President Donald Trump signed an executive order on Bitcoin earlier this week, officially creating a Strategic Bitcoin Reserve (SBR) using only the seized Bitcoin the US government already owns.

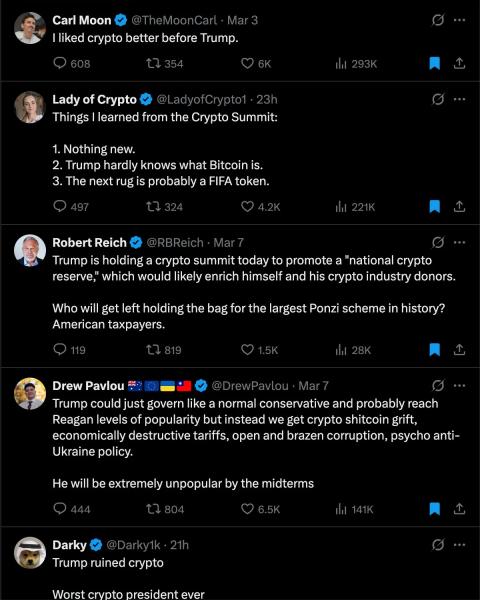

This means no new purchases, no market buys—just stockpiling what’s already been taken from criminals and fraudsters. Crypto traders expected something different. They wanted the government to start buying more Bitcoin, which would push prices up. Instead, they got disappointment, and they’ve been sharing their frustrations all over X (formerly Twitter).

Scott Melker, host of The Wolf of All Streets podcast, responded to the outrage with a post on X today, saying, “If you think that the Bitcoin SBR is bad news because it will only contain seized Bitcoin, then you are bad at reading and worse at comprehending what you are reading. Sell me your Bitcoin.”

XRP lawyer John Deaton backed him up, saying, “Scott, as usual, is 100% spot on. I’ve seen a lot of negative takes regarding the EO. I realize many crypto investors were hoping for a Strategic MultiCoin Reserve, not just a Strategic Bitcoin Reserve.”

Trump orders Treasury and Commerce to find ‘budget-neutral’ ways to acquire Bitcoin

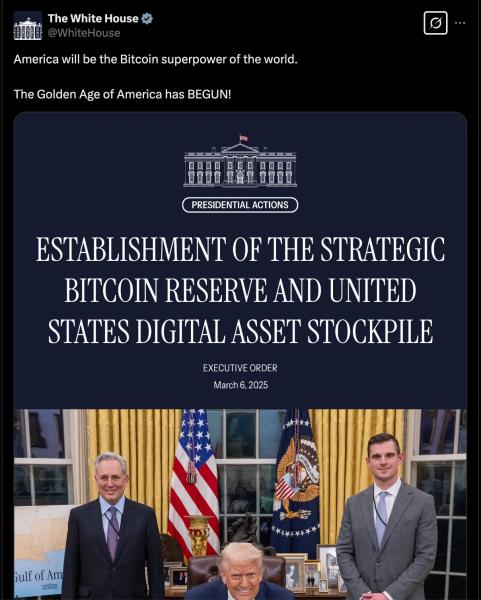

During his White House crypto summit, Trump said, “Last year, I promised to make America the Bitcoin superpower of the world and the crypto capital of the planet and we’re taking historic action to deliver on that promise.”

The executive order also directed Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick to figure out how to get more Bitcoin without spending taxpayer dollars. That means creative methods—loopholes, incentives, partnerships.

Deaton pointed to a major tool at their disposal: the Exchange Stabilization Fund (ESF). The ESF gives the Treasury Secretary broad authority to buy and hold financial assets to stabilize the dollar. Could Bitcoin be included? It’s possible, but Deaton said it would likely be challenged in court.

Another potential option is the International Emergency Economic Powers Act (IEEPA). If Trump declared the $36 trillion national debt an economic emergency, he could use the IEEPA to justify Bitcoin purchases through executive action.

But that would require printing money to buy Bitcoin, which would create a whole new set of problems. Then there’s the Defense Production Act. If Trump declared Bitcoin mining critical to national security, the government could start mining and acquiring Bitcoin directly. Deaton called this idea “insane,” but legally, it’s not off the table.

