XRP wipes $11 billion just 48 hours after Ripple case dismissed

![]() Cryptocurrency Mar 21, 2025 Share

Cryptocurrency Mar 21, 2025 Share

President Donald Trump’s re-election and the news that the now-former Securities and Exchange Commission (SEC) Chair Gary Gensler would resign helped XRP soar from about $0.51 to January highs near $3.31 for a 549% rally.

Events in the subsequent months provided substantially fewer tailwinds, with even the SEC’s watershed decision to abandon its lawsuit against Ripple Labs triggering only a short-lived rally.

In fact, though the immediate reaction to the news was positive and led to a 14.35% rally from March 18 lows near $2.23 to March 19 highs near $2.55, sending the token’s market capitalization to $149.18 billion, subsequent trading proved something of a bloodbath.

Picks for you

Trump’s White House return wipes out nearly 20% of Bitcoin millionaires 4 hours ago Long squeeze alert for Gold as key price levels get the spotlight 21 hours ago Ripple v. SEC case: The final verdict 23 hours ago Here's what happened to the $1.4 billion stolen crypto from Bybit 23 hours ago

Specifically, XRP erased $11.4 billion within just 48 hours despite it shedding arguably the biggest bearish factor that kept it depressed since the lawsuit was first filed in 2021, per the data Finbold retrieved from CoinMarketCap on March 21.

XRP 7-day market capitalization chart. Source: CoinMarketCap

XRP 7-day market capitalization chart. Source: CoinMarketCap

XRP proves susceptible to wider crypto market headwinds

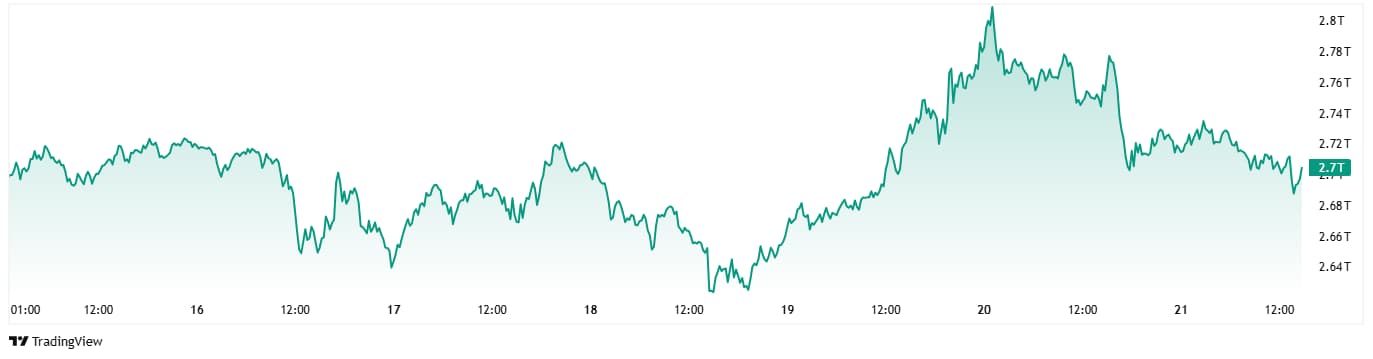

The same phenomenon affected the entire cryptocurrency market, though the effect was somewhat delayed. The cumulative valuation of digital assets soared from $2.62 trillion on March 18 to a March 20 high of $2.81 trillion. By press time on March 21, the figure diminished by some $110 billion and stands at $2.7 trillion.

Total cryptocurrency market cap, 7-day chart. Source: TradingView

Total cryptocurrency market cap, 7-day chart. Source: TradingView

Generally, the cryptocurrency market appears entirely affected by the same fear that has gripped stock investors and led to a significant equity selloff and, if gold’s price movements are to be used as a gauge, a flight to the safety of commodities.

While President Trump’s protectionist tariffs may yet prove positive in the long run, in the short term, they have generated an escalating trade war that has ensured traders are uncertain about their investments, consumers are uncertain about the prices of necessary goods, and analysts are speculating if the U.S. is already in a recession.

Still, not all headwinds can be directly linked to the commander-in-chief. Breakthroughs in China have shaken the increasingly important technology sector, a shift that had a spillover effect into other industries and is, by all accounts, visible among digital assets.

Long-term picture remains bullish for XRP

Despite the turmoil and the likely short-term disappointment many XRP bulls might be feeling, it is worth pointing out that the token remains substantially above the levels it had been maintaining for years.

XRP 6-month price chart. Source: Finbold

XRP 6-month price chart. Source: Finbold

Though it is just over 2% down in the last 7 days, the fact it remains 304.03% in the green in the last six months at its press-time price of $2.38 is a major accomplishment and has demonstrated that a long-term bull case remains.

Featured image via Shutterstock