Uptober: Indicators suggest the 2024 crypto bull market is back

![]() Cryptocurrency Oct 16, 2024 Share

Cryptocurrency Oct 16, 2024 Share

The long-awaited Uptober could have finally started as Bitcoin (BTC) and the cryptocurrency market break out of a seven-month downtrend. Indeed, 2024’s crypto bull market found a local top in March, downtrending since then until this point, indicating a reversal.

Among the signals, there is an increased activity in meme coin trading with traders registering impressive gains, as Finbold reported. Also, benefiting from a current growing optimism, early investors have started to realize profit through strategic sales.

These are common indicators of a first impulse wave after a period of accumulation that usually precedes a bull market. Moreover, liquidity is re-entering the market, giving space to impressive transactions like a recent $1.4 million BAYC NFT purchase.

Picks for you

Dogecoin price prediction: Analyst hints DOGE could hit $10 2 hours ago Tesla moves $760 million in Bitcoin; Here's what you need to know 2 hours ago Recession panic fades; Are investors underestimating risks ahead? 3 hours ago Donald Trump’s crypto launch faces issues on day one — What’s happening? 19 hours ago

In the meantime, CoinGlass‘s crypto fear and greed index surged to 73 points of greed, back to July levels. The “Uptober” promise is now closer than ever as the market moves to the second half of October with gains.

Crypto Fear & Greed Index. Source: CoinGlass / Finbold

Crypto Fear & Greed Index. Source: CoinGlass / Finbold

Bitcoin (BTC) Uptober price analysis

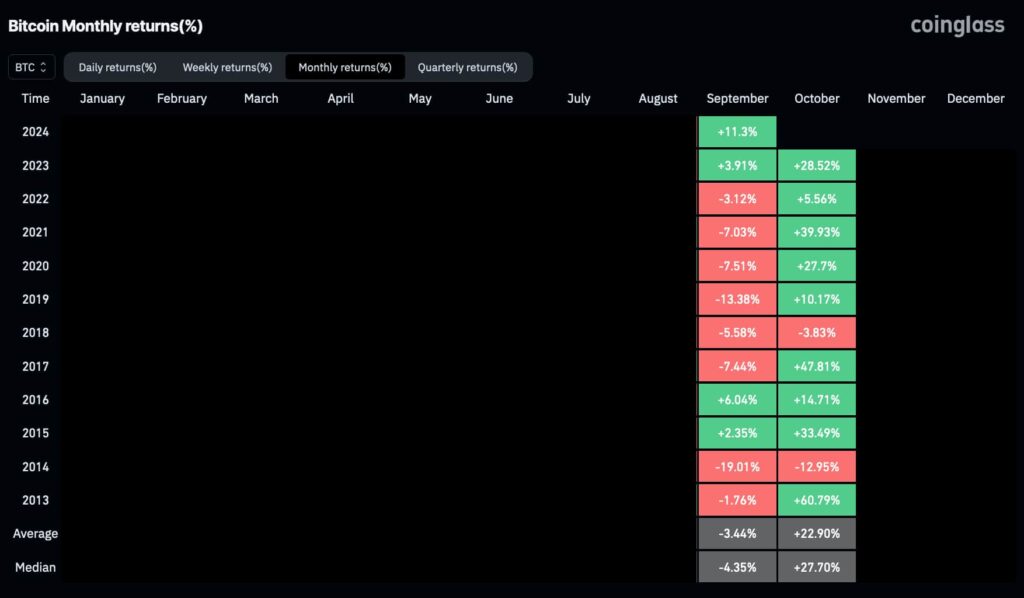

“Uptober” is a moniker used to describe a bullish price action for Bitcoin during October, given a historical positive performance. On September 29, Finbold dove into BTC’s historical results since 2013, providing a price prediction for this year’s Uptober.

Overall, Bitcoin price has average and median gains of 22.9% and 27.7%, respectively, from October 1 to 31. This is a result of only two out of eleven losing “Uptobers.”

Bitcoin Monthly returns (%). Source: CoinGlass / Finbold

Bitcoin Monthly returns (%). Source: CoinGlass / Finbold

If the pattern repeats, Bitcoin could be heading toward closing Uptober between $77,836 and $80,876. This is calculated from BTC price opening on October 1 at $63,333, adding the historical average and median gains.

As of this writing, the leading cryptocurrency trades at $68,264, half-way the above price target. Bitcoin broke out of its seven-month down trend since March’s all-time high, indicating the 2024 crypto bull market is back.

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold

Bitcoin (BTC) daily price chart. Source: TradingView / Finbold

2024 crypto bull market starts now

Following the leader, TradingView‘s crypto total market cap index (TOTAL) has just broken out of a similar down trend. Thus, holding above this key level with enough volume and strength would indicate the 2024 crypto bull market has started.

Now, the index shows a total of $2.287 trillion in capitalization, eyeing to surpass the $3 trillion record high from the last cycle.

Crypto Total Market Cap Index (TOTAL) daily chart. Source: TradingView / Finbold

Crypto Total Market Cap Index (TOTAL) daily chart. Source: TradingView / Finbold

However, traders and investors must understand that fake breakouts can occur, delaying the 2024 crypto bull market a bit more. Cryptocurrencies can be extremely volatile and unpredictable, requiring caution from market participants.