Will Bitcoin crash below $100k as network activity nosedives 45%?

![]() Cryptocurrency Jul 1, 2025 Share

Cryptocurrency Jul 1, 2025 Share

As Bitcoin (BTC) consolidates around the $107,000 mark, on-chain data is showing signs of fatigue, suggesting a potential price move may be imminent.

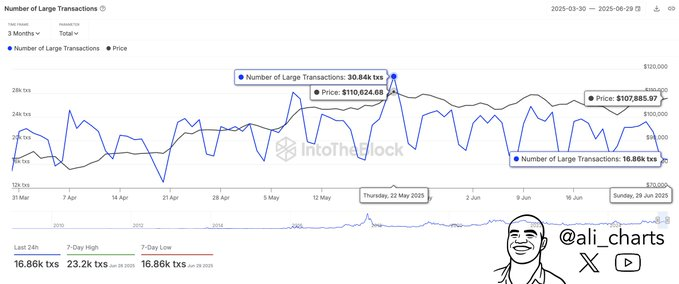

Specifically, the number of large Bitcoin transactions exceeding $100,000 has decreased by 45.3% over the past month. The transactions peaked at around 30,840 on May 22 but fell to just 16,860 by June 29, according to data from the crypto analytics platform IntoTheBlock.

Bitcoin whale transaction data. Source: IntoTheBlock

Bitcoin whale transaction data. Source: IntoTheBlock

The steep decline often signals reduced activity from whales and institutions. This drop indicates potential weakening confidence and thinning liquidity, which increases the risk of Bitcoin slipping below the key $100,000 support level.

If large-scale buying continues to wane, the market could face deeper volatility unless new demand emerges.

Capital inflow into crypto plunges $20 billion

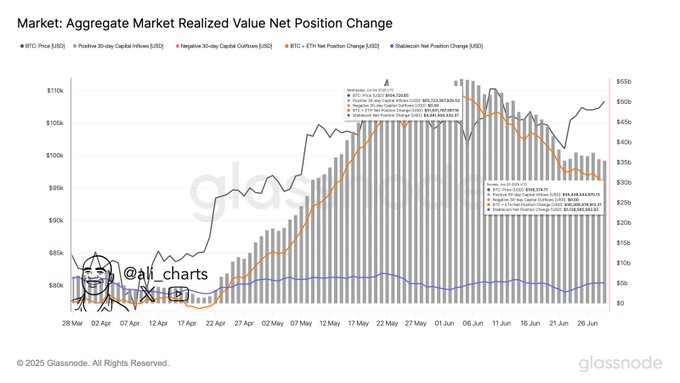

At the same time, broader cryptocurrency market trends echo this caution. Capital inflows into cryptocurrencies have declined by more than $20 billion, suggesting a shift in investor sentiment.

Glassnode data shows the net position change in realized value, a measure of capital entering or exiting the market, dropped from nearly $55 billion in late May to $34 billion by June 28.

Crypto market realized value change. Source: Glassnode

Crypto market realized value change. Source: Glassnode

This drawdown highlights a slowdown in momentum across major assets, including Bitcoin and Ethereum (ETH), both of which had experienced steady accumulation earlier in the second quarter.

Bitcoin price analysis

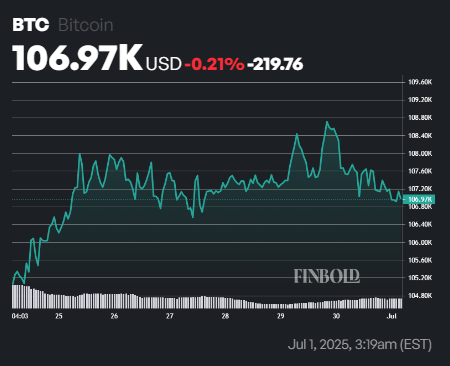

Currently, Bitcoin’s key support level is at $105,000. Holding above this level is critical for any attempt to reclaim $110,000 and push toward new all-time highs. As of press time, BTC was trading at $106,972, down 0.6% on the day and 0.3% for the week.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Technically, Bitcoin remains in a bullish posture. It’s trading above both its 50-day simple moving average ($105,970) and 200-day SMA ($87,717), a sign of strength.

Meanwhile, the 14-day RSI stands at 58.77, indicating that momentum remains intact without signaling overbought conditions.

Overall, Bitcoin’s setup appears constructive, with key moving averages providing support and technical indicators still favoring the bulls.

Featured image via Shutterstock