary seems to have been TRON, which has now surpassed Bitcoin and accounts for 31.5% of transactions. In the same timeframe, Litecoin (LTC) grew its share of payments from 9.5% to 13.1%

Changes in blockchain popularity from 2022 to 2024. Source: CoinGate

Changes in blockchain popularity from 2022 to 2024. Source: CoinGate

Finally, layer 2 solutions experienced significant growth in 2024. The Lightning Network (LN) saw a 39.1% increase in usage and now accounts for 15.4% of all payments made in Bitcoin. Even more impressively, Polygon marked a 135% uptick in transactions — while Arbitrum (ARB) saw adoption surge by 565% owing to the increased popularity of ETH and USDT payments.

Stablecoins have cemented their place as a crucial part of the wider cryptocurrency ecosystem — while the shifts in blockchain preference point to a vibrant, dynamic space that is still focused on advancing scalability, efficiency, speed, and cost-effectiveness.

Featured image via Shutterstock