Wall Street predicts PayPal stock price amid hitting a 52-week high

![]() Stocks Aug 22, 2024 Share

Stocks Aug 22, 2024 Share

Shortly after PayPal (NYSE: PYPL) announced a partnership with Dutch payments firm Adyen to offer Fastlane, PayPal’s checkout tool for enterprise and marketplace customers in the United States, its stocks soared to a 52-week high, and Wall Street analysts have expressed optimism.

Indeed, PayPal stock hit its highest closing price in over a year on August 20, as it onboarded Adyen to Fastlane, which it launched earlier this month, as part of the years-long cooperation that has provided Adyen’s customers with access to Venmo and PayPal’s buy-now-pay-later (BNPL) solutions.

Wall Street’s PayPal stock forecast

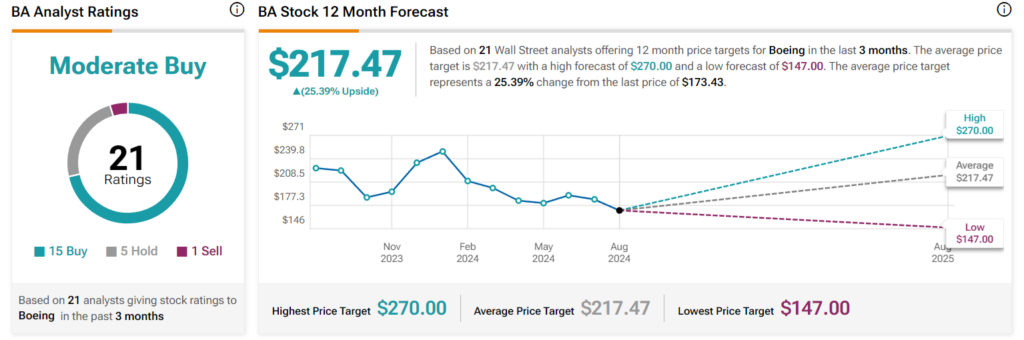

For the time being, the average 12-month PayPal stock forecast offered by 31 Wall Street analysts in the past three months stands at $74.92, which would indicate an increase of 4.84% from its current price, with the lowest target at $65 (-9%), and the highest amounting to $90 (+25.95%).

Picks for you

Fhenix introduces grant and bounty programs to boost L2 adoption 1 hour ago Neymar's net worth 2024: How rich is the world's most expensive football player? 2 hours ago Alex Cooper’s net worth revealed: How rich is the Call Her Daddy podcast host? 4 hours ago Opportunity? Cardano prepares for 2,222% bullish wave 6 hours ago  Wall Street’s PayPal stock prediction 2025. Source: TipRanks

Wall Street’s PayPal stock prediction 2025. Source: TipRanks

At the same time, these experts have given the PayPal stock a ‘moderate buy’ score, which is the result of 17 of them suggesting a ‘hold,’ 14 recommending a ‘buy,’ and no ‘sell’ calls, according to the most recent TipRanks data retrieved by Finbold on August 22.

What analysts say about PayPal stock

Among the more optimistic analysts is Dan Dolev, a senior Mizuho expert who has maintained an ‘outperform’ rating for PYPL shares after the Adyen announcement and argued that the Fastlane product must be strong to compel a direct competitor to PayPal-owned Braintree to get onboard.

According to his recent note, in which he also reiterated his company’s $90 price target for PayPal shares, this move could drive broader adoption of Fastlane, which he earlier said had a total addressable market of $3 trillion, with realistically addressable $1.43 trillion, and in that case:

“We see the potential for $1 billion to $1.5 billion transaction margin dollar lift [5-10% upside]. (…) Investors should start thinking about PYPL as a platform for all-things payments versus the myopic narrow view of just branded checkout.”

Elsewhere, JPMorgan (NYSE: JPM) analyst Tien-Tsin Huang maintained coverage on PayPal stock with an ‘overweight’ score and raised his company’s price target from $77 to $80, accompanied by several other experts who have also increased their PayPal stock forecast targets.

PayPal stock price analysis

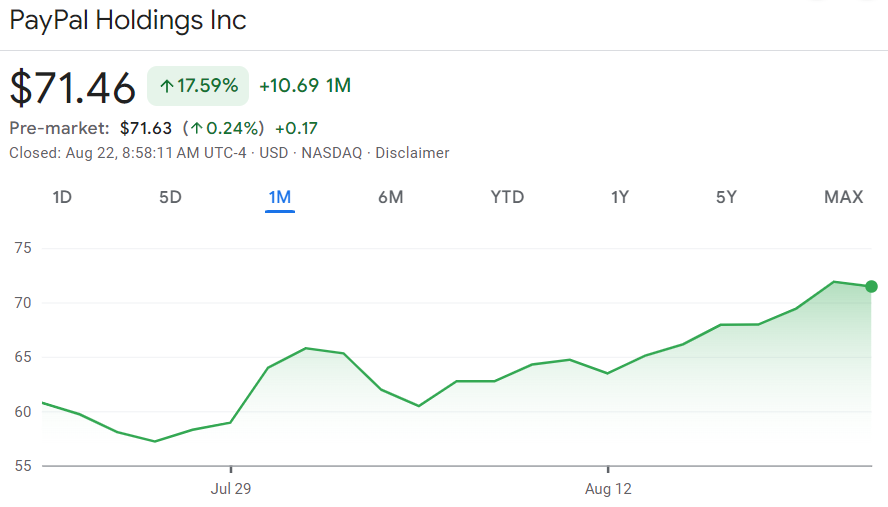

At the moment, PayPal stock price stands at $71.46, reflecting a 6.40% increase across the week, and adding up to the gain of 17.59% in the last month, recording an accumulated advance of 16.27% year-to-date (YTD), as per the latest chart information on August 22.

PayPal stock price 1-month chart. Source: Google Finance

PayPal stock price 1-month chart. Source: Google Finance

It is also worth noting that the market capitalization of PayPal USD stablecoin (PYUSD), launched in August 2023, has jumped sharply in the past several weeks, crossing $960 million, up over 500% from the $159.06 million it recorded at the year’s start despite the growing competition in the stablecoin industry.

PYUSD market cap 12-month chart. Source: CoinMarketCap

PYUSD market cap 12-month chart. Source: CoinMarketCap

All things considered, experts’ views of the PayPal stock forecast are rather bullish, and there are plenty of reasons for them to be so. However, things in the stock market can sometimes change unpredictably, so doing one’s own research and keeping up with any relevant news is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.