‘Window for crypto to blow off is shrinking,’ then recession will follow, warns expert

![]() Cryptocurrency Jul 21, 2025 Share

Cryptocurrency Jul 21, 2025 Share

For investors anticipating a continued rally in the cryptocurrency market, an expert has warned that the window may be closing, especially after Bitcoin (BTC) led the recent surge, hitting a new all-time high above $123,000.

According to cryptocurrency analyst Gert van Lagen, a parabolic move similar to the final-stage rallies of 2011, 2013, and 2017 is likely to unfold in the coming months, he said in an X on July 21.

He suggested this could be the last major upswing before a broader economic downturn sets in.

“The window for crypto to blow off is shrinking — expect a vertical frenzy like the final phase of 2011, 2013, or 2017 — not 2021. Then comes the recession… and the first true correction in Bitcoin’s history,” Lagen said.

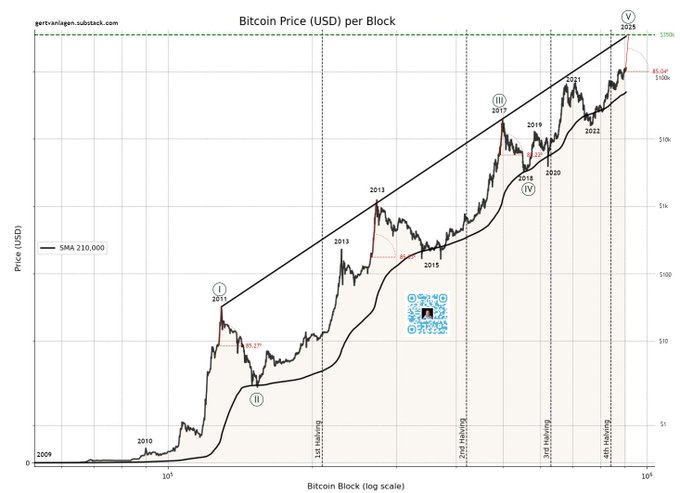

Bitcoin price analysis chart. Source: Gert Lagen

Bitcoin price analysis chart. Source: Gert Lagen

Referencing long-term Bitcoin price trends, Lagen noted that the market is approaching the top of a decade-long channel. He believes the current setup suggests a potential climax in 2025, consistent with the final leg of a major Elliott Wave cycle.

This expected blow-off phase is forming under high-risk conditions, sparking concern about what may follow.

Beyond crypto, Lagen highlighted ominous signals from traditional financial markets. He noted that stock indices have reached long-term resistance levels, dating back to the market peaks of 1929 and 2000, while technical patterns indicate signs of a Wyckoff Distribution, which often precedes major market reversals.

S&P 500 and recession outlook. Source: TradingView

S&P 500 and recession outlook. Source: TradingView

Reversed recession indicators

At the same time, recession indicators have sharply reversed and are now nearing contraction territory. Despite these warning signs, Lagen suggested the Federal Reserve is unlikely to implement aggressive rate cuts until economic weakness becomes more evident.

Historically, significant monetary easing has only occurred after weaker companies are flushed from the system and labor markets soften significantly.

It’s worth noting that markets have been anticipating Bitcoin to maintain its momentum and potentially target the $140,000 mark, following multiple new highs in recent sessions.

As of press time, Bitcoin has slightly pulled back from its record, trading at $119,069, up 0.7% in the last 24 hours and 0.23% over the past week.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Meanwhile, the stock market has also been trading at fresh highs, with the benchmark S&P 500 recently climbing above 6,300. However, the financial world remains divided over the likelihood of a recession hitting this year, especially after the U.S. took steps to ease trade tensions with key allies.

Featured image via Shutterstock