Bitcoin’s 13-year trend predicts when BTC will peak at $200,000

![]() Cryptocurrency Jul 28, 2024 Share

Cryptocurrency Jul 28, 2024 Share

Bitcoin (BTC) has once again failed to breach the $70,000 resistance zone, exhibiting volatility in the last 24 hours, with the crypto dropping to below $67,000 at some point.

Indeed, Bitcoin failed to capitalize on Republican presidential nominee Donald Trump’s bullish sentiments about incorporating the crypto into the United States Treasury.

Despite Bitcoin’s short-term price volatility, analysts maintain that the maiden crypto is destined for a new all-time high. Particularly, in an X post on July 27, analyst apsk32 indicated that Bitcoin’s historical price movement models have a target of about $200,000.

Picks for you

Bitcoin enters 'early parabolic rally levels'; Is $100k next? 12 hours ago U.S. recession indicator dangerously close to trigger 13 hours ago Mike Johnson’s net worth revealed: How much is the Speaker of the US House of Representatives worth? 14 hours ago Bitcoin to the moon? Experts identify new all-time high 14 hours ago

The analyst detailed an examination of Bitcoin’s price movements over the past 13 years, which has provided a striking prediction for its future. In projecting the next Bitcoin target, the analyst deployed a combination of a power law and an exponential decay model.

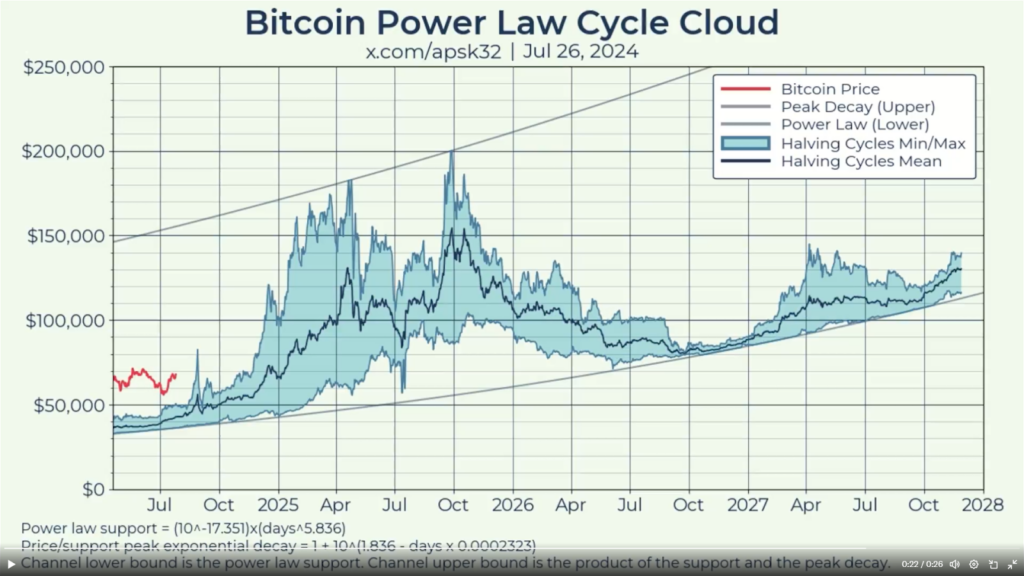

Notably, the “Bitcoin Power Law Cycle Cloud” illustrates Bitcoin’s historical price behavior within two primary bounds: the power law lower bound and the exponential decay upper bound. These bounds create a channel within which Bitcoin’s price has oscillated, adhering closely to these mathematical models over the years.

Bitcoin Power Law Cycle chart. Source: apsk32

Bitcoin Power Law Cycle chart. Source: apsk32

According to apsk32, the lower bound of this channel is defined by a power law equation, which has reliably supported Bitcoin’s price. The upper bound, meanwhile, is determined by an exponential decay of the peaks, effectively capping the highest values that Bitcoin has achieved.

Bitcoin’s $200,000 peak

Based on the analysis, Bitcoin is projected to reach a peak of $200,000 by 2025. This peak prediction aligns with the upper bound established by the exponential decay model. However, the projection doesn’t just stop at the peak. Following this anticipated high, Bitcoin’s price will decline significantly, falling to around $85,000 by 2026.

“A power law equation provides a lower bound, and an exponential decay of the peaks provides the upper bound. We can hope it will change while staying aware of this 13-year trend. What does that mean for this cycle? (1) Bitcoin will peak at or below $200k in 2025. (2) Bitcoin will fall to $85k in 2026,” the expert said.

It’s worth noting that the power law and exponential decay models have consistently predicted Bitcoin’s price movements over the past 13 years. Interestingly, apsk32 pointed out that the model aligns with predictions made by other key players, such as MicroStrategy’s (NASDAQ: MSTR) Michael Saylor, who has shared different price targets for the cryptocurrency.

Speaking at the 2024 Bitcoin Conference, Saylor predicted that in a base scenario, Bitcoin could reach $13 million, or 7% of global wealth, with a market cap of $280 trillion and an annual return of 29%. Saylor envisions Bitcoin soaring to $49 million, or 22% of global wealth, in a bullish scenario.

Bitcoin price analysis

Bitcoin was down almost 1% in the 24-hour timeframe by press time, trading at $67,470. On the weekly chart, it is up nearly 0.8% after recording a high of about $69,300.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

As things stand, Bitcoin’s main obstacle remains reclaiming the $70,000 mark, but investors should keep an eye on the $67,000 support.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk. Share