Finance experts predict Bitcoin price for Halloween 2024

![]() Cryptocurrency Oct 7, 2024 Share

Cryptocurrency Oct 7, 2024 Share

Despite cryptocurrency investors’ high hopes in the weeks leading up to October, the start of the month – historically notable for the strong performance of digital assets – Bitcoin (BTC) has been trading lower at the beginning of the month.

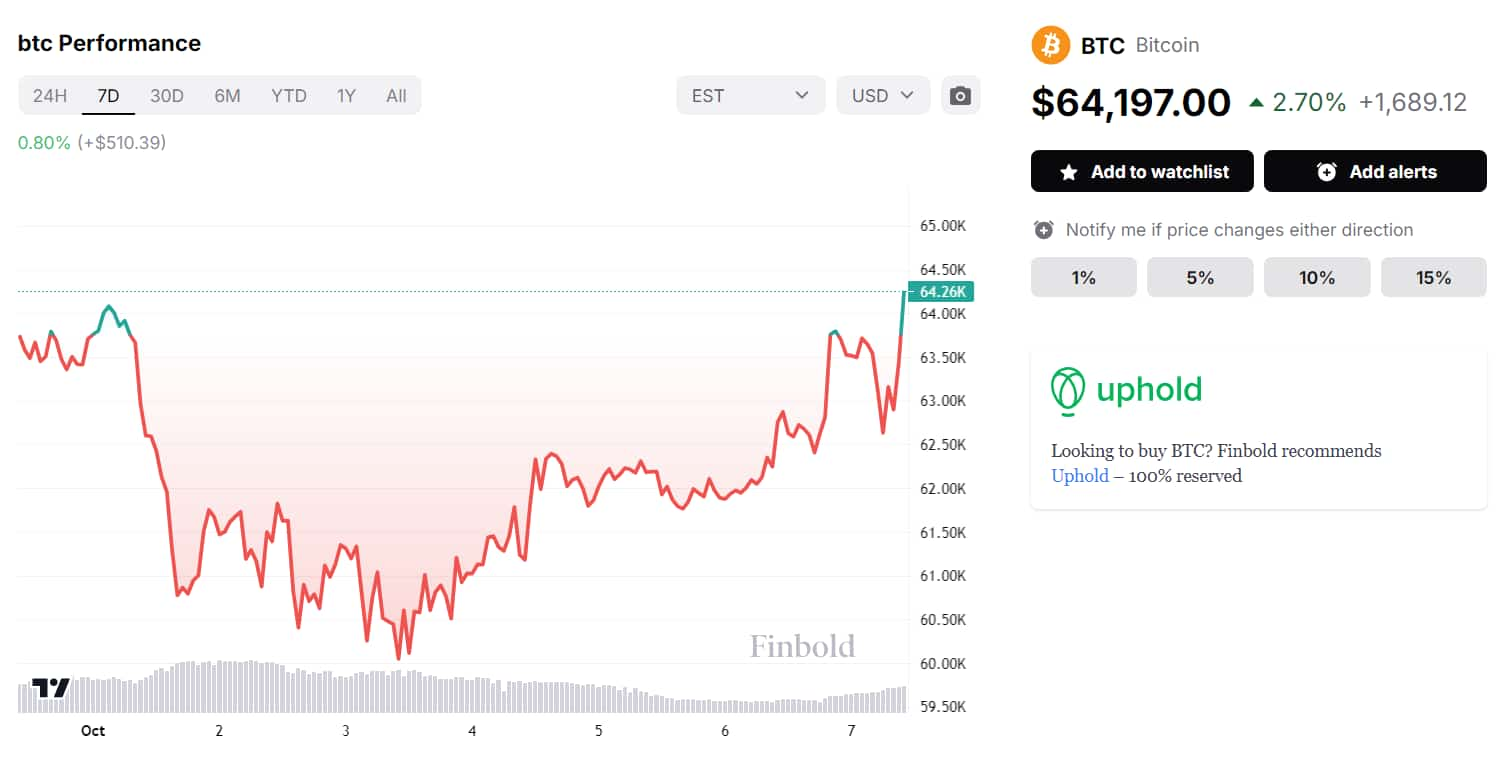

Indeed, after seemingly breaking the trend of lower highs followed by lower lows – an event that hinted at a possible rally toward $70,000 BTC experienced a sharp price crash on October 2. However, it recovered to $64,197 thanks to a strong rally on the morning of October 7.

To be precise, the world’s premier cryptocurrency dropped from over $64,000 to just under $61,000 as Iran unleashed one of the biggest missile attacks against Israel in retaliation for a string of assassinations carried out against the country’s allies and officers.

