Trading expert sets Solana price roadmap to $565

![]() Cryptocurrency Feb 10, 2025 Share

Cryptocurrency Feb 10, 2025 Share

Despite the recent bearish sentiment, Solana (SOL) is showing signs of a potential breakout, with both technical and fundamental indicators aligning for a bullish move.

A trading expert has identified a recurring price pattern, suggesting that if historical trends hold, SOL could be on track to reach $565, signaling another major rally for the asset.

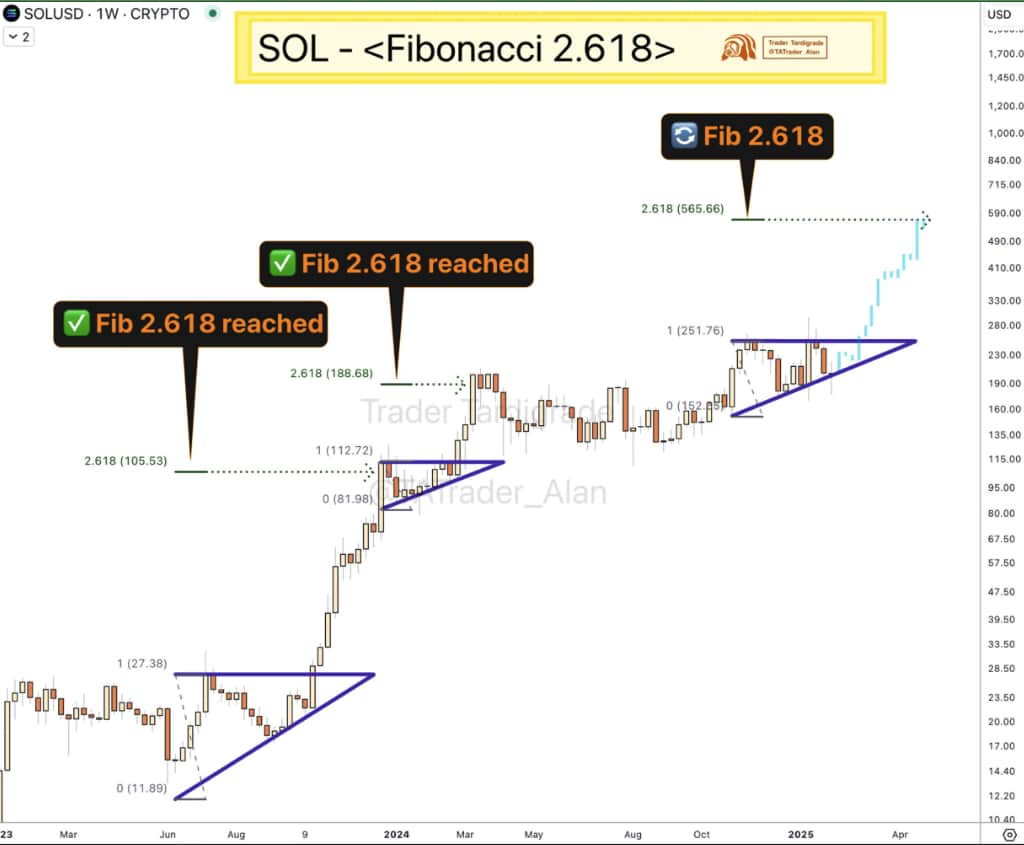

Solana technical analysis: Fibonacci model targets $565

Notably, Trader Tardigrade has highlighted a recurring trend in Solana’s price movements, where each breakout from an ascending triangle formation has consistently reached the Fibonacci 2.618 extension level.

Picks for you

Giza mananges over $500,000 in stables within a week on Base 1 hour ago Here’s why analysts think Ethereum’s $10,000 breakout is ‘programmed this cycle’ 1 hour ago This country just launched a national meme coin; Crashes 80% 4 hours ago Polkadot Blockchain Academy debuts JAM course for future blockchain architects 4 hours ago  Solana price analysis chart. Source: Trader Tardigrade/ X

Solana price analysis chart. Source: Trader Tardigrade/ X

This pattern has been a reliable indicator of SOL’s price surges, further strengthening the possibility of another upward move.

Currently, SOL is in the later stages of yet another ascending triangle. With the pattern now more than halfway complete, traders are watching for a breakout confirmation that could propel SOL toward its next Fibonacci target of $565.

Fundamental outlook: VanEck’s $520 Solana price projection

Beyond technical indicators, institutional projections further support a bullish case for Solana.

Investment firm VanEck has projected that SOL could hit $520 by 2025, citing rising market share in the smart contract platform (SCP) sector as a key growth driver.

According to estimates, Solana’s market dominance within the SCP sector is expected to grow from 15% to 22% by the end of 2025. This projection is based on macroeconomic factors, particularly U.S. M2 money supply growth, which has historically shown a strong correlation with crypto market capitalization.

Moreover, Solana’s increasing developer adoption, rising DEX trading volumes, and expanding active user base further reinforce this bullish outlook.

Based on these factors, VanEck estimates that Solana’s market capitalization could reach approximately $250 billion, translating to a price target of $520 by the end of the year.

Regulatory shift and institutional interest boost optimism

Adding to the bullish outlook, the SEC’s recent acknowledgment of Grayscale’s Solana ETF filing marks a shift in regulatory tone, potentially paving the way for institutional inflows into the asset.

Meanwhile, on-chain data from analyst Ali Martinez highlights Solana’s accelerating adoption, with five million new addresses created daily.

This indicates the network’s rapid expansion and increasing user base, further strengthening Solana’s long-term growth trajectory.

Solana price analysis

At press time, Solana is trading at $204.67, reflecting a one-day gain of 1.31%. Over the past week, SOL has climbed 3.33%.

Solana one-day price chart. Source: Finbold

Solana one-day price chart. Source: Finbold

As institutional interest rises and adoption accelerates, Solana continues to strengthen its position as a leading smart contract platform, with multiple bullish catalysts fueling its upside potential heading into 2025.

Featured image via Shutterstock