We asked this AI to build a crypto portfolio for the altseason bull market

![]() Cryptocurrency Nov 10, 2024 Share

Cryptocurrency Nov 10, 2024 Share

As the bull market starts and cryptocurrencies added over $465 billion in capitalization in the last five days, Finbold asked a leading artificial intelligence (AI) to build a crypto portfolio for the expected upcoming altseason.

The AI model we used was Perplexity Online, thriving as a leading ChatGPT competitor, given its real-time web scanning capacity. This is ideal while gathering up-to-date information, which is crucial to building a winning crypto portfolio for 2024 and 2025.

Notably, Perplexity AI diversified its allocations among four cryptocurrency categories, investing in solid altcoins for the bull market. Each category has two projects, except for the first category, with 50% of the entire portfolio split into three tokens.

Picks for you

El Salvador is now in $200 million profit on their Bitcoin bet 3 hours ago AI predicts Cardano price for 2025 amid Hoskinson-Trump rumors 6 hours ago How much would $1,000 in Bitcoin from the 2020 COVID-19 crash be worth today 7 hours ago Investor says ‘you will make a lot of money very quickly,’ urges to ‘take profit frequently’ 8 hours ago

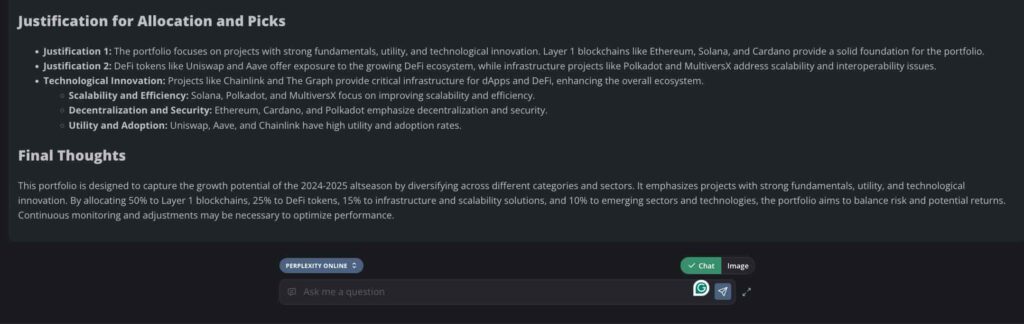

“The portfolio focuses on projects with strong fundamentals, utility, and technological innovation. Layer 1 blockchains like Ethereum, Solana, and Cardano provide a solid foundation for the portfolio. DeFi tokens like Uniswap and Aave offer exposure to the growing DeFi ecosystem, while infrastructure projects like Polkadot and MultiversX address scalability and interoperability issues. Projects like Chainlink and The Graph provide critical infrastructure for dApps and DeFi, enhancing the overall ecosystem.”

– Perplexity Online AI

Perplexity AI Justification for Allocation and Picks. Source: NanoGPT / Finbold

Perplexity AI Justification for Allocation and Picks. Source: NanoGPT / Finbold

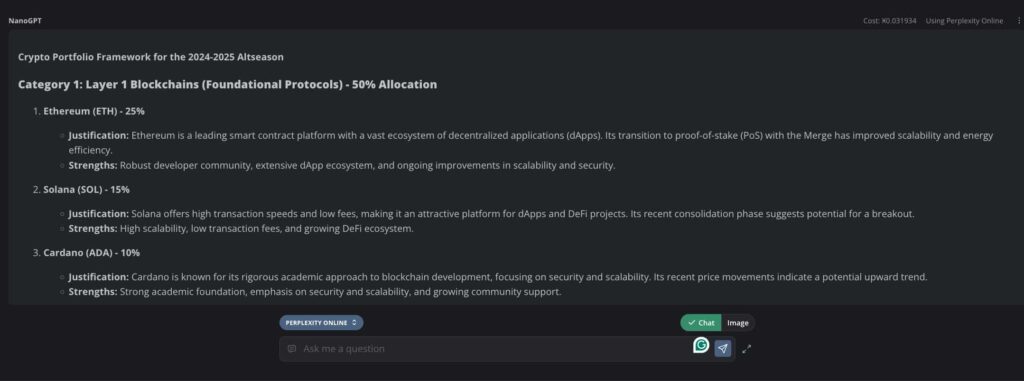

Layer 1 blockchains (foundational protocols) – 50% allocation

First, the AI listed Ethereum (ETH), Solana (SOL), and Cardano (ADA), making 25%, 15%, and 10% of the portfolio, respectively.

Ethereum features as the leading altcoin and smart contract platform fueled by its ecosystem of decentralized apps.

Then, Solana makes the second-largest allocation due to fast transactions with low fees, being attractive to the end-user. Cardano concludes the first category, known for its “rigorous academic approach to blockchain development,” creating a solid foundation.

