XRP enters death spiral as $25 billion wiped in a day

![]() Cryptocurrency Feb 3, 2025 Share

Cryptocurrency Feb 3, 2025 Share

XRP has witnessed a massive price crash, significantly underperforming the general cryptocurrency market, which remains volatile following the rollout of tariffs by the Donald Trump White House.

The latest drop has invalidated XRP’s recent push to hold its price above the $3 mark in pursuit of a new all-time high.

At the time of writing, the token was trading at $2.50, reflecting daily losses of over 15%, while on the weekly chart, XRP is down almost 20%. At one point on February 3, XRP saw a sharp decline of about 40% within 13 hours before recovering slightly.

Picks for you

Here's why Gold could 'go even higher' amid the tariff war and Fed stance 8 hours ago Crypto liquidations are 'lot more' than reported; Bybit CEO estimates up to $10B wipeout 11 hours ago $65M reportedly stolen from Coinbase users in past two months 11 hours ago If you put $1,000 into an Anthony Scaramucci crypto portfolio at the start of 2025, here’s your return now 12 hours ago  XRP seven-day price chart. Source: Finbold

XRP seven-day price chart. Source: Finbold

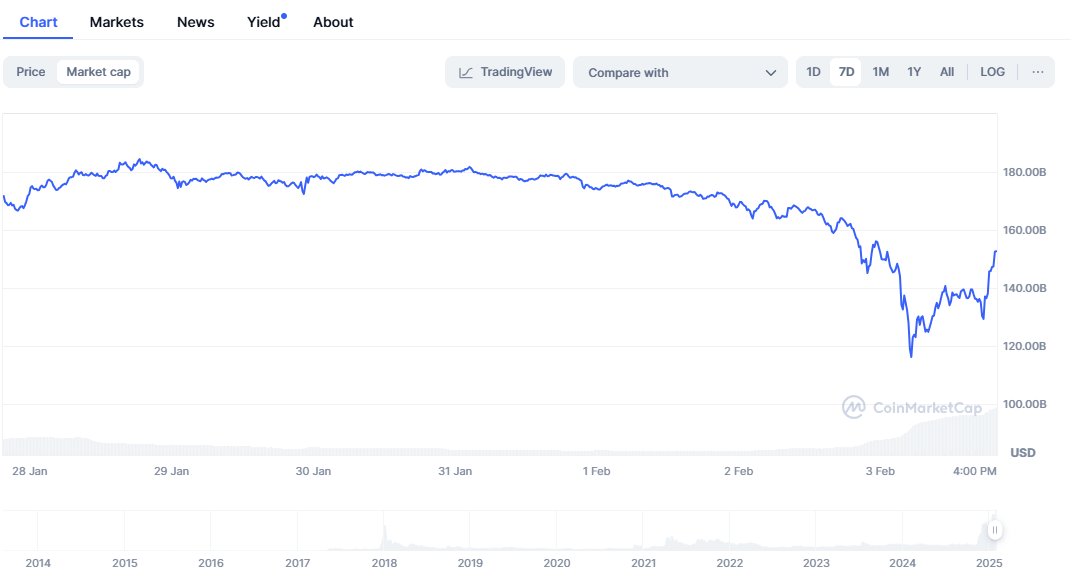

Massive capital outflows have accompanied this price plunge. In this case, XRP’s market cap currently stands at $138.09 billion, a total drop of $24.97 billion in the last 24 hours. On a weekly timeframe, the asset has wiped out $32.96 billion, according to CoinMarketCap data.

XRP one-week market cap chart. Source: CoinMarketCap

XRP one-week market cap chart. Source: CoinMarketCap

Whales dumping XRP

Amid this trend, whale investors have also been on a selling spree as XRP showed increasing signs of weakness.

Specifically, data shared by prominent on-chain cryptocurrency analyst Ali Martinez in an X post on February 3 indicated that whales sold off more than 130 million XRP within 24 hours.

XRP whale transaction chart. Source: Santiment/Ali_charts

XRP whale transaction chart. Source: Santiment/Ali_charts

It remains to be seen whether the full impact of this offloading has been realized, given the potential for increased volatility following Ripple’s release of another 1 billion XRP from escrow.

Despite the current bearish movement, sentiment around XRP remains bullish in the long term, particularly from a regulatory standpoint. There is anticipation that the Securities and Exchange Commission (SEC) will soon decide on the Ripple case, potentially terminating the legal suit or reaching a settlement in favor of the blockchain company.

Indeed, the resolution of this case could be monumental for the asset, especially since XRP’s recent price breakout was partly driven by speculation of friendly regulation under the Trump administration.

Similarly, the regulator is set to decide on an XRP exchange-traded fund (ETF) application. If approved, the product could drive institutional capital into the asset, with chances of approval appearing stronger amid perceptions of a more favorable SEC stance.

XRP’s technical outlook

From a technical perspective, analysis by pseudonymous cryptocurrency trading expert The Great Mattsby in an X post on February 3 identified key price levels for XRP to watch.

The expert observed that XRP successfully backtested the conversion line at $1.98 and the baseline at $1.87 during the monthly timeframe, which serve as crucial support zones. These levels, part of the Ichimoku system, define momentum and trend direction.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

Currently trading above the $2 level, XRP has pulled back from its recent $3.26 high. If support holds, a renewed push toward resistance is possible. However, a breakdown below $1.87 could trigger a deeper retracement toward the $1.30 to $1.50 range.

Generally, market sentiment for XRP remains bearish, as reflected by the Fear & Greed Index at 44, signaling fear. The 50-day simple moving average (SMA) of $2.58 indicates that XRP is below its short-term average, signaling a possible extension of the bearish outlook.

However, the 200-day SMA at $1.25 reflects long-term growth potential. The 14-day Relative Strength Index (RSI) stands at 40.02, indicating a neutral position with room for movement, though a short-term downside appears more likely in the immediate future.

Featured image via Shutterstock