Will XRP price reach $1?

![]() Cryptocurrency Aug 8, 2024 Share

Cryptocurrency Aug 8, 2024 Share

XRP received a significant short-term boost after Ripple secured a key victory in its legal battle with the Securities Exchange Commission (SEC).

A judge ordered Ripple to pay a $125 million civil penalty but ruled that the company is “permanently restrained and enjoined” from violating U.S. securities laws.

Importantly, following the August 7 court decision, there are no indications that XRP will be classified as a security, suggesting the long-standing legal dispute may be ending.

Picks for you

Brighty launches AI-powered investment platform 6 hours ago PlasmaCon 2024 hints at a resurgence of Plasma’s blockchain technology 7 hours ago Kevin McCarthy’s net worth revealed: How rich is the 55th speaker of the US House of Representatives? 8 hours ago Ron DeSantis' net worth revealed: How rich is the Governor of Florida? 9 hours ago

The SEC asked for $2B, and the Court reduced their demand by ~94% recognizing that they had overplayed their hand. We respect the Court’s decision and have clarity to continue growing our company.

This is a victory for Ripple, the industry and the rule of law. The SEC’s…

— Brad Garlinghouse (@bgarlinghouse) August 7, 2024

With XRP surging on the news, attention now turns to whether the token can sustain its rally and reclaim the $1 psychological level.

Technical indicators outlines XRP’s path to $1

In this regard, in an X post on August 8, a crypto analyst by the pseudonym Word of Charts observed that a critical technical pattern had emerged on XRP’s price chart, indicating the possibility of a bullish breakout.

The analysis highlighted a symmetrical triangle formation that has been developing over several years. This pattern, characterized by converging trendlines, typically signals a period of consolidation followed by a breakout that can lead to significant price movement.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

Currently, XRP is testing the upper boundary of this triangle, signaling a potential breakout to the upside. If XRP sustains this breakout, the analyst suggests the price could rise to $1.

“XRP Has Formed A Textbook Multiple-Year Symmetrical Triangle, And A Successful Breakout Could Lead To A Massive Bullish Wave, Potentially Pushing The Price Towards $3-5,” the expert said.

Similarly, another trading analyst, Captain Faibik, also shared a bullish sentiment in another X post. According to the expert, investors should prepare for a possible “mega bullish rally” for XRP.

The expert’s analysis also indicated that XRP had formed a symmetrical triangle pattern on the weekly timeframe. He suggested that the asset is on the verge of breaking out from this triangle, which could trigger a significant rally.

The analysis sets a midterm target of $2.30, which. This overview also indicates a potential price trajectory that could see XRP surpass the $1 mark—a psychological milestone that has been elusive for some time.

XRP price analysis chart. Source: TradingView/CryptoCave

XRP price analysis chart. Source: TradingView/CryptoCave

XRP’s on-chain data uptick

On-chain data indicates that amid the latest case ruling, XRP has recorded a significant uptick in both price and market sentiment.

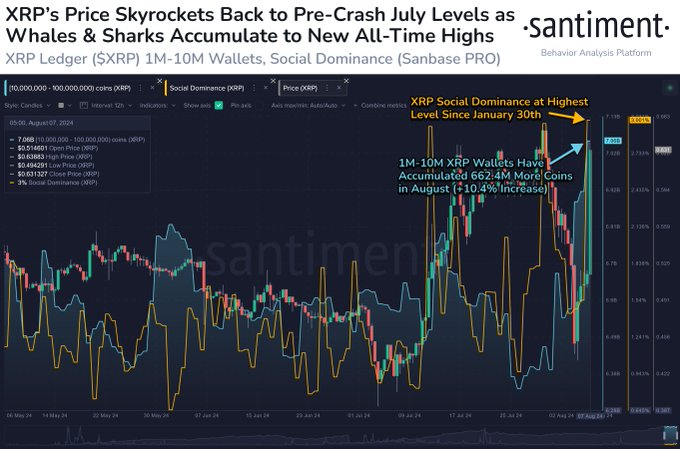

Data from Santiment particularly supports the bullish outlook for XRP. As of August 8, XRP’s market cap has surged by an impressive 23% over the past 24 hours, signaling renewed investor interest and confidence in the asset.

Large holders with 1 to 10 million XRP now hold a record 7.06 billion XRP, valued at about $4.42 billion, signaling potential positioning for a rally.

XRP whale wallets and social dominance chart. Source: Santiment

XRP whale wallets and social dominance chart. Source: Santiment

XRP’s social media presence has also surged to its highest since January, suggesting increased community engagement and potential for heightened market activity.

XRP price analysis

As of press time, XRP was trading at $0.60, reflecting a surge of over 21% in the last 24 hours. In the weekly timeframe, the token is up by nearly 3%.

XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

Meanwhile, XRP investors are likely eyeing short-term targets, with the $0.70 resistance as the next key level to watch.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.