Bitcoin hits $95k and nears a potential trendline breakout for a surge towards the overhead resistance $106k. Is a rally to a new all-time high inevitable?

With U.S. President Donald Trump announcing a U.S. strategic crypto reserve, the crypto market is on a booming rally. Bitcoin surged 9.5% yesterday to bounce from $86,000 to $95,000.

Currently, with an intraday pullback of 1.60%, Bitcoin is trading at a market value of $92,760. Challenging the local resistance trendline, the bullish recovery in Bitcoin is aiming for a breakout rally. Will this breakout rally drive Bitcoin prices to $127,000?

Bitcoin Recovery Eyes Trendline Breakout Rally

The BTC price action showcases a bullish comeback from the 61.80% Fibonacci level with multiple lower price rejections. Bouncing off from the 7-day low at $78,197, the lower price rejection propelled Bitcoin for a V-shaped recovery.

Bitcoin Price Chart

With the news-based rally, Bitcoin has now reclaimed the $90,000 level, surpassing the 78.60% Fibonacci level at $91,780. Bitcoin is now aiming for a trendline breakout.

Furthermore, the bullish reversal has brought Bitcoin back within the consolidation range, with the overhead ceiling at $106,184. The intraday pullback reveals a bullish struggle near the resistance trendline.

However, the Chaikin Money Flow Index has bounced off into the positive territory, standing at 0.13. Furthermore, the super trend indicator has turned bullish with the overnight surge.

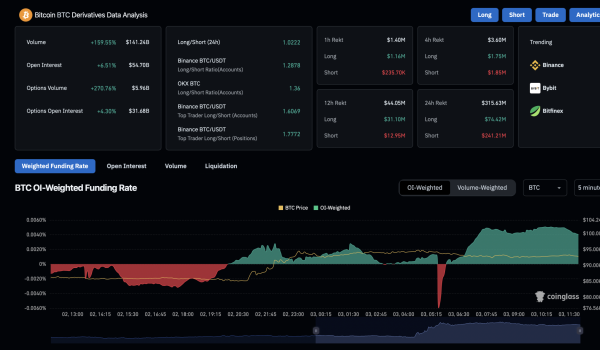

Open Interest Hits $54B, Optimism Surges

With the sudden boost in the crypto market, traders are back in the game. The derivatives data reveals a 6.47% surge in the open interest, rising up to $54.68 billion.

Bitcoin Derivatives

Bitcoin Derivatives

Furthermore, the long-to-short ratio has equalized at 1.0222, bouncing off from 0.90 levels. This reveals a surge in the number of long positions with the market recovery.

Meanwhile, the funding rate in Bitcoin exchanges has reached 0.0040%. This reveals the willingness of traders to pay extra premiums to hold long positions.

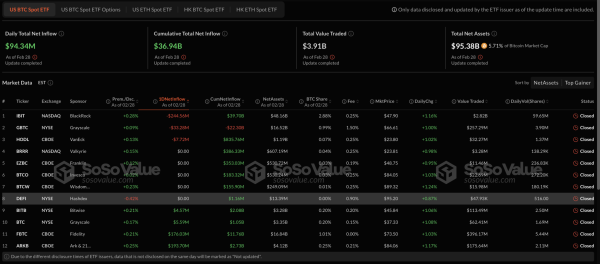

Bitcoin ETFs End Eight Days of Outflow

On February 28, the U.S. Bitcoin spot ETFs recorded a net inflow of $94.34 million. This marked the conclusion of eight consecutive days of outflows.

Bitcoin ETFs

Bitcoin ETFs

ARK and 21 shares recorded an inflow of $193.70 million, followed by Fidelity at $176.03 million. Grayscale mini-trust and Bitwise recorded inflows of $5.59 million and $4.57 million.

However, BlackRock maintained an outflow of $244.56 million, followed by Grayscale offloading $33.28 million. VanEck also registered an outflow of $7.72 million. The rest of the five Bitcoin ETFs saw a net zero flow.

Bitcoin Price Targets

Based on the Fibonacci levels, the current intraday pullback comes as a potential retest of the broken 78.60% level. Hence, the potential bounceback in Bitcoin will likely surpass the overhead trendline.

The trendline breakout will likely propel Bitcoin towards the overhead ceiling near the $106,000 mark. Optimistically, the breakout of a new all-time high will likely hit the 1.272 Fibonacci level at $127,800.

However, if Bitcoin closes below $90,000, it could invalidate the bullish recovery and trigger a retest of the $87,000 support level.