Picks for you

Banking giant sets new recession probability after 'employment report reset' 1 hour ago Crypto trader makes $4.4 million in a month trading this meme coin 5 hours ago Donald Trump strengthens lead over Kamala Harris in prediction markets 7 hours ago Finance expert sees bullish global liquidity incoming to push markets higher 22 hours ago  BTC 7-day price chart. Source: Finbold

BTC 7-day price chart. Source: Finbold

Along with causing an immediate price drop, the assault also cast doubt on Bitcoin’s role as a safe haven asset as investors fled from the digital asset and into gold amidst fears of unprecedented.

Still, the cryptocurrency markets are nothing if not full of surprises. With Bitcoin slowly recovering from the plunge and ‘Uptober’ well underway, Finbold consulted several prominent experts on where BTC might stand on Halloween 2024.

Ben Sporn

Ben Sporn, the CEO of Joy Wallet, started his analysis by acknowledging the ever-present difficulties of predicting Bitcoin prices. Nonetheless, reflecting on the coin’s strong finish in September and current trends, especially given the cryptocurrency’s historical track record, Sporn estimated BTC might end October between $65,000 and $70,000.

Honestly, predicting Bitcoin’s price is always a bit of a wild ride, but based on what I’m seeing, I think we could be looking at a pretty strong finish for October. Given Bitcoin’s historical track record—what everyone calls “Uptober”—and the recent momentum from closing September in the green, I wouldn’t be surprised if we see it push higher, possibly into the $65,000 to $70,000 range by Halloween.

When discussing historical prices, the CEO drew particular attention to Bitcoin’s 40% rally during October 2021, but also warned that there is always room for surprises.

Tim Morris

Tim Morris, the CEO of ForexMT4Indicators, explained he has been tracking Bitcoin’s performance closely and estimated – after considering cyclical trends, technological developments focused on scalability and security, the benefits of regulatory clarity, and macroeconomic factors like inflation concerns – that BTC will trade between $60,000 and $70,000 by Halloween 2024.

I’ve noticed that after previous halving events, Bitcoin’s price experienced substantial growth within 6 to 12 months. I think this pattern will repeat, especially as institutional adoption continues to rise. I’ve seen major financial institutions showing increased interest in Bitcoin, and I believe this could significantly boost market confidence.

Michael Matthew

The owner of HodlMaven, Michael Matthew, similarly pointed toward growing institutional adoption, exchange-traded fund (ETF) inflows, changes to inflation and interest rates, and the lingering effects of the April halving when setting his $72,000 price target.

With a price target of $72,000 by the end of October 2024, Bitcoin presents a compelling buy opportunity.

Matthew also backed his forecast – a target that would, if reached, mean that Bitcoin is just $1,000 away from its all-time high (ATH) – by noting that ‘Uptobers’ have historically caused BTC to rise an average of 22%.

Stephen Maitland

Quoting highly similar factors and particularly highlighting the lingering effects of the April halving and institutional interest, Stephen Maitland, the owner and investment research manager at Gold IRA Investment Guy, set a highly bullish but wide BTC Halloween price target:

I project Bitcoin could land between $65,000 and $85,000 by Halloween 2024. With factors like the April 2024 halving and continued institutional interest around Bitcoin ETFs, prices are poised for a potential upward trend, similar to previous bullish Octobers.

Finally, despite the optimistic forecast, Maitland also warned that the cryptocurrency markets are known to be volatile and major surprises are perpetually possible.

Adam Garcia

Adam Garcia, the founder of Stock Dork, has meticulously built his bull case for Bitcoin in October.

To begin with, Garcia explained cryptocurrencies tend to operate in cycles, with September usually being filled with profit-taking and October with institutions going on a buying spree.

He also commented that the seasonal rallies can be viewed from a standpoint of scarcity:

Relating back to the previous point about the fact that BTC has a limited stock along with what was previously explained regarding the recent halving affecting miner rewards, the yearly price changes in October can thus be viewed from the perspective of scarcity. With an increasing number of holders expecting a future appreciation in prices, the normal, buy at the low and sell at the high mannerism comes into play. It starts creating a psychological flywheel effect.

Still, though it, in many ways, followed the common patterns of analyzing Bitcoin’s likely performance during ‘Uptober,’ Garcia’s assessment featured one major surprise.

To be specific, the founder estimated that recent momentum and likely opportunities for institutional activities are likely to lead BTC to a major downturn and that the cryptocurrency will trade somewhere between $35,000 and $55,000 by October 31.