Meta AI predicts Ethereum price for 2025

![]() Cryptocurrency Aug 10, 2024 Share

Cryptocurrency Aug 10, 2024 Share

2024 has been a key year for Ethereum (ETH), attracting institutional investors’ attention to its native token and ecosystem. Ether’s price, however, had a worse performance year-to-date (YTD) than competing cryptocurrencies like Bitcoin (BTC) and Solana (SOL), for example.

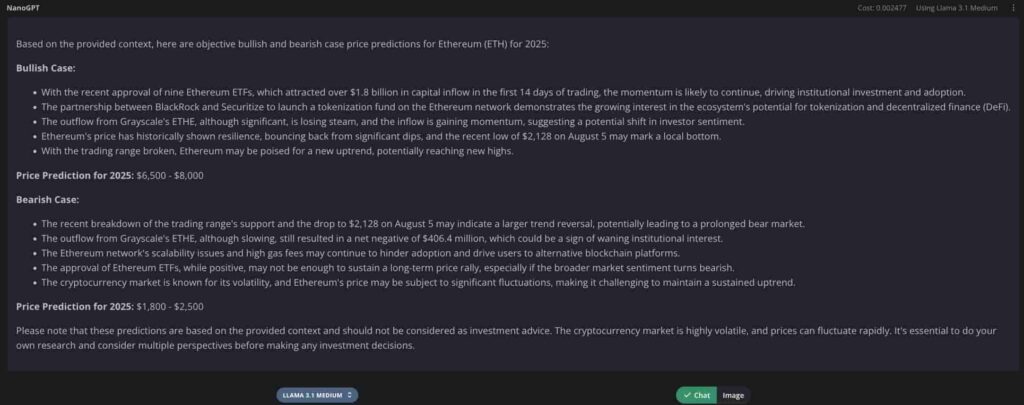

Looking for insights into what is to come next year, Finbold asked Meta‘s artificial intelligence (AI) most advanced open-source model, Llama 3.1, for an Ethereum price prediction for 2025.

As a bullish case, Meta AI predicts ETH will trade between $6,500 and $8,000 in 2025. Meanwhile, it is possible that Ethereum ranges between $1,800 and $2,500 in a bearish case.

Picks for you

Buy signal for two strong cryptocurrencies this week 3 hours ago Here's when Bitcoin will hit $81,000, according to analyst 6 hours ago Cryptocurrencies will unlock $230 million this week – What to expect? 7 hours ago Analyst sets XRP's next all-time high for upcoming bull market 8 hours ago

This forecast considers fundamental aspects based on the following context, provided to Llama 3.1 for a solid analysis.

Meta AI (Llama 3.1) Ethereum (ETH) price prediction for 2025. Source: NanoGPT / Finbold

Meta AI (Llama 3.1) Ethereum (ETH) price prediction for 2025. Source: NanoGPT / Finbold

Ethereum (ETH) context and price history in 2024

In January this year, BlackRock‘s (NYSE: BLK) CEO Larry Fink forecasted ETH spot ETF approval and explained the value of tokenization. Furthermore, BlackRock later started its own tokenization fund running on the Ethereum network in partnership with Securitize.

On July 23, the nine recently approved Ethereum exchange-traded funds (ETFs) started trading in the United States. Eight of these investment vehicles attracted over $1.8 billion in capital inflow in the first 14 days of trading. Conversely, Grayscale’s ETHE registered $2.3 billion in outflows, resulting in a net negative of $406.4 million.

Total Ethereum Spot ETF Net Inflow USD. Source: CoinGlass

Total Ethereum Spot ETF Net Inflow USD. Source: CoinGlass

Nevertheless, the market saw a similar offloading pattern from Grayscale’s Bitcoin ETF (GBTC), and analysts noted that the outflow is losing steam while inflow gains momentum.

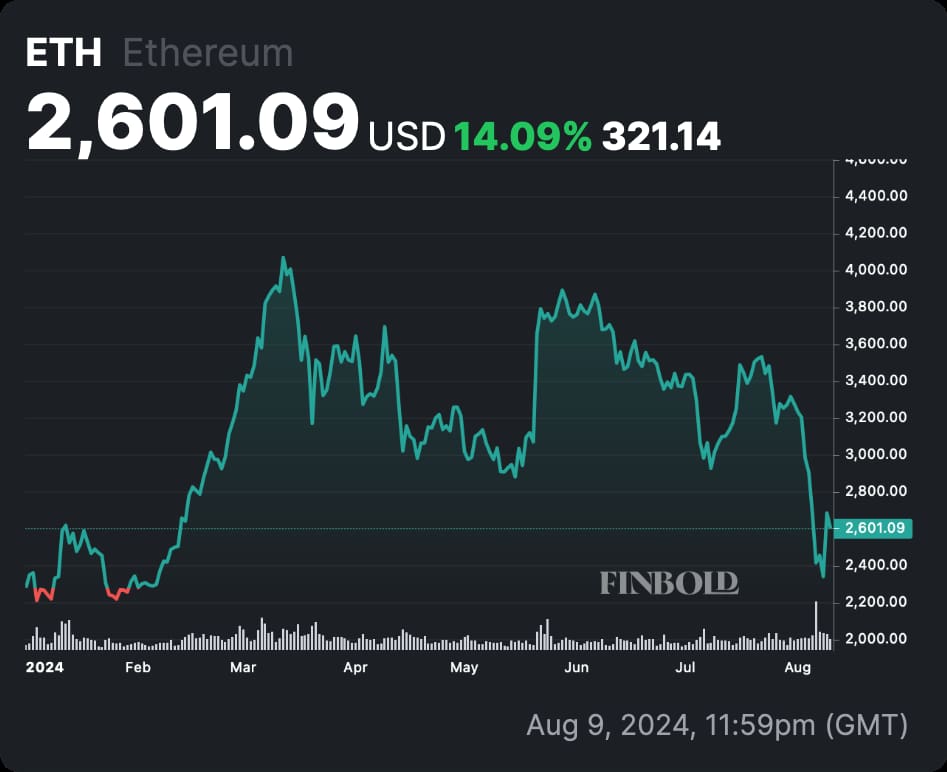

Price-wise, ETH moved from $2,283 on January 1 to this cycle’s high at $4,091 in March. The cryptocurrency held a trading range for four months, recently breaking down the range’s support in a generalized crash.

Interestingly, the dip drove Ethereum to as low as $2,128 on August 5. As of this writing, ETH trades at $2,601 with 14% gains YTD.

Ethereum (ETH) year-to-date price chart. Source: Finbold

Ethereum (ETH) year-to-date price chart. Source: Finbold

Reaching Meta AI’s bullish price prediction for 2025 would result in 149% to 207% gains in approximately one year. Nevertheless, Llama 3.1’s bearish forecast could bring 4% to 30% losses to investors from the current price.

In closing, such a wide range highlights the challenges of correctly predicting the price of cryptocurrencies like Ethereum. Investors should always be cautious while investing in this highly volatile space, avoiding letting emotion drive their decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.