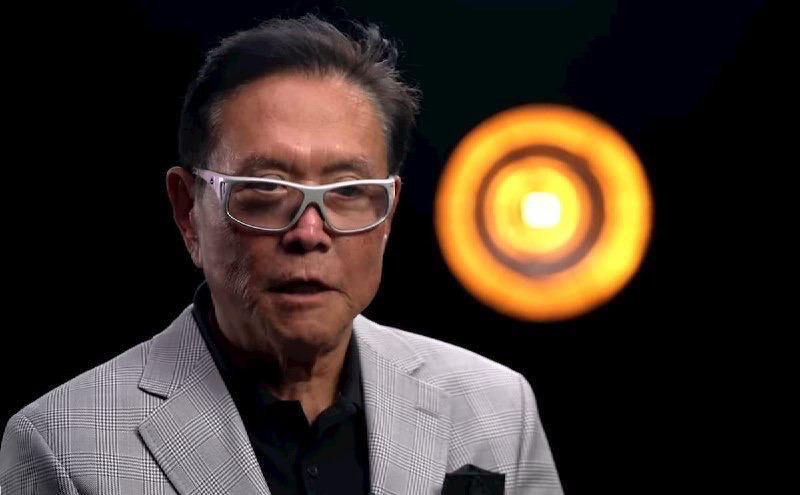

R. Kiyosaki’s ominous warning: ‘We are all in critical financial times’

![]() Finance Aug 29, 2024 Share

Finance Aug 29, 2024 Share

As he continues to alert about an upcoming economic crisis that he believes will sweep the United States and the world, renowned investor, entrepreneur, and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has just issued another ominous warning.

Specifically, Kiyosaki discussed the current political climate in the U.S., arguing that one should watch what politicians do, “not what they say” as “actions speak louder than words,” and highlighting that “we are all in critical financial times,” in an X post on August 29.

POLITICS is a DIRTY GAME.

Q: How do you know when a politician is lying.

A: When their lips are moving.That is why I say “ Watch what a person is saying…. Not what they are doing.”

Trump put the border wall up …Biden and Kamala took Trumps wall down.

Today…

— Robert Kiyosaki (@theRealKiyosaki) August 29, 2024

End of fiat money?

As it happens, Kiyosaki’s recent post aligns with his general doomsday views that a financial crash is approaching, that fiat money, especially the U.S. dollar, will entirely lose its value, and that the only way to preserve one’s wealth is to invest in alternative assets like gold, silver, and Bitcoin (BTC).

Picks for you

Crypto trader hits jackpot, turns $29 into $125,000 in 3 minutes 23 mins ago Bitcoin payments nosedive while Ethereum rises, Bitrefill study shows 16 hours ago ‘Rich Dad’ Robert Kiyosaki portfolio: Millionaire’s top 5 assets 18 hours ago Cardano founder fears ‘death of U.S. crypto industry’ if Kamala Harris is elected 18 hours ago

BITCOIN is the easiest way to become a millionaire. Making millions as an entrepreneur is hard. I know. You have to be really smart, dedicated, and lucky to become a millionaire starting your own business. I save Bitcoin because Bitcoin does the hardwork

for me. That is why I…— Robert Kiyosaki (@theRealKiyosaki) June 11, 2024

Additionally, the ‘Rich Dad Poor Dad’ author invests in lithium mines and carbon credits, as well as other crypto assets besides the flagship decentralized finance (DeFi) asset, particularly Ethereum (ETH) and Solana (SOL), which he has been recommending for a while now.

Indeed, last month, the finance educator suggested that the “biggest crash in history” was imminent based on technical analysis (TA) charts, including in stocks, real estate, commodities, and cryptocurrencies like Bitcoin, but also that the time to buy his favorite assets cheaply will follow.

BITCOIN is the easiest way to become a millionaire. Making millions as an entrepreneur is hard. I know. You have to be really smart, dedicated, and lucky to become a millionaire starting your own business. I save Bitcoin because Bitcoin does the hardwork

for me. That is why I…— Robert Kiyosaki (@theRealKiyosaki) June 11, 2024

What to avoid in financial crash?

On the other hand, he is a strict opponent of exchange-traded funds (ETFs), including those related to Bitcoin, as he prefers to “stay as far away from Wall Street’s financial products as possible,” keeping the responsibility for potential mistakes in his own hands instead:

“Packaging my own financial products is best for me because packaging my own securities requires me to be smarter than most ETF buyers. It is what is best for me. If I F’ up, I have no one to blame but me. The more important question is ‘what is best for you.’”

More recently, he has also recommended continuous learning, keeping successful and supportive individuals near, as well as focusing on self-improvement and confidence, sharing his mentor’s philosophy on resilience and strength, and creating passive income streams.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.