Crypto portfolio – Category 1: Layer 1 Blockchains (Foundational Protocols) – 50% Allocation. Source: NanoGPT / Perplexity AI / Finbold

Crypto portfolio – Category 1: Layer 1 Blockchains (Foundational Protocols) – 50% Allocation. Source: NanoGPT / Perplexity AI / Finbold

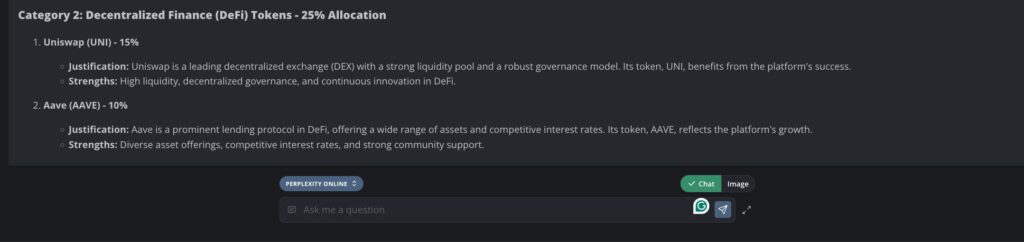

Decentralized finance (DeFi) tokens – 25% allocation

Second, Perplexity AI favors decentralized finance (DeFi) tokens with 25% of the crypto portfolio’s allocation, focusing on yield farming.

For that, Uniswap (UNI) and Aave (AAVE) get the spotlight with 15% and 10% investments, respectively. Both are the leading DeFi protocols in their segments, pioneering the decentralized exchange and lending protocol solutions.

Crypto portfolio – Category 2: Decentralized Finance (DeFi) Tokens – 25% Allocation. Source: NanoGPT / Perplexity AI / Finbold

Crypto portfolio – Category 2: Decentralized Finance (DeFi) Tokens – 25% Allocation. Source: NanoGPT / Perplexity AI / Finbold

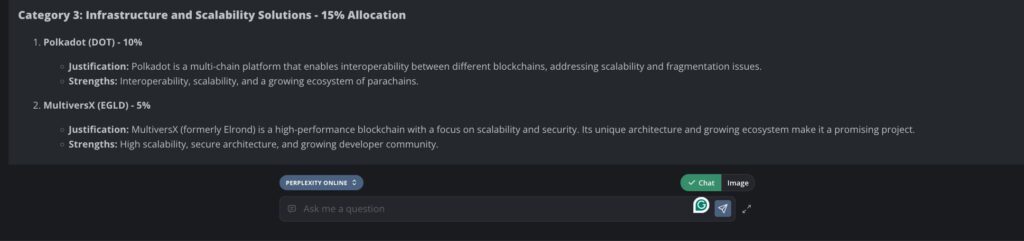

Infrastructure and scalability solutions – 15% allocation

Looking for higher growth potential, the AI separates 15% of its investing capital for mid-cap altcoins building scalable infrastructures.

On that note, Polkadot (DOT) receives a 10% allocation and MultiversX (EGLD) 5% of the bull market crypto portfolio. While Polkadot focuses on multi-chain interoperability, MultiversX goes for high scalability and security, also addressing modularity through its sovereign chains.

Finbold recently published highlights for EGLD due to its technology and growth potential as an Ethereum rival to earn passive income.

Crypto portfolio – Category 3: Infrastructure and Scalability Solutions – 15% Allocation. Source: NanoGPT / Perplexity AI / Finbold

Crypto portfolio – Category 3: Infrastructure and Scalability Solutions – 15% Allocation. Source: NanoGPT / Perplexity AI / Finbold

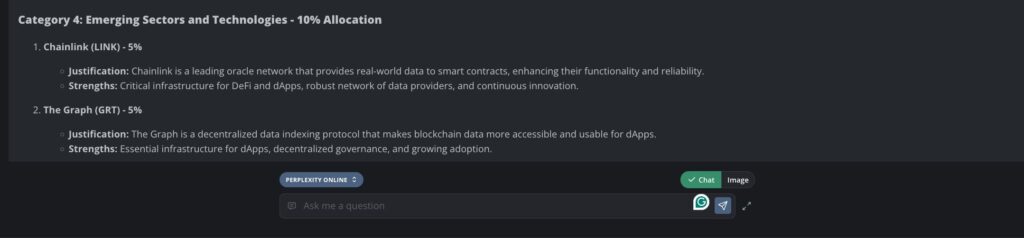

Emerging sectors and technologies – 10% allocation of the crypto portfolio for an altseason bull market

Finally, Perplexity allocates 10% of the crypto portfolio to emerging sectors and technologies like Chainlink (LINK) and The Graph (GRT). The AI concludes its investment allocation with 5% in each of these cryptocurrencies, ready for the upcoming altseason.

Crypto portfolio – Category 4: Emerging Sectors and Technologies – 10% Allocation. Source: NanoGPT / Perplexity AI / Finbold

Crypto portfolio – Category 4: Emerging Sectors and Technologies – 10% Allocation. Source: NanoGPT / Perplexity AI / Finbold

“This portfolio is designed to capture the growth potential of the 2024-2025 altseason by diversifying across different categories and sectors. It emphasizes projects with strong fundamentals, utility, and technological innovation. By allocating 50% to Layer 1 blockchains, 25% to DeFi tokens, 15% to infrastructure and scalability solutions, and 10% to emerging sectors and technologies, the portfolio aims to balance risk and potential returns. Continuous monitoring and adjustments may be necessary to optimize performance.”

– Perplexity Online AI

Despite the AI advanced capacities to gather and analyze up-to-date data from the internet, Perplexity can still make mistakes. Thus, investors must check all the provided information and do their own research before making financial decisions and allocations.

Building a solid crypto portfolio for the altseason bull market can be highly rewarding but also brings significant risks. Yet, savvy investors also have a clear strategy to take profits throughout the rally.

Featured image via Shutterstock