Warren Buffett just dumped $860 million of this stock

![]() Cryptocurrency Sep 25, 2024 Share

Cryptocurrency Sep 25, 2024 Share

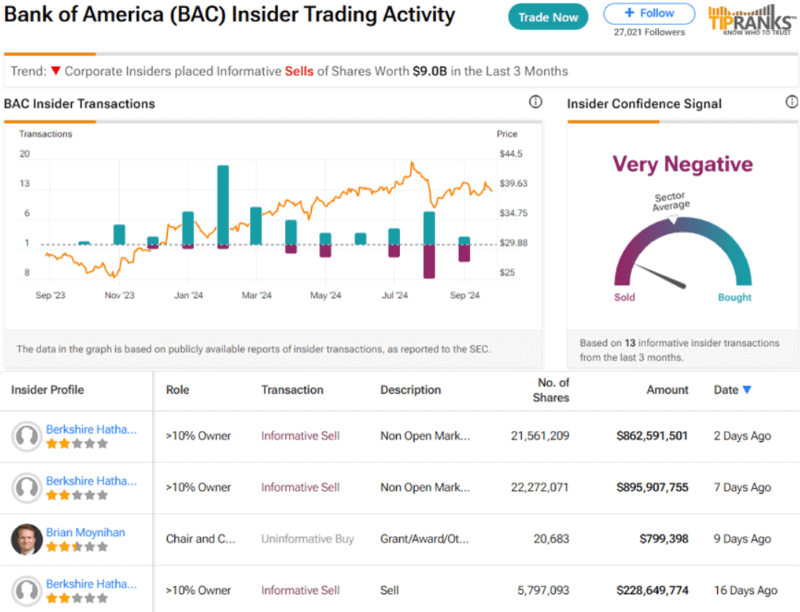

In the continuation of his Bank of America (NYSE: BAC) stock selling binge, Warren Buffett, the famous investor and CEO of Berkshire Hathaway (NYSE: BRK.A), has sold additional millions of BAC shares through his company, with his latest move nearing 22 million.

Specifically, Buffett’s most recent sale of BAC stocks, worth about $863 million, took place between September 20 and September 24, bringing the total value of Bank of America shares sold by Berkshire Hathaway to $9 billion, as per TipRanks data on September 25.

Bank of America insider trading activity. Source: TipRanks

Bank of America insider trading activity. Source: TipRanks

As it happens, the ‘Oracle of Omaha’ also sold 22.3 million BAC stocks seven days ago, netting $896 million in profit, and before that, his company sold about 5.8 million Bank of America stocks, worth $228.65 million at the time, between September 6 and September 10, as Finbold reported on September 12.

Picks for you

Crypto trader turns $1.3k into $3.4 million in 15 days 5 hours ago Here's what Bitcoin needs before 'Uptober' can start 5 hours ago Bitcoin price is set to 'crash and produce one major low' 6 hours ago Silver is in one of its ‘hottest bull markets of all time’ 8 hours ago

For reference, Buffett’s Berkshire, which is also Bank of America’s largest shareholder, started its BAC stock selling spree back in mid-July this year and has since sold a whopping $9 billion in multiple trading sessions, the latest sale bringing the company’s stake in Bank of America down to 10.5%.

Why is Buffett selling BAC stock?

Although the popular investor has not yet said anything about the motivation for selling, Haruki Toyama, portfolio manager and head of the Mid and Large Cap Team at Madison Investments, does not see it as an explicit bearish market call, arguing that:

“I think if you look at [Buffett’s] track record, maybe every couple decades, he comes out and explicitly says: ‘Hey, stocks are really cheap or stocks are expensive,’ (…) He hasn’t done that recently. So I take him at his word, and I don’t think he thinks it’s really extreme either way.”

Earlier this month, Bank of America’s CEO Brian Moynihan commented on Buffett’s recent activities by praising him as a “great investor” who “stabilized” the company, adding that he was uncertain over why he is reducing his exposure:

“I don’t know what exactly he’s doing because, frankly, we can’t ask, and we wouldn’t ask, but on the other hand, the market is absorbing the stock, and it’s a portion of the volume every day, and we’re buying the stock, a portion of the stock, and so life will go on.”

Bank of America stock price analysis

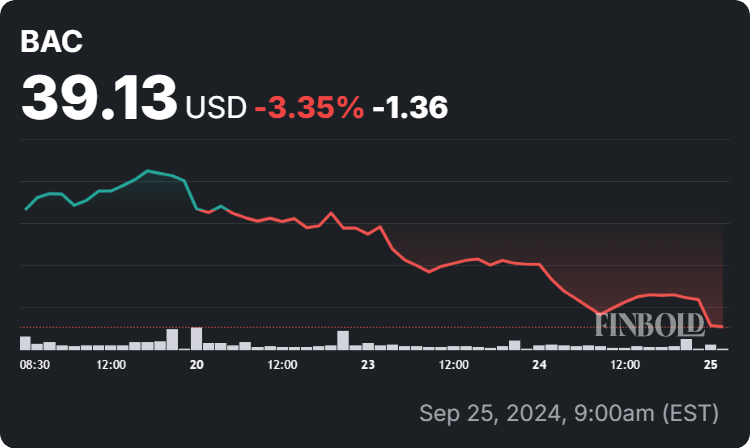

Meanwhile, the price of Bank of America stocks at press time stood at $39.13 per share, reflecting a 0.24% decline on the day, dropping 3.53% across the past week, as well as losing 1.97% over the month, and reducing its year-to-date (YTD) growth to 15.25%, according to the most recent charts.

Bank of America stock price 7-day chart. Source: Finbold

Bank of America stock price 7-day chart. Source: Finbold

Overall, Buffett’s BAC blowout might be part of his years-long trend of withdrawing from the U.S. banking sector, as he had earlier abandoned his positions in Goldman Sachs (NYSE: GS), JPMorgan (NYSE: JPM), Wells Fargo (NYSE: WFC), U.S. Bancorp (NYSE: USB), and Bank of New York Mellon (NYSE: BK).