Why Bitcoin price is set for $105,000 target and beyond

![]() Cryptocurrency Oct 13, 2024 Share

Cryptocurrency Oct 13, 2024 Share

As Bitcoin (BTC) navigates an unusually calm ‘Uptober,’ a trading expert believes a review of technical indicators and the asset’s past performance suggests a new record might be in the offing.

This projection comes as the maiden cryptocurrency reclaimed the $62,000 mark, with bulls anticipating a potential push toward the $65,000 resistance.

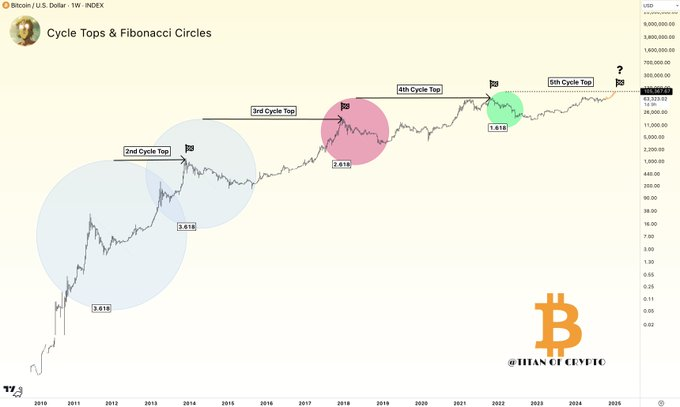

In this regard, Bitcoin could be on track to reach $105,000 in its current cycle, driven by Fibonacci circle analysis that highlights historical cycle tops, as crypto analyst Titan of Crypto observed in an X post on October 13.

Picks for you

Sell time? Overbought cryptocurrency signals a bearish reversal 3 hours ago Realize profits: Millionaire sales take over the market as price surges 20 hours ago Crypto trader misses out on $17.5 million return from $1,000 investment 22 hours ago Bitcoin price gears up for major rally with two key peaks on the horizon 22 hours ago

The analysis is based on five distinct market cycles, each reaching a peak that aligns with key Fibonacci levels.

Bitcoin technical indicators

In 2013, Bitcoin reached its second major cycle top around the 3.618 Fibonacci level, setting a benchmark for future movements. By 2017, Bitcoin’s third cycle top aligned with the 2.618 Fibonacci level, indicating significant gains but at a lower magnitude relative to Fibonacci ratios. In 2021, the fourth cycle peak reached approximately the 1.618 level, further solidifying the trend of tapering returns with each cycle.

The analysis forecasts a top of around $105,000 for the current cycle, once again targeting the 1.618 Fibonacci level. According to the expert, this projection is a conservative yet optimistic outlook, but there is room for Bitcoin to exceed this target.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Another analyst, Cryptocon, also discussed Bitcoin cycles and noted that in the long term, the asset looks bullish based on the Consecutive Candles 9 (CC9) indicator. This technical indicator suggests that Bitcoin might trade at a high of $240,000.

Bitcoin’s bearish outlook

The projection comes as Bitcoin recovers from the October 10 dip below the $60,000 mark in response to the CPI data. Following the recovery, analyst RLinda noted in a TradingView post on October 12 that Bitcoin’s recent price action has solidified a bearish market structure characterized by sharp fluctuations and a failure to sustain higher price levels.

She observed that after retesting the $59,000 mark, Bitcoin rallied by 7%, displaying high volatility without any clear technical or fundamental basis. In the last two weeks, the cryptocurrency has experienced rapid movements—dropping by $6,000, then rallying $4,000, only to fall another $5,000 and rise again by $4,000. Despite these fluctuations, Bitcoin remains confined within a sideways trading range of $65,000 to $52,000.

RLinda stated that Bitcoin is currently testing a key resistance zone as part of its recent rally. However, the price will likely face resistance without strong accumulation or technical signals to break past this level.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Meanwhile, Ali Martinez’s analysis suggested that the current fluctuation in Bitcoin prices might be healthy. The volatility, which has seen the asset interact with the $60,000 mark, could provide room for a rally toward $78,000.

Bitcoin price analysis

Bitcoin was trading at $62,770 at press time, having dropped less than 1% in the last 24 hours. On the weekly chart, BTC is up 1%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

In conclusion, as Bitcoin weathers a period of volatility and consolidation within a sideways trading range, there is a need for a cautiously optimistic outlook. Bitcoin must overcome key resistance levels at $65,000 to sustain any upward momentum.

As such, while short-term fluctuations may continue, the outlook for a new all-time high remains within reach if market conditions align.