Don’t trust crypto ‘daily active user’ reports; Here’s why

![]() Cryptocurrency Sep 27, 2024 Share

Cryptocurrency Sep 27, 2024 Share

“Daily Active Addresses” is one of the most misused metrics in the crypto space, often creating confusion with “Daily Active Users.” Experts have urged people to stop using “DAA” when evaluating users’ activity for fundamental analyses, and recent data shows why.

Often referred to as “daily active users,” the Daily Active Addresses (DAA) indicator measures the number of crypto wallet addresses that performed at least one activity (or transaction) in a day.

At first glance, this could be a valuable metric for crypto fundamental analyses, considering users are essential for any ecosystem. However, “addresses” are not the same as “users” – especially true for bot-dominated chains like Solana (SOL) and now Base (ETH).

Picks for you

Can Shiba Inu (SHIB) replicate Dogecoin’s (DOGE) 2021 bull rally? 44 seconds ago Congressman discloses $175 million in trades 580 days late, gets off with $200 fine 4 hours ago GraFun launches new meme coin launchpad on BNB chain with over 3.8 million pre-registrations 4 hours ago Here’s why silver could reach $50, according to analyst 4 hours ago

Essentially, a single user can control hundreds, thousands, or millions of addresses, artificially inflating the number of daily active addresses. This can be malicious, faking a “valuable” chain, or profit-driven, exploiting built-in incentives like Maximum Extractable Value (MEV), or both.

‘MEV is theft’ and ‘fake it until you make it’ criticisms

Given the combination of high liquidity and MEV dynamics, Solana has become one of the bot operators’ favorite blockchains.

Thanks to the chain’s design, wealthy bot operators can perform different exploits over Solana’s MEV dynamics, harming non-bot organic users. The infamous high transaction failure rates are also part of these nefarious incentives for bot growth, affecting metrics like DAA.

Blockchain developer Robert Sasu categorically argues that “MEV is theft,” creating perverse incentives against users and developers. In a post, Sasu raises concerns related to “Sandwich Attacks,” a common practice in SOL trades, blaming its design.

“MEV protection is a must for any chain if it cares about developers and users. If the protocol cares more about validators and those who extract/steal from users it will let MEV to go on.”

– Robert Sasu

Historically, opposing experts accused Solana of relying on a “fake it until you make it” business model. For example, citing the “Master of Anons” report by Coindex in 2022, telling the story of the Macalinao brothers. As reported, the brothers created a network of fake accounts and projects to inflate Solana’s total value locked (TVL) metric.

Ethereum co-founder Joseph Lubin also commented about this phenomenon, explaining it is unsustainable in the long term. In his words:

“All the projects in our ecosystem essentially fake it until they make it, or they die.”

– Joseph Lubin

Data shows over 80% of Solana traders aren’t “quality users”

Now, the strong incentives toward Solana traders running botnets to both exploit and avoid being exploited by MEV dynamics and transaction failures have created another inflated metric, often reported by news portals, influencers, and SOL fans: The Daily Active Addresses, or even worse, “Daily Active Users.”

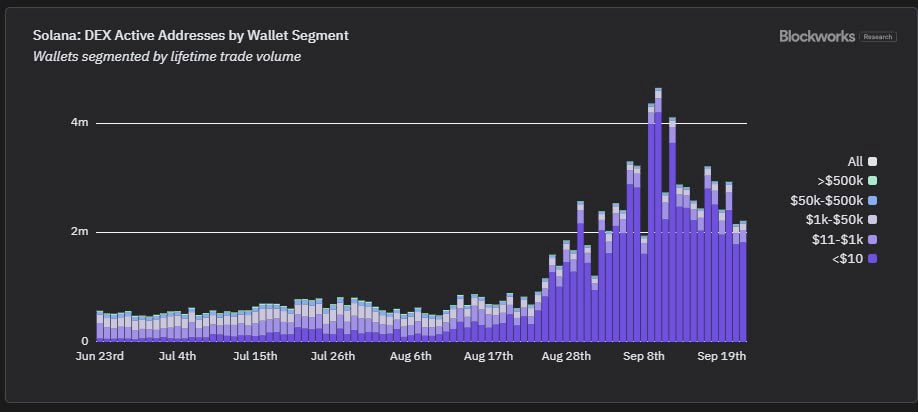

Notably, over 80% of Solana’s active addresses have traded less than $10 volume on decentralized exchanges (DEX) in their lifetime. This is a remarkably low trading volume, which Dan Smith from Blockworks Research called “not quality users.”

Smith used this recent data from a Blockworks Research report to urge people to “Stop. Reporting. Active. Addresses.” Meanwhile, the report itself warned of Daily Active Addresses as an “extremely misleading metric.”