President Trump at the White House crypto summit on March 7, 2025. Source: White House X/Twitter

President Trump at the White House crypto summit on March 7, 2025. Source: White House X/Twitter

One of the easiest ways for the government to increase its Bitcoin holdings is through those criminal seizures. When authorities take Bitcoin from fraudsters, they usually auction it off. Trump’s executive order could mean keeping it instead. This would push law enforcement to crack down even harder on crypto-related crimes, and oh there are tons and tons of that still happening right now.

Another way is taxing Bitcoin miners in BTC. The US is home to some of the world’s largest Bitcoin mining operations, and they could be required to pay a small portion of their mining rewards to the government. In return, they’d get tax breaks or regulatory benefits.

The IRS and Commerce Department could also start accepting Bitcoin for federal payments. People paying taxes, fines, and fees in Bitcoin wouldn’t just be converting it to dollars—the government could keep a portion in the reserve. This would allow the US to accumulate Bitcoin naturally over time.

A particularly aggressive approach is requiring federal land and energy lease payments in Bitcoin. Companies mining coal, lithium, or drilling for oil on federal land could be required to pay part of their royalties in BTC. This would make Bitcoin a national asset while giving mining and energy companies a direct stake in its success.

Deaton also suggested that: “Partnering with U.S. Tech & Finance Firms by creating incentivized partnership where companies like Coinbase and Ripple help acquire and manage Bitcoin reserves and digital asset stockpiles.”

Swapping gold for Bitcoin, Bitcoin-based bonds, tariffs in BTC, and many more budget-neutral ideas for buying more Bitcoins

Trump’s executive order didn’t mention gold reserves, but that doesn’t mean they’re off-limits, especially if you consider Crypto-loving Senator Cynthia Lummis proposal in the BITCOIN Act, which actually first introduced the idea of a Bitcoin strategic reserve.

The US government holds over 8,100 tons of gold in reserves. If they swapped even a small portion for Bitcoin, they’d create a huge BTC stockpile overnight.

(From the left) Howard Lutnick, Scott Bessent, Trump, David Sacks, Bo Hines, Brian Armstrong, and Michael Saylor at the summit. Source: White House

(From the left) Howard Lutnick, Scott Bessent, Trump, David Sacks, Bo Hines, Brian Armstrong, and Michael Saylor at the summit. Source: White House

Another possibility is tokenized US Treasury bonds. The government could issue Bitcoin-backed securities that investors buy with BTC, which would allow the US to acquire Bitcoin while still financing operations through debt instruments.

Deaton said, “Trump could impose a “Bitcoin Tariff” instead of USD Tariff on Certain Imports. This is combining Tariff and BTC policy. For example, on high-tech goods, rare earth metals, or semiconductors, which are critical to national security or on electronics imported from China, given its dominance in global supply chains.”

This of course comes as Trump is imposing tariffs on Canada, Mexico, and China almost every other week since taking back the Oval on January 20th.

Another option Deaton gave was Bitcoin-pegged export credits. The Commerce Department could create export incentives where US companies receive BTC credits when selling goods abroad. Foreign buyers paying a portion in Bitcoin would allow the government to build reserves without direct market purchases.

Deaton said the US could also strike energy deals where countries like Saudi Arabia (oil) or Canada (natural gas) accept US exports at a discount in exchange for BTC payments. This would push international demand for Bitcoin transactions involving the US government.

Another idea is that the US could issue Bitcoin-backed bonds tied to energy reserves, kind of like El Salvador’s Bitcoin bonds. These bonds could be linked to future oil, gas, or federal land lease revenues, giving investors exposure to both Bitcoin and US energy production, said Deaton.

Trump’s executive order doesn’t stop private companies or individuals from donating Bitcoin to the US reserve. A tax incentive for BTC donations could encourage people to send Bitcoin to the government without direct spending.

Federal contractors could also pay in Bitcoin, with a small portion going directly into the reserve. This would allow the US to accumulate Bitcoin while still paying contractors as usual.

Even regular taxpayers could be incentivized. If the government offered capital gains tax breaks for people paying taxes in Bitcoin, Ethereum, or XRP, it could encourage crypto holders to pay directly in BTC. A tiny fraction of each payment could be kept in the reserve, steadily increasing holdings over time.

“Hence, the EO we received is as aggressive as a President can do, absent invoking emergency powers. I’m surprised BTC isn’t $120K already. As for the MultiCoin debate and people disappointed, BTC has ALWAYS led the market. You can dislike it, but it’s reality,” Deaton said in his X post.