Solana: DEX Active Addresses by Wallet Segment. Source: Blockworks Research / Dan Smith

Solana: DEX Active Addresses by Wallet Segment. Source: Blockworks Research / Dan Smith

Base’s and Near’s questionable Daily Active Addresses

Nevertheless, Solana is not the only chain displaying quality-questionable Daily Active Addresses (or Users) results. Near Protocol (NEAR) and Ethereum’s second-layer Base have also registered questionable DAA, blurring potential insights this metric could provide.

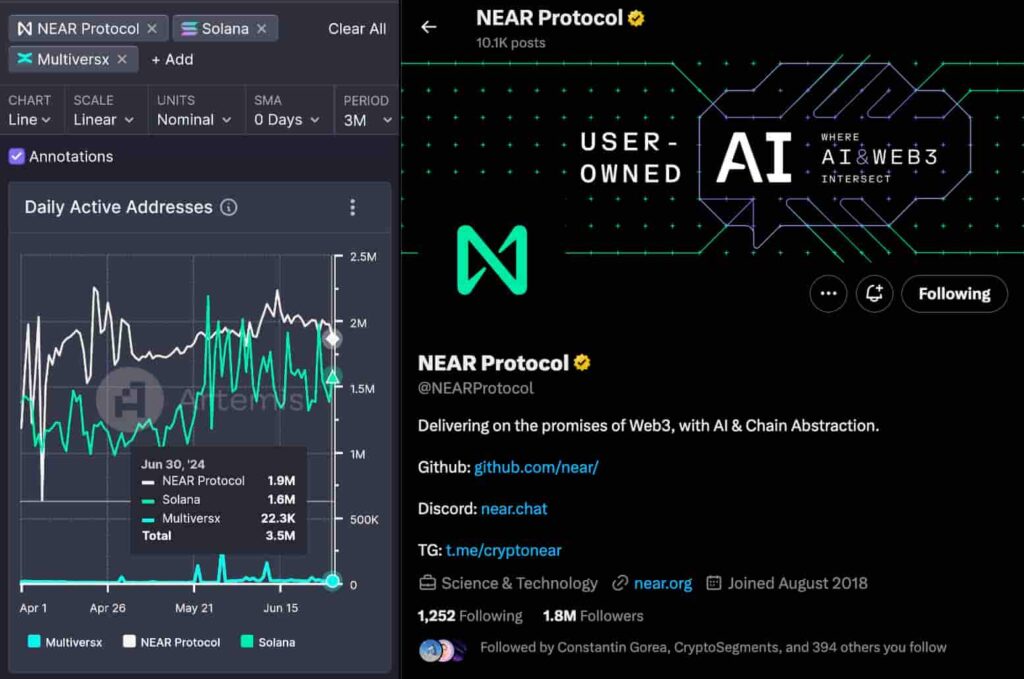

In March, a Messari report highlighted Near’s 1.2 million average DAA for Q1 2024, a 41.5% quarter-over-quarter growth. Data received by Finbold from JP Stanley on July 1 displayed 1.9 million Daily Active Addresses for Near. Yet, as of this writing, Near Protocol’s account on X has only 1.8 million followers in total.

Near Protocol DAA vs. followers on X. Source: Finbold

Near Protocol DAA vs. followers on X. Source: Finbold

Moreover, Dan Smith identified a similar divergence of Solana’s active addresses sub-$10 volume domination on Base. According to Smith, 90% to 92% of active Base traders on DEXes have moved less than $10 in total volume.

He doubled down on his opinion that “we can do better” than active addresses while looking for “growth to showcase.”

And btw the same metric for base hovers around 90-92%

I will do anything to get us to collectively move on from this useless metric

We can do better! There's a ton of growth to showcase, its just not active addresses https://t.co/aP8aU80lHs pic.twitter.com/tBbSguZAAL

— Dan Smith (@smyyguy) September 25, 2024

Don’t trust ‘daily active users’ reports on crypto

Like Blockworks‘s researcher Dan Smith, other analysts, commentators, investors, and educators position against the “daily active users” reports on crypto.

Talking to Finbold, Dave, creator of DBCrypto, deemed daily active addresses a “superficial metric,” easily manipulated. Dave explained that people should not trust it to gather insights into a chain’s user base or its fundamental value.

“Many have shown how easy and cheap it is to spin up 10,000 wallets or a million transactions. Unfortunately, these superficial metrics often carry significant weight in the web3 space and until that is no longer the case we can expect to see more and more of it being manipulated.”

– Dave, from DBCrypto

Previously, Finbold covered a video from DBCrypto exposing Solana’s “manipulation and lies.”

In conclusion, crypto reports should mature and evolve together with this fast-moving industry, as analysts make discoveries and learn new things. Metrics like Daily Active Addresses or Users may not be ideal anymore, requiring caution and a bit of skepticism.

Overall, traders and investors should always face metrics critically, as hardly any metric will provide conclusive insights